Global Stocks Roar Back To All-Time Highs As Irma, North Korea Fears Fade

And we're back at all time highs.

And we're back at all time highs.

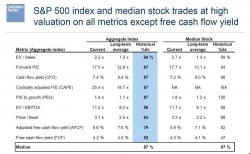

Over the years, the clients of Goldman Sachs have periodically found themselves on the verge of panic.

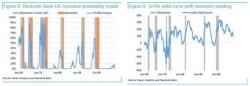

Even before Harvey and Irma were set to punish Texas and Florida, erasing at least 0.4% GDP from Q3 GDP according to BofA and costing hundreds of billions in damages (contrary to the best broken window fallacy, the lost invested capital more than offsets the "flow" benefits from new spending, which is why the US does not bomb itself every time there is a recession to "stimulate growth"), things were turning south for the US economy, so much so that according to the latest Deutsche Bank model, which looks at economic data that still has to incorporate the Irma/Harvey effects,

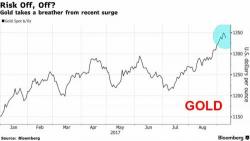

Catastrophic storms, worst week for macro data since July, debt ceiling to be cancelled, Gary Cohn off the list for Fed Chair (amid resignation chatter) and Korean hydrogen bombs... gold spikes, dollar dumps, bond yields plunge, and... stocks limp less than 1% lower...

Authored by Adam Taggart via PeakProsperity.com,

The planet-sized egos of rock & roll performers are legendary.

Few things symbolize this better than the outrageous requests they often make when on tour.