Trump Turmoil Trounces Bullard Bullshit As Dollar Dives To 6-Month Lows

As President Trump jets towards The Middle East leaving behind him a wake of headlines from the mainstream media, we suspect this will help him sleep...

Let's start with this...

As President Trump jets towards The Middle East leaving behind him a wake of headlines from the mainstream media, we suspect this will help him sleep...

Let's start with this...

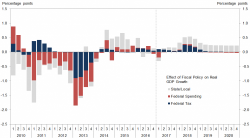

It took the market about 6 months to realize that contrary to initial expectations, Trump's fiscal reform would be substantially delayed and implemented in 2018 at the earliest, if at all. Next, it's time to take the machete to the total size of the program, which is what Goldman's chief political economist Alec Phillips did today when he reported that Goldman is lowering the firm's expectations for fiscal policy changes over the next year: "Rather than the $1.75 trillion/10 years tax cut we had previously assumed, we now assume a cut of $1 trillion" or a cut of over 40%.

Authored by Goldbroker.com's Helder Mello Guimares via Acting-Man.com,

Chugging along in Nosebleed Territory

Last Friday, both the S&P 500 and the Nasdaq composite indexes closed at record highs in the US, with the Dow Jones Industrial Average only a whisker away from its peak set in March. What has often been called the “most hated bull market in history” thus far continues to chug along in defiance of its detractors.

Is today's the day someone - following the suddenly resurgent VIX - finally blows up? Here are some timely thoughts from RBC's head of cross-asset correlation Charlie McElligott.

* * *

Why Energy Teams Are Getting Blown Out

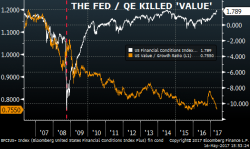

Following disappointing CPI prints for two months in a row, even such stalwart believers in the Fed's tightening cycle as Goldman Sachs (recall Hatzius warned recently that the Fed may need to "shock" markets to tighten monetary conditions in light of the S&P relentless grind higher despite rising rates) are suggesting that the Fed's rate hike trajectory for the rest of 2017 is suddenly in question.