Stocks, Dollar, Yields Rally On Mnuchin Tax Cut Comments

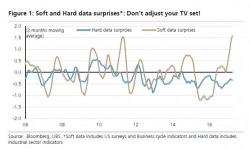

In a day full of upside catalyst for the reflation trade including the strong TIPS auction, the speculation that the Obamacare repeal effort is back on track, and perhaps best of all the absence of hard data (today's Philly Fed "soft data" was, well, quite soft), the dollar, the S&P and Treasury yields all rose, after Treasury Secretary Steven Mnuchin said that "we are close to bring forward major tax reform", refuting speculation that it may be delayed into 2018.