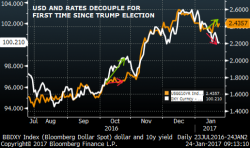

Dow Set To Open On Verge Of 20,000 As Trump Trade Sends Global Stocks To 19 Month Highs

The day the Dow crosses 20,000 may finally be here, because with DJIA futures trading 65 points higher in premarket trading, added to yesterday's close of 19,912 and latest record high in the S&P, it means that all it will take is a modest of only 25 points for the critical Dow threshold to be finally breached. Celebrating the upcoming record, world stocks hit a 19-month high on Wednesday, lifted by strong Japanese trade data, strong European company earnings and hopes that U.S. President Donald Trump will press ahead with a large fiscal spending package.