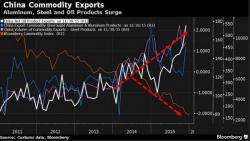

Unintended Consequences: Easy Money = Overcapacity = Trade Wars

Submitted by John Rubino via DollarCollapse.com,

It’s unclear what China was thinking when it borrowed all those trillions to quadruple its capacity to make steel, cement and other basic industrial products. There’s no record of it checking in with the other countries that have such industries to see if a sudden surge of cheap imports was okay with them.

Turns out that it’s not. The US in particular seems to lack a sense of humor where the death of its steel industry is involved: