Too Far, Too Fast? Strategists Expect European Stocks To Tumble By Year-End

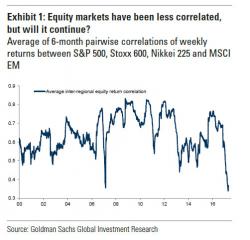

Equity strategists are cooling on the prospects for further gains in European stocks just as investors poured a record amount of money into the region’s equity funds...

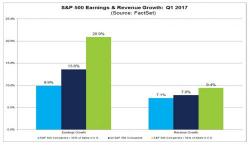

After a French election victory for centrist Emmanuel Macron and analysts suggesting that optimism over better profits is largely priced in, forecasters now see fewer triggers for the rally to continue in 2017.