Japan Rocked By Violent Stock Plunge As Nikkei Tumbles 850 Points Before Recovering Losses

Something snapped in Japan today.

Something snapped in Japan today.

U.S. equity futures are little changed as European and Asian shares retreated, led by sliding bank stocks and a drop in the dollar as doubts over republican tax cuts and ongoing bond curve flattening hurt sentiment and prompted fresh questions over the viability of the US expansion.

The global risk levitation continues, sending Asian stocks just shy of records, to the highest since November 2007 and Japan's Nikkei topped 22,750 - a level last seen in 1992 - while European shares and US equity futures were mixed, and the dollar rose across the board, gains accelerating through the European session with EURUSD sumping below 1.16 shortly German industrial output shrank more than forecast, eventually dropping to the lowest point since last month’s ECB meeting.

Following an early shaky start, which saw the Hang Seng tumble as much as 1.6% driven by weakness in financials and real estate names following the latest warning by PBOC governor Zhou about "sudden, complex, hidden, contagious, hazardous" risks In markets and a decline in local real estate prices, and pressure global risk, US equity futures have recouped all losses and are back to unchanged on monday morning, as President Trump continues on his first official trip to Asia.

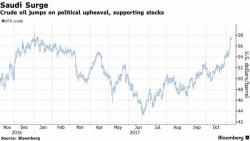

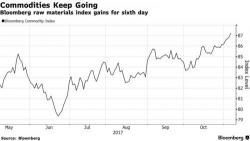

US equity futures have hit a new records, helped by surging Asian and European stocks which have all started November on a euphoric note. Surging commodity prices, optimism about tax reform and hope for a new dovish Fed chair all combined to drive global stock markets to record highs on Wednesday, with the MSCI’s world stock index climbing 0.3% to a fresh all time high. Mining stocks lead gains as nickel and other industrial metals soar.