Gold Will Be Safe Haven Again In Looming EU Crisis

Gold will be safe haven again in looming EU crisis

Gold will be safe haven again in looming EU crisis

US equity futures and Asian shares are flat this morning with European shares treading water ahead of the ECB's policy meeting in which it’s expected to announce a tapering to its €60bn in monthly QE. On this busiest day of Q3 earnings season, companies set to report earnings include Alphabet, Microsoft, Amazon and Intel, while we also get data on jobless claims and wholesale inventories.

Authored by Matthew Jamison via The Strategic Culture Foundation,

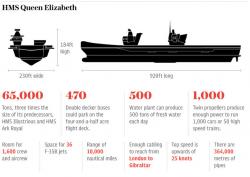

Over the course of the summer there was great fanfare and much to do from the British Secretary of State, Sir Michael Fallon MP, regarding the 'completion' of two new British aircraft carriers called HMS Queen Elizabeth and HMS Prince of Wales.

- Gold's value is due to exceptional rarity: Only 0.00000002% of earth's crust is gold- Gold's allure and psychology behind it are steeped in history and human psychology- Gold's colour and texture appeals to basic human survival instincts- Gold's sheen resembles water and "humans need water in order to survive" - Gold remains a sign of wealth but today is also a sign of prudence

Editor Mark O'Byrne

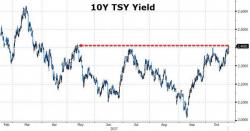

S&P futures are fractionally in the red while traders await President Trump’s pick for Fed chair and more clues on the fate of tax reform; Asian stocks slide, European shares are little changed ahead of tomorrow's ECB tapering announcement as US 10Y yields finally break out of their multi-month range below 2.40%...