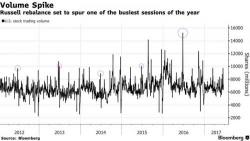

Prepare For A Surge In Volume: Russell Rebalance Day Is Here

Welcome to the one year anniversary of the Brexit vote. Welcome also to the annual Russell rebalance, traditionally one of the busiest trading days of the year: according to Bloomberg, last year's rebalance helped propel a near record turnover of over 15 billion shares, as a result of the $8.5 trillion in stocks linked to the various Russell indices, many of which will be forced to find new owners after today's index recomposition. In fact, in four of the last five years, reconstitution day ranked in the 10 busiest trading sessions.