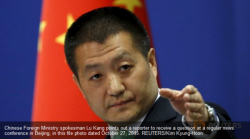

China Warns US: "Don't Disturb" Hong Kong Social Order; Threatens "Bad Reaction"

Over the past few months, tensions have been high between the U.S. and China. Events such as China denying USS John C. Stennis and its escort ships access to a Hong Kong port showed just how strained relations have become between the two countries, and with China's recent comments saying that U.S. activity near the Fiery Cross Reef "threatened China's sovereignty and security interests", one would assume that things couldn't get much worse.