After Blowing Up Its Clients With Its "Top 6 Trades For 2016", Goldman Has A New Trade Recommendation

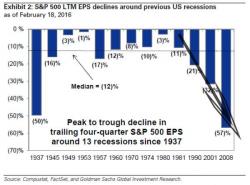

After refusing to even consider the possibility of a recession in the US for over a year, the first cracks in Goldman's armor are starting to appear. Over the weekend chief equity strategist David Kostin said that while the probability of a recession according to GS economists remains low, saying that "their model suggests the US has an 18% probability of recession during the next year and 24% likelihood during the next two years", Goldman's clients and investors "continue to inquire about the impact a contraction would have on the US equity market."