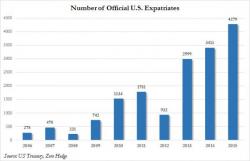

Another Exponential Chart: Record Numbers Renounce Their U.S. Citizenship In 2015

Another year, another record number of Americans willing to not only pay the $2,350 fee, but also appear in the US Treasury's "name of shame" list published every, quarter which reveals all the now-former US citizens who have decided to hand over their US passport back to Uncle Sam and expatriate.