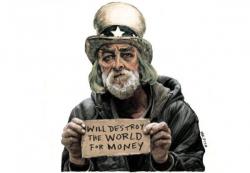

Chris Hedges On The End Of Empire: "The Death Spiral Appears Unstoppable"

Authored by Chris Hedges via TruthDig.com,

Authored by Chris Hedges via TruthDig.com,

As various institutions continue to publish very detailed estimates of how Trump's tax plan will impact the federal budget, which is somewhat amazing since income brackets haven't even been assigned yet, Moody's published a note today threatening to finally strip the U.S. of its AAA credit rating if the tax plan is ultimately passed as currently contemplated.

President Donald Trump’s tax proposal would probably weigh on the U.S. government’s credit outlook, on concerns that it would cause the federal deficit to swell, according to Moody’s Investors Service.

With the Trump administration lately focused mostly on domestic policy - even as Mueller's ongoing Russian probe continues to hang over Trump's head - US power and influence in the Middle East has found itself in retreat, a continuation of unsuccessful and/or failed policies implemented by the Obama administration, resulting in a power vacuum that has to be filled, and one country has emerged willing to take America's spot.

Summer closed in a whirlwind of weather chaos for the United States and its territories. At the start of the summer, two obvious signs that the US economy was flying apart emerged -- the big blowouts in the auto industry and in retail . I found it helpful to take a review of what summer brought:

Carmageddon crashes on

The auto industry began a decline similar to the one we experienced at the start of the Great Recession. (See “Carmageddon Crashes into ‘the Recovery’ Right on Schedule.”)

There are two distinct parts to the latest, just released research note from JPM's quant "wizard" Marko Kolanovic.