A Blind Eye Toward Turkey's Crimes

The alleged ties between Turkish President Erdogan and Islamist terrorists in Syria is an embarrassment for the Obama administration and the U.S. news media, which would prefer to look the other way rather than face up to the danger created by an out-of-control NATO "ally," writes Robert Parry.

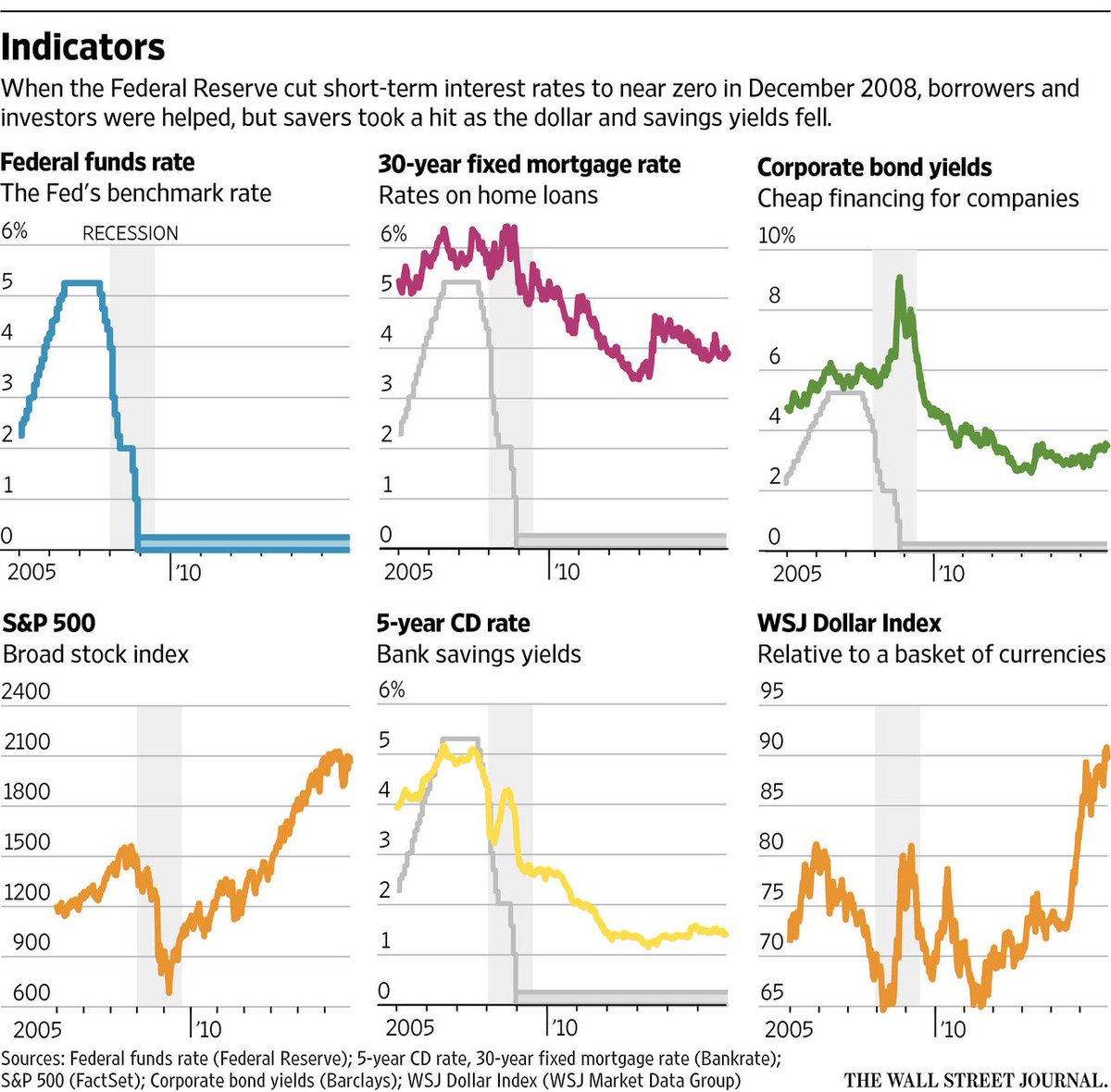

Sticker Shock: Fed to Hike Rates First Time in NINE Years!

Sticker Shock: Fed to Hike Rates First Time in NINE Years!