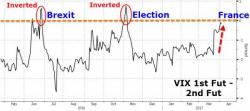

VIX Term Structure Inverts Amid French Election Uncertainty

Following weeks of utter comaplcency, there are signs that investors are beginning to hedge for potential U.S. stock swings around France’s presidential ballot.

As Bloomberg writes, futures on the CBOE Volatility Index

expiring in the next month are now trading around the same level as

contracts maturing a month later.

In fact the VIX term structure briefly inverted on Monday...