In Dramatic Reversal, US Vice President Biden Calls On Turkey To Withdraw Its Troops From Iraq

It has been a strange two days for US foreign policy.

Earlier today we reported that in what amounts to a significant blow to the official US position over Syria, namely the multi-year demands to replace president Assad with a western puppet ruler, John Kerry on Tuesday accepted Russia's long-standing demand that President Bashar Assad's future be determined by his own people, as Washington and Moscow edged toward putting aside years of disagreement over how to end Syria's civil war."

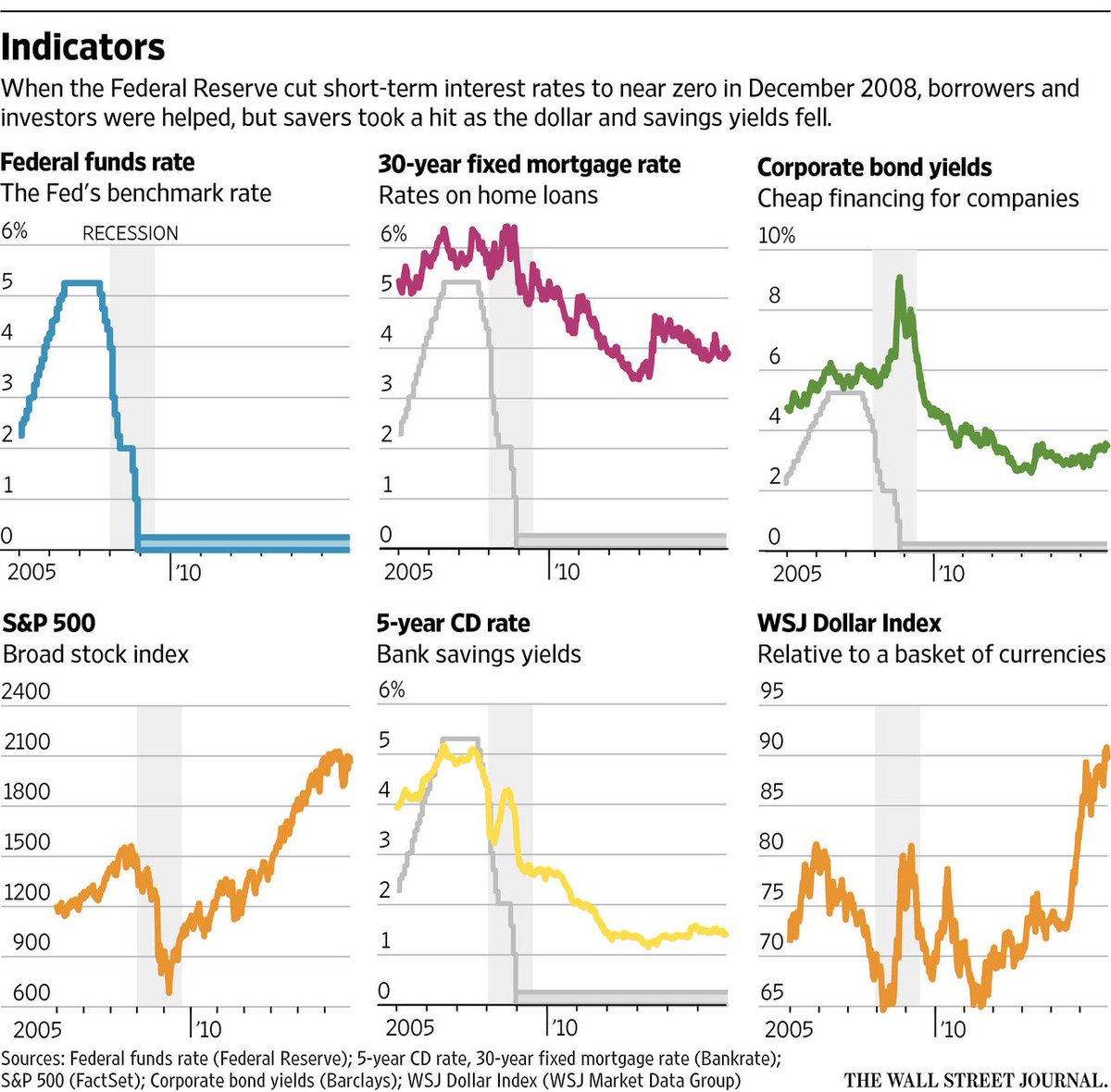

Sticker Shock: Fed to Hike Rates First Time in NINE Years!

Sticker Shock: Fed to Hike Rates First Time in NINE Years!