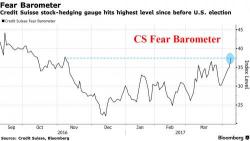

Futures Flat Ahead Of Yellen As Geopolitical Risks Loom; Fear Barometer Spikes

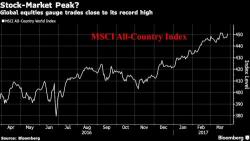

S&P futures point to a slightly lower open, while Asian and European stocks are likewise modestly in the red. Trading volumes are muted for most markets on Monday with investors spooked by rising geopolitical tensions in the Middle East and the Korean peninsula. It is also a holiday-shortened week in much of the West. As Bloomberg puts it, there is a "sense of unease" across markets, with global stocks mixed as investors weighed looming security risks and French bonds retreating ahead of the election following the surprising surge of far-leftist Melenchon in the polls.