Why Negative Rates Are Positive For Gold

Submitted by John Browne via Euro Pacific Capital,

Submitted by John Browne via Euro Pacific Capital,

Despite the proclamations from any and every Federal Reserve talking-head, Sam Zell appears to be willing to 'peddle some fiction' about the less than awesome reality in America. Having correctly called the top of the last commercial real-estate cycle, Zell is predicting global problems will likely push the U.S. into a recession in the next year...

"I’m not being pessimistic, I’m being realistic,” he said last week at a real-estate conference in New York. The U.S. economy is now “in the ninth inning,” he said.

Whether or not there was a secret "Shanghai Accord" to push the dollar lower, the outcome has been clear: moments ago, the USD as measured by the Bloomberg Dollar spot index just dropped to the lowest level since June 22, long before the Fed commenced its rate hikes, indicating that the market is, at least for now, convinced that the Fed is "one and done" and that Eric Rosengren's warning that rate hikes will accelerate from here is nothing but a hollow threat.

The Fed’s “Four Horsemen” Unite

Written by Jeff Nielson (CLICK FOR ORIGINAL)

Submitted by Lance Roberts via RealInvestmentAdvice.com,

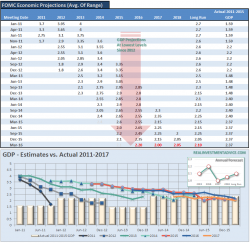

Since the end of the financial crisis, economists, analysts, and the Federal Reserve have continued to predict a return to higher levels of economic growth. As I showed in my discussion of the Fed’s forecasts, these predictions have continued to fall short of reality.