What The BOJ's Final "Yentervention" Option Would Look Like

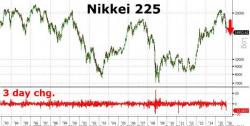

Japanese stock markets have crashed 15% (the "most since Lehman") and USDJPY plunging (most since 1998) since Kuroda unleashed NIRP and are down 11% since QQE2 was unveiled to save the world from an absent Fed. So with NIRP and QE (and jawboning) now 'useless' for Japanese monetary policy, there is only one option left - Yentervention.

Suddenly it all stopped working..

As Central Banker faith falters...

Overnight saw some hints at this beginning to happen, as Bloomberg reports,