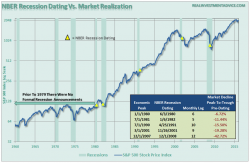

Recession Signs - 2008 & Now

Submitted by Lance Roberts via RealInvestmentAdvice.com,

Warning Signs Of A Recession

In late 2007, I was giving a presentation to a group of about 300 investors discussing the warning signs of an impending recessionary period in the economy. At that time, of course, it was near “blasphemy” to speak of such ills as there was “no recession in sight.”