"Let Them Eat CaQE": Yellen Abandons Markets; Stocks Plunge

"F'ed Up"

Fed vs Mawkets https://t.co/VRiEASX4y9

— Dick Darlington (@Darlington_Dick) January 27, 2016

"F'ed Up"

Fed vs Mawkets https://t.co/VRiEASX4y9

— Dick Darlington (@Darlington_Dick) January 27, 2016

After the Fed's statement, one thing was clear: the career economists at the Marriner Eccles building are very confused, admitting to hiking rates for the first time in nine years "even as economic growth slowed late last year".

Well here we are, a month after liftoff and the world's on fire again, just as it was in late August.

So far in 2016 we've seen continued pressure on crude and just as we saw late last summer, there's big trouble in little China.

Meanwhile, US markets got off to an inauspicious start in 2016 logging what for a time was the worst start to a year in market history.

Surging bonds and bullion and slumping stocks was not what Janet had in mind so she had some 'splaining to do. Hopes for a "passive hawkish" note appear to be met as confirmation of dismal data dependence offers just enough dovishness for the stock bulls and just enough hawkishness for economy bulls.

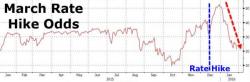

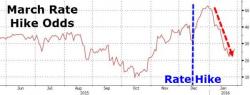

While the odds of a rate hike have collapsed since The Fed's decision to hike rates in the middle of an industrial and earnings recession, the odds of a rate cut remain non-negligible.

As investors await the Fed’s announcement following today’s FOMC meeting, Bloomberg's Richard Breslow they have a conundrum. No change in rates is expected. That is pretty much taken as a given. But we have to add the sub-clause: in either direction. What an interesting concept.