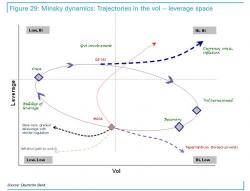

Deutsche: Every Time We Asked "How Much Lower Could Vol Go” Things Would Become Unpleasant

According to Deutsche Bank's Aleksandar Kocic, we live in a reflexive world, one where "the Fed knows that the market knows and the market knows that the Fed knows that the market knows, so everyone knows, but pretends that nobody knows and the game goes on." That pretty much covers much of modern market analysis which, like some mutant version of the Heisenberg Uncertainty Principle, implies that it is impossible to know the value of assets without also taking into account what the Fed thinks about said value, and what it will do in response to the valuation manifesting itself in