Kevin Warsh Fed Chair Odds Soar After WSJ Report Of Trump Meeting

Kevin Warsh's PredictIt odds to be the next Fed chair soared moments ago after the WSJ reported that President Trump and Treasury Secretary Steven Mnuchin met with the former Fed governor on Thursday to discuss his potential nomination as the next Federal Reserve chairman, "a White House official said, signaling that the West Wing is moving ahead with a process that the president has said he would like to have completed by the end of the year."

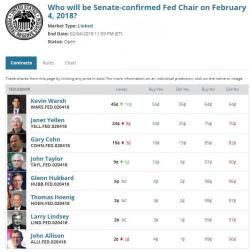

In immediate reaction, Warsh's odds jumped by 10% to 45% while Janet Yellen's tumbled by 8 to 24%.