Why Economic Data No Longer Matters

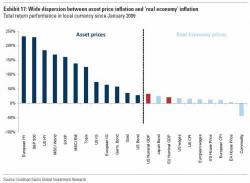

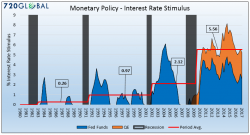

Back in mid-2009, we said that with the Fed and central banks nationalizing capital markets, macro and even micro data and newsflow will matter increasingly less and less, and the only thing that does matter is the Fed's weekly H.4.1 statement, showing the changes to the Fed's balance sheet. It also means that so-called "data dependency" is a farce (it is, and has always been "Dow dependency"), and that the impact of incremental newsflow will shrink with every passing week until virtually nobody pays attention (we have largely reached this state now).