"Reading Between The Dots": Is The Fed About To Admit The Market Was Right All Along

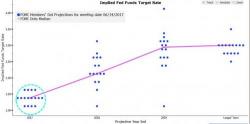

With the Fed set to unveil its first balance sheet reduction in modern history - an event that is largely priced in - what traders are far more interested in, is what will happen to the Fed's "dots", where consensus anticipates no move for the 2017 dot, while the 2018 and 2019 dots could shift lower as the FOMC language turns slightly more dovish.

How could this dot "migration" take place?

First, as Adnan Chian observes, at least 4 Fed members need to move their 2017 dots lower to shift the median from 1 more hike in 2017 to no more hikes, i.e. December is "dead."