2008 Deja Vu? Treasury Warns Congress - Bailout Puerto Rico Or Risk "Chaotic Unwinds... Cascading Defaults"

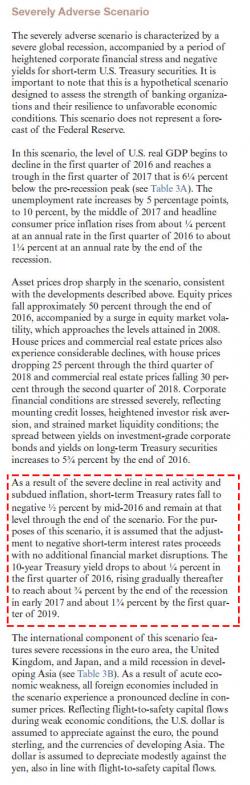

In a disappointingly similar tone to the warnings, threats, and promises sent to Congress in 2008 when demanding the banks get their bailout (or else), Treasury Secretary Jack lew has released a letter he sent to Congress warning that if Puerto Rico's situation is not "fixed" in an "orderly" manner "quickly" then the nation will face "cascading defaults."