China’s tighter overseas currency use impacts Canadian real estate landscape

The heavy exodus of the Chinese renminbi from mainland China put pressure on the country’s economy. In an effort to stymie the outflow, the Peoples Bank of China (PBOC) enacted new rules that are meant to help it exert more control over its currency…and that could spell trouble for the Canadian real estate market!

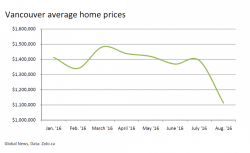

A CANADIAN REAL ESTATE “BUBBLE”