![]()

See this visualization first on the Voronoi app.

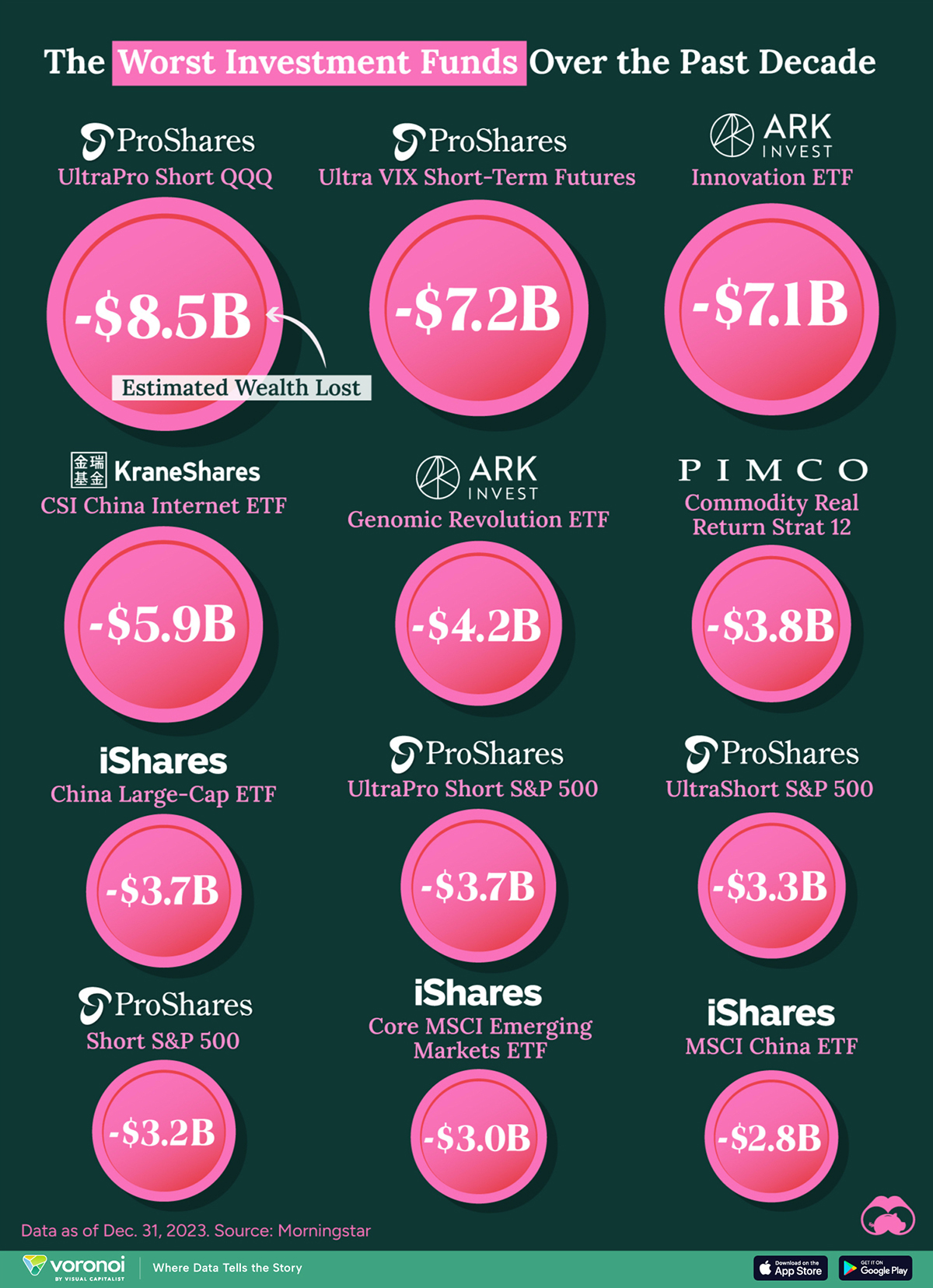

The 12 Worst Investment Funds Over the Past Decade

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In this graphic, we visualize the 12 worst investment funds over the past decade, as of Dec. 31, 2023. This ranking was compiled by Morningstar, and is based on the amount of shareholder wealth lost.

The data we used to create this graphic can also be found in the table below.

| Fund | Ticker | Category | Estimated Wealth Lost ($ billions) |

|---|---|---|---|

| iShares MSCI China ETF | MCHI | Emerging Markets | -$2.8 |

| iShares Core MSCI Emerging Markets ETF |

IEMG | Emerging Markets | -$3.0 |

| ProShares Short S&P 500 |

SH | Inverse Equity | -$3.2 |

| ProShares UltraShort S&P 500 |

SDS | Inverse Equity | -$3.3 |

| ProShares UltraPro Short S&P 500 |

SPXU | Inverse Equity | -$3.7 |

| iShares China Large-Cap ETF |

FXI | Emerging Markets | -$3.7 |

| PIMCO Commodity Real Return Strat 12 |

PCRPX | Commodities | -$3.8 |

| ARK Genomic Revolution ETF |

ARKG | Thematic | -$4.2 |

| KraneShares CSI China Internet ETF |

KWEB | Emerging Markets | -$5.9 |

| ARK Innovation ETF | ARKK | Thematic | -$7.1 |

| ProShares Ultra VIX Short-Term Futures |

UVXY | Volatility | -$7.2 |

| ProShares UltraPro Short QQQ |

SQQQ | Inverse Equity | -$8.5 |

From this list we can see that many of these funds are focused on emerging markets like China, or follow an “inverse equity” strategy, meaning they short their respective index.

Two noteworthy outliers are the ARK Innovation ETF and ARK Genomic Revolution ETF, which attempt to invest in “disruptive innovation”. Both ETFs are actively managed.

Shorting the U.S. Market

The U.S. stock market has experienced a long-term upward trend since 2009, meaning funds that short major indices like the S&P 500 and Nasdaq 100 have suffered over the 10-year period.

Seeing the heaviest losses is the ProShares UltraPro Short QQQ (SQQQ), which seeks daily investment results that correspond to three times the inverse (-3x) of the daily performance of the Nasdaq-100.

While these funds are likely unsuitable for a long-term buy and hold strategy, they can be profitable during downturns. One example would be the COVID-19 crash on March 12, 2020, where the S&P 500 fell by 12%.

Chinese Equities Stumble

Another common theme from this ranking are China-focused funds such as the KraneShares CSI China Internet ETF (KWEB).

Since their 2021 peak, Chinese stocks have lost over $6 trillion in market cap. This has been due to various reasons, including a sluggish COVID-19 recovery, a troubled real estate market, and alarming crackdowns on tech firms by government officials.

Want to learn more about global equity markets? Check out this graphic that visualizes the biggest companies on the Nasdaq, NYSE, and international exchanges.

The post The 12 Worst Investment Funds Over the Past Decade appeared first on Visual Capitalist.