![]()

See more visualizations like this on the Voronoi app.

Use This Visualization

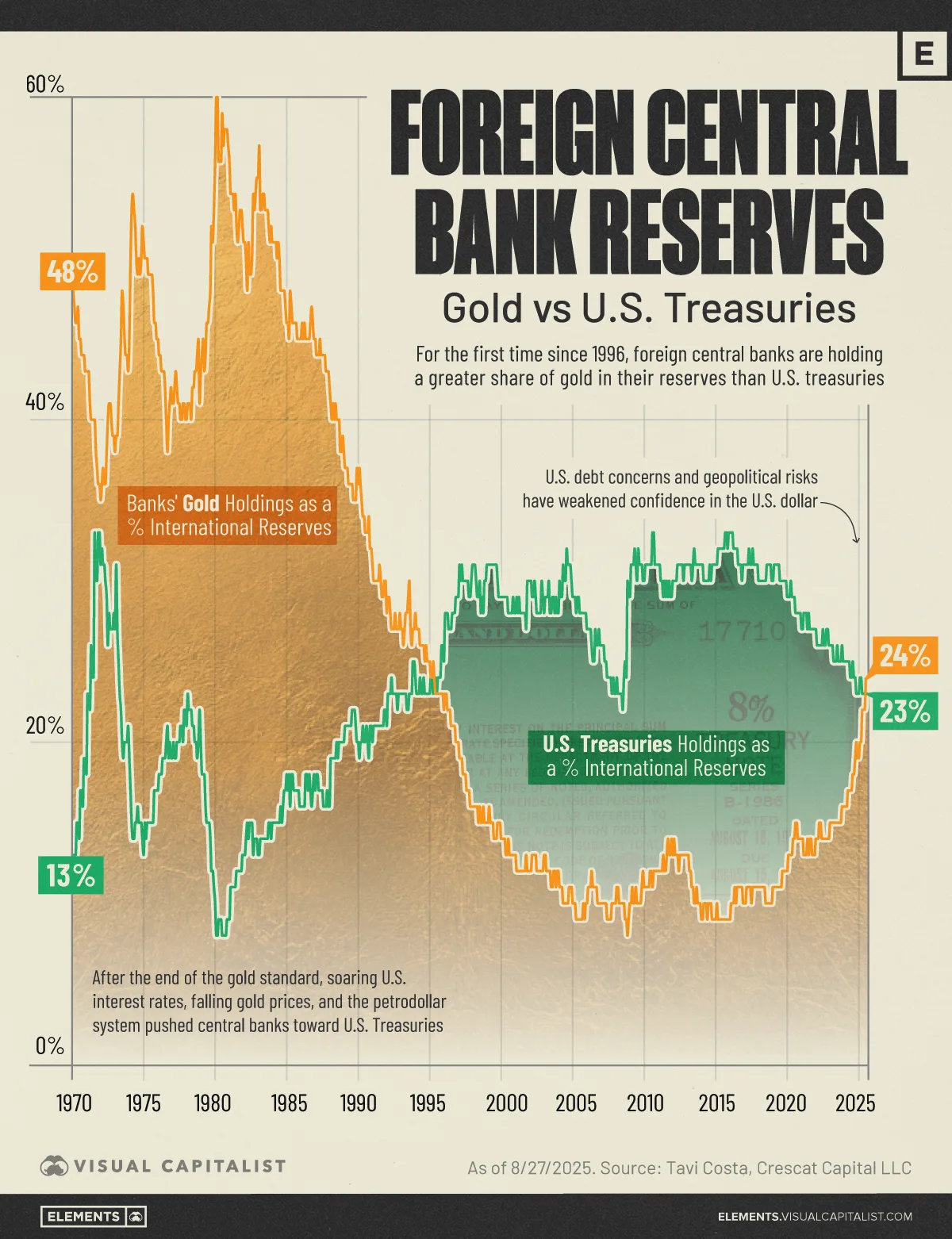

Central Banks Now Hold More Gold Than U.S. Treasuries

See visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- For the first time since 1996, foreign central banks’ gold reserves have overtaken their U.S. Treasury holdings.

- Persistent gold buying and rising U.S. debt risks are reshaping reserve composition toward hard assets.

Central banks have crossed a symbolic line: their combined gold reserves now exceed their U.S. Treasury holdings for the first time in nearly three decades.

The crossover underscores a gradual diversification away from dollar-denominated securities and toward hard assets.

This visualization tracks how these shares have evolved from the 1970s to today. The data comes from Crescat Capital macro strategist Tavi Costa.

From Petrodollars to De-Dollarization

After the end of Bretton Woods, soaring real interest rates and the rise of the petrodollar steered reserve managers toward U.S. Treasuries through the 1980s and 1990s.

In the 2000s, the dollar’s depth and liquidity reinforced that preference. Since 2022, however, heavy official gold buying has picked up again — 1,136 tonnes in 2022, a record — with 2023 and 2024 maintaining historically strong accumulation. The trend is even more striking considering that nearly one-fifth of all the gold ever mined is now held by central banks.

| Date | Gold Holdings As a % International Reserves | U.S. Treasuries Holdings As a % International Reserves |

|---|---|---|

| 1/30/1970 | 48% | 13% |

| 1/29/1971 | 43% | 23% |

| 1/31/1972 | 36% | 32% |

| 1/31/1973 | 39% | 31% |

| 1/31/1974 | 50% | 17% |

| 1/31/1975 | 50% | 15% |

| 1/30/1976 | 44% | 18% |

| 1/31/1977 | 41% | 20% |

| 1/31/1978 | 41% | 23% |

| 1/31/1979 | 44% | 18% |

| 1/31/1980 | 60% | 8% |

| 1/30/1981 | 54% | 11% |

| 1/29/1982 | 51% | 13% |

| 1/31/1983 | 57% | 13% |

| 1/31/1984 | 51% | 15% |

| 1/31/1985 | 46% | 17% |

| 1/31/1986 | 46% | 16% |

| 1/30/1987 | 44% | 18% |

| 1/29/1988 | 41% | 19% |

| 1/31/1989 | 37% | 21% |

| 1/31/1990 | 37% | 19% |

| 2/28/1990 | 36% | 20% |

| 1/31/1991 | 30% | 21% |

| 1/31/1992 | 29% | 23% |

| 1/29/1993 | 27% | 23% |

| 1/31/1994 | 27% | 23% |

| 1/31/1995 | 24% | 24% |

| 1/31/1996 | 23% | 28% |

| 1/31/1997 | 19% | 31% |

| 1/30/1998 | 16% | 31% |

| 1/29/1999 | 15% | 31% |

| 1/31/2000 | 14% | 29% |

| 2/29/2000 | 14% | 29% |

| 3/31/2000 | 14% | 29% |

| 4/28/2000 | 13% | 29% |

| 5/31/2000 | 13% | 29% |

| 6/30/2000 | 14% | 28% |

| 7/31/2000 | 13% | 28% |

| 8/31/2000 | 13% | 28% |

| 9/29/2000 | 13% | 28% |

| 10/31/2000 | 13% | 29% |

| 11/30/2000 | 13% | 28% |

| 12/29/2000 | 13% | 28% |

| 1/31/2001 | 12% | 29% |

| 2/28/2001 | 12% | 28% |

| 3/30/2001 | 12% | 29% |

| 4/30/2001 | 12% | 28% |

| 5/31/2001 | 12% | 28% |

| 6/29/2001 | 12% | 28% |

| 7/31/2001 | 12% | 28% |

| 8/31/2001 | 12% | 28% |

| 9/28/2001 | 13% | 27% |

| 10/31/2001 | 12% | 30% |

| 11/30/2001 | 12% | 30% |

| 12/31/2001 | 12% | 30% |

| 1/31/2002 | 12% | 30% |

| 2/28/2002 | 13% | 29% |

| 3/29/2002 | 13% | 29% |

| 4/30/2002 | 13% | 30% |

| 5/31/2002 | 13% | 29% |

| 6/28/2002 | 12% | 28% |

| 7/31/2002 | 12% | 28% |

| 8/30/2002 | 12% | 28% |

| 9/30/2002 | 12% | 28% |

| 10/31/2002 | 12% | 30% |

| 11/29/2002 | 12% | 29% |

| 12/31/2002 | 13% | 28% |

| 1/31/2003 | 13% | 29% |

| 2/28/2003 | 12% | 29% |

| 3/31/2003 | 12% | 29% |

| 4/30/2003 | 12% | 30% |

| 5/30/2003 | 12% | 28% |

| 6/30/2003 | 11% | 28% |

| 7/31/2003 | 11% | 29% |

| 8/29/2003 | 12% | 29% |

| 9/30/2003 | 12% | 28% |

| 10/31/2003 | 11% | 29% |

| 11/28/2003 | 12% | 28% |

| 12/31/2003 | 12% | 28% |

| 1/30/2004 | 11% | 30% |

| 2/27/2004 | 11% | 29% |

| 3/31/2004 | 11% | 29% |

| 4/30/2004 | 10% | 31% |

| 5/31/2004 | 10% | 30% |

| 6/30/2004 | 10% | 30% |

| 7/30/2004 | 10% | 32% |

| 8/31/2004 | 10% | 31% |

| 9/30/2004 | 11% | 31% |

| 10/29/2004 | 11% | 31% |

| 11/30/2004 | 11% | 30% |

| 12/31/2004 | 10% | 29% |

| 1/31/2005 | 10% | 29% |

| 2/28/2005 | 10% | 29% |

| 3/31/2005 | 9% | 28% |

| 4/29/2005 | 9% | 29% |

| 5/31/2005 | 9% | 29% |

| 6/30/2005 | 9% | 28% |

| 7/29/2005 | 9% | 28% |

| 8/31/2005 | 9% | 28% |

| 9/30/2005 | 10% | 28% |

| 10/31/2005 | 9% | 28% |

| 11/30/2005 | 10% | 28% |

| 12/30/2005 | 10% | 27% |

| 1/31/2006 | 11% | 27% |

| 2/28/2006 | 11% | 27% |

| 3/31/2006 | 11% | 27% |

| 4/28/2006 | 12% | 26% |

| 5/31/2006 | 11% | 25% |

| 6/30/2006 | 11% | 25% |

| 7/31/2006 | 11% | 27% |

| 8/31/2006 | 11% | 26% |

| 9/29/2006 | 10% | 26% |

| 10/31/2006 | 10% | 27% |

| 11/30/2006 | 10% | 26% |

| 12/29/2006 | 10% | 26% |

| 1/31/2007 | 10% | 26% |

| 2/28/2007 | 10% | 26% |

| 3/30/2007 | 10% | 25% |

| 4/30/2007 | 10% | 25% |

| 5/31/2007 | 9% | 24% |

| 6/29/2007 | 9% | 24% |

| 7/31/2007 | 9% | 24% |

| 8/31/2007 | 9% | 24% |

| 9/28/2007 | 10% | 23% |

| 10/31/2007 | 10% | 24% |

| 11/30/2007 | 10% | 23% |

| 12/31/2007 | 10% | 23% |

| 1/31/2008 | 11% | 24% |

| 2/29/2008 | 11% | 23% |

| 3/31/2008 | 10% | 23% |

| 4/30/2008 | 10% | 23% |

| 5/30/2008 | 10% | 23% |

| 6/30/2008 | 10% | 22% |

| 7/31/2008 | 10% | 24% |

| 8/29/2008 | 9% | 25% |

| 9/30/2008 | 9% | 24% |

| 10/31/2008 | 8% | 30% |

| 11/28/2008 | 9% | 29% |

| 12/31/2008 | 10% | 29% |

| 1/30/2009 | 10% | 31% |

| 2/27/2009 | 11% | 31% |

| 3/31/2009 | 10% | 31% |

| 4/30/2009 | 10% | 32% |

| 5/29/2009 | 11% | 31% |

| 6/30/2009 | 10% | 30% |

| 7/31/2009 | 10% | 32% |

| 8/31/2009 | 10% | 31% |

| 9/30/2009 | 10% | 31% |

| 10/30/2009 | 11% | 31% |

| 11/30/2009 | 12% | 30% |

| 12/31/2009 | 11% | 30% |

| 1/29/2010 | 11% | 31% |

| 2/26/2010 | 11% | 31% |

| 3/31/2010 | 11% | 31% |

| 4/30/2010 | 11% | 31% |

| 5/31/2010 | 12% | 31% |

| 6/30/2010 | 12% | 31% |

| 7/30/2010 | 11% | 33% |

| 8/31/2010 | 12% | 33% |

| 9/30/2010 | 12% | 31% |

| 10/29/2010 | 12% | 31% |

| 11/30/2010 | 12% | 31% |

| 12/31/2010 | 12% | 31% |

| 1/31/2011 | 12% | 31% |

| 2/28/2011 | 12% | 30% |

| 3/31/2011 | 12% | 30% |

| 4/29/2011 | 13% | 29% |

| 5/31/2011 | 12% | 30% |

| 6/30/2011 | 12% | 29% |

| 7/29/2011 | 13% | 30% |

| 8/31/2011 | 14% | 29% |

| 9/30/2011 | 13% | 30% |

| 10/31/2011 | 13% | 29% |

| 11/30/2011 | 14% | 29% |

| 12/30/2011 | 13% | 30% |

| 1/31/2012 | 14% | 30% |

| 2/29/2012 | 13% | 30% |

| 3/30/2012 | 13% | 30% |

| 4/30/2012 | 13% | 31% |

| 5/31/2012 | 12% | 31% |

| 6/29/2012 | 13% | 31% |

| 7/31/2012 | 13% | 31% |

| 8/31/2012 | 13% | 31% |

| 9/28/2012 | 13% | 30% |

| 10/31/2012 | 13% | 31% |

| 11/30/2012 | 13% | 31% |

| 12/31/2012 | 13% | 31% |

| 1/31/2013 | 13% | 31% |

| 2/28/2013 | 12% | 31% |

| 3/29/2013 | 12% | 31% |

| 4/30/2013 | 11% | 30% |

| 5/31/2013 | 11% | 31% |

| 6/28/2013 | 10% | 32% |

| 7/31/2013 | 10% | 31% |

| 8/30/2013 | 11% | 31% |

| 9/30/2013 | 10% | 31% |

| 10/31/2013 | 10% | 31% |

| 11/29/2013 | 10% | 31% |

| 12/31/2013 | 9% | 31% |

| 1/31/2014 | 9% | 31% |

| 2/28/2014 | 10% | 30% |

| 3/31/2014 | 10% | 30% |

| 4/30/2014 | 10% | 30% |

| 5/30/2014 | 9% | 30% |

| 6/30/2014 | 10% | 30% |

| 7/31/2014 | 10% | 31% |

| 8/29/2014 | 10% | 30% |

| 9/30/2014 | 9% | 31% |

| 10/31/2014 | 9% | 31% |

| 11/28/2014 | 9% | 31% |

| 12/31/2014 | 9% | 31% |

| 1/30/2015 | 10% | 31% |

| 2/27/2015 | 9% | 32% |

| 3/31/2015 | 9% | 32% |

| 4/30/2015 | 9% | 32% |

| 5/29/2015 | 9% | 32% |

| 6/30/2015 | 9% | 32% |

| 7/31/2015 | 9% | 32% |

| 8/31/2015 | 9% | 33% |

| 9/30/2015 | 9% | 33% |

| 10/30/2015 | 9% | 32% |

| 11/30/2015 | 9% | 33% |

| 12/31/2015 | 9% | 33% |

| 1/29/2016 | 10% | 33% |

| 2/29/2016 | 10% | 33% |

| 3/31/2016 | 10% | 32% |

| 4/29/2016 | 11% | 32% |

| 5/31/2016 | 10% | 32% |

| 6/30/2016 | 11% | 32% |

| 7/29/2016 | 11% | 31% |

| 8/31/2016 | 11% | 31% |

| 9/30/2016 | 11% | 31% |

| 10/31/2016 | 11% | 30% |

| 11/30/2016 | 10% | 31% |

| 12/30/2016 | 10% | 31% |

| 1/31/2017 | 10% | 31% |

| 2/28/2017 | 11% | 31% |

| 3/31/2017 | 11% | 31% |

| 4/28/2017 | 11% | 32% |

| 5/31/2017 | 11% | 31% |

| 6/30/2017 | 10% | 31% |

| 7/31/2017 | 11% | 32% |

| 8/31/2017 | 11% | 31% |

| 9/29/2017 | 11% | 31% |

| 10/31/2017 | 11% | 31% |

| 11/30/2017 | 11% | 31% |

| 12/29/2017 | 11% | 30% |

| 1/31/2018 | 11% | 30% |

| 2/28/2018 | 11% | 30% |

| 3/30/2018 | 11% | 30% |

| 4/30/2018 | 11% | 30% |

| 5/31/2018 | 11% | 30% |

| 6/29/2018 | 10% | 30% |

| 7/31/2018 | 10% | 31% |

| 8/31/2018 | 10% | 31% |

| 9/28/2018 | 10% | 31% |

| 10/31/2018 | 10% | 31% |

| 11/30/2018 | 10% | 30% |

| 12/31/2018 | 11% | 30% |

| 1/31/2019 | 11% | 31% |

| 2/28/2019 | 11% | 31% |

| 3/29/2019 | 11% | 31% |

| 4/30/2019 | 11% | 31% |

| 5/31/2019 | 11% | 31% |

| 6/28/2019 | 11% | 30% |

| 7/31/2019 | 11% | 30% |

| 8/30/2019 | 12% | 30% |

| 9/30/2019 | 12% | 30% |

| 10/31/2019 | 12% | 30% |

| 11/29/2019 | 12% | 30% |

| 12/31/2019 | 12% | 29% |

| 1/31/2020 | 13% | 29% |

| 2/28/2020 | 13% | 29% |

| 3/31/2020 | 13% | 30% |

| 4/30/2020 | 13% | 29% |

| 5/29/2020 | 14% | 29% |

| 6/30/2020 | 14% | 29% |

| 7/31/2020 | 15% | 28% |

| 8/31/2020 | 15% | 28% |

| 9/30/2020 | 14% | 28% |

| 10/30/2020 | 14% | 28% |

| 11/30/2020 | 14% | 28% |

| 12/31/2020 | 14% | 27% |

| 1/29/2021 | 14% | 27% |

| 2/26/2021 | 13% | 28% |

| 3/31/2021 | 13% | 28% |

| 4/30/2021 | 13% | 28% |

| 5/31/2021 | 14% | 27% |

| 6/30/2021 | 13% | 28% |

| 7/30/2021 | 14% | 27% |

| 8/31/2021 | 14% | 27% |

| 9/30/2021 | 13% | 27% |

| 10/29/2021 | 13% | 27% |

| 11/30/2021 | 13% | 27% |

| 12/31/2021 | 14% | 27% |

| 1/31/2022 | 14% | 26% |

| 2/28/2022 | 14% | 26% |

| 3/31/2022 | 15% | 26% |

| 4/29/2022 | 15% | 26% |

| 5/31/2022 | 14% | 26% |

| 6/30/2022 | 14% | 27% |

| 7/29/2022 | 14% | 26% |

| 8/31/2022 | 14% | 26% |

| 9/30/2022 | 14% | 27% |

| 10/31/2022 | 14% | 27% |

| 11/30/2022 | 14% | 26% |

| 12/30/2022 | 15% | 26% |

| 1/31/2023 | 15% | 26% |

| 2/28/2023 | 15% | 26% |

| 3/31/2023 | 15% | 25% |

| 4/28/2023 | 15% | 25% |

| 5/31/2023 | 15% | 25% |

| 6/30/2023 | 15% | 26% |

| 7/31/2023 | 15% | 25% |

| 8/31/2023 | 15% | 25% |

| 9/29/2023 | 15% | 25% |

| 10/31/2023 | 16% | 26% |

| 11/30/2023 | 16% | 25% |

| 12/29/2023 | 16% | 25% |

| 1/31/2024 | 16% | 25% |

| 2/29/2024 | 16% | 25% |

| 3/29/2024 | 17% | 25% |

| 4/30/2024 | 17% | 25% |

| 5/31/2024 | 17% | 24% |

| 6/28/2024 | 17% | 24% |

| 7/31/2024 | 18% | 25% |

| 8/30/2024 | 18% | 24% |

| 9/30/2024 | 19% | 24% |

| 10/31/2024 | 20% | 23% |

| 11/29/2024 | 19% | 23% |

| 12/31/2024 | 19% | 23% |

| 1/31/2025 | 20% | 24% |

| 2/28/2025 | 20% | 24% |

| 3/31/2025 | 22% | 23% |

| 4/30/2025 | 22% | 23% |

| 5/30/2025 | 22% | 23% |

| 6/30/2025 | 24% | 23% |

As political uncertainty and geopolitical risks continue to fuel safe-haven demand, this purchasing momentum has also lifted prices: gold surpassed $4,000 an ounce for the first time ever in October 2025.

Why “More Gold than Treasuries” Matters

Crossing above Treasuries signals that reserve managers are prioritizing durability, portability, and neutrality over yield.

According to the IMF, gold’s share of global reserves climbed to about 18% in 2024, up sharply from mid-2010s levels, reflecting a structural reweighting toward tangible assets.

Seen as an alternative to heavily indebted fiat currencies, especially the U.S. dollar, the share of gold in central bank reserves has increased most among emerging market economies. China, Russia, and Türkiye have been the largest official buyers over the past decade.

Learn More on the Voronoi App ![]()

If you enjoyed today’s post, check out U.S. Dollar Index Falls 10.1% in 2025, Steepest Drop in Three Decades on Voronoi, the new app from Visual Capitalist.