Published

41 mins ago

on

August 11, 2023

| 43 views

-->

By

Rida Khan

Graphics & Design

- Alejandra Dander

The following content is sponsored by Fidelity Investments

Market Volatility and Investor Emotions

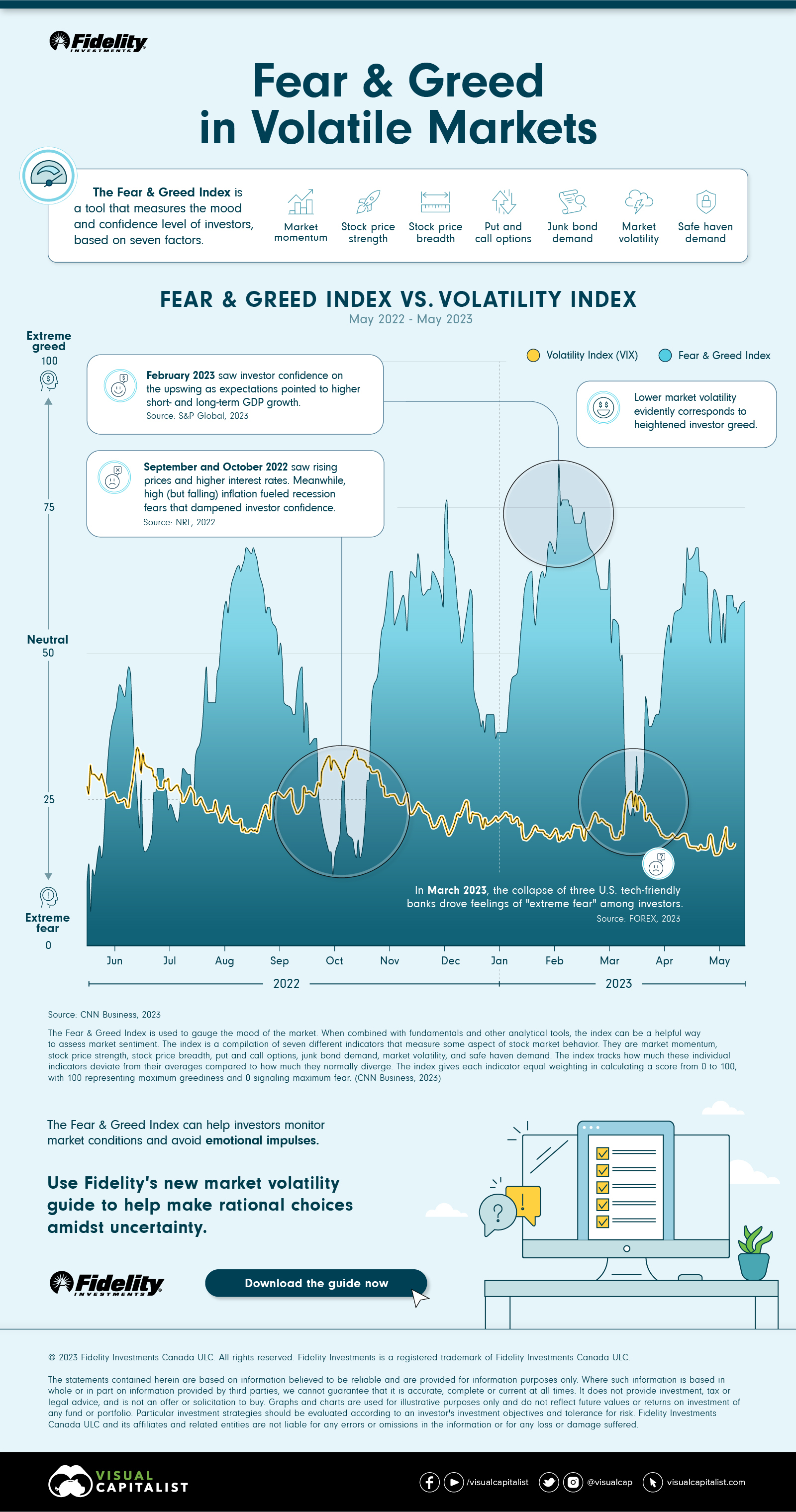

The Fear & Greed Index, created and popularized by CNN, is a powerful tool that captures investor sentiment and confidence levels. It rises when markets are greedy and falls when investors are fearful.

In this infographic sponsored by Fidelity Investments, we compare the Fear & Greed Index with the CBOE Volatility Index (VIX) to see the connection between volatile markets and the impulses of investors.

The Fear & Greed Index

The Fear & Greed Index combines the following indicators to see how much they differ from their averages.

- Market momentum

- Stock price strength

- Stock price breadth

- Put and call options

- Junk bond demand

- Market volatility

- Safe haven demand

The index gives each indicator equal weighting in calculating a score from 0 to 100, with 100 representing maximum greediness and 0 signaling maximum fear.

CBOE Volatility Index (VIX)

The VIX gauges expected price changes in S&P 500 Index options over the next month, indicating market volatility. It has lower values during bull markets and higher values during bear markets.

When these two indexes are correlated, it becomes evident that lowering market volatility corresponds to heightened investor greed.

Impact of Key Events on Investor Sentiment

This infographic highlights significant points emphasizing the relationship between the two indexes.

September and October 2022

During this period, rising prices, interest rates, and the possibility of a recession led to the highest level of fear observed between May 2022 and May 2023.

February 2023

February brought a breath of fresh air as GDP growth led to the highest levels of investor confidence during the period under study.

March 2023

The collapse of three mid-sized tech-friendly banks triggered a wave of extreme fear. It served as a stark reminder of the inherent vulnerability of financial markets and how quickly panic can spread.

Weathering the Storm

By proactively thinking about their emotional impulses, investors can better navigate volatile conditions, and what’s more, benefit from them.

Fidelity’s new market volatility guide provides invaluable insights, empowering investors to make informed decisions in unpredictable markets while avoiding emotional biases.

Download the free guide now.

Please enable JavaScript in your browser to complete this form.Enjoying the data visualization above? *Subscribe

Related Topics: #banks collapse #financial markets #volatile markets #volatility #market volatility #emotions #Recession #2023 #inflation #2022 #stock market #fear and greed index #markets #fidelity #interest rates #fidelity investments #investors #volatility guide #index #market momentum #GDP growth #stock price strength

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "Charted: Market Volatility and Investor Emotions";

var disqus_url = "https://www.visualcapitalist.com/sp/investor-fear-and-greed-and-market-volatility/";

var disqus_identifier = "visualcapitalist.disqus.com-160117";

You may also like

-

Finance2 months ago

Visualized: The 100 Largest U.S. Banks by Consolidated Assets

In this visual we showcase the relative size of the 100 largest U.S. banks in terms of consolidated assets.

-

China4 months ago

De-Dollarization: Countries Seeking Alternatives to the U.S. Dollar

The U.S. dollar is the dominant currency in the global financial system, but some countries are following the trend of de-dollarization.

-

Finance5 months ago

Ranked: The World’s Most Valuable Bank Brands (2019-2023)

This infographic ranks the 10 most valuable bank brands over the past five years (Spoiler: U.S. banks aren’t in the top four)

-

Technology2 years ago

Companies Gone Public in 2021: Visualizing IPO Valuations

Tracking the companies that have gone public in 2021, their valuation, and how they did it.

-

Investor Education2 years ago

Visualizing The World’s Largest Sovereign Wealth Funds

To date, only two countries have sovereign wealth funds worth over $1 trillion. Learn more about them in this infographic.

-

Healthcare2 years ago

Visualizing the World’s Biggest Pharmaceutical Companies

The world’s biggest pharmaceutical companies are worth $4.1 trillion. Here we map the top 100 companies based on their market cap value.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up

The post Charted: Market Volatility and Investor Emotions appeared first on Visual Capitalist.