Via DoctorHousingBubble.com,

Americans are realizing something is wrong with the system. You can see it this year with the rise of outsiders in both political parties. People realize the system is rigged. Instead of some folks that kowtow and simply move forward like subservient lemmings, millions are mobilizing and taking action. Many are voting with their wallets. The number of renter households has increased by 10 million over the last decade while net homeowners has been stagnant. The bailouts were supposed to help American families but what happened is that many were kicked out of their homes (for missing payments) and then giving them to banks that also missed much larger payments (too big to fail). People got a quick education on how things work. This is why the homeownership rate fell dramatically yet somehow, homes sold to investors and now rents are at all-time highs while incomes are stuck in neutral. This is a major problem and people are taking notice.

A crisis in American housing

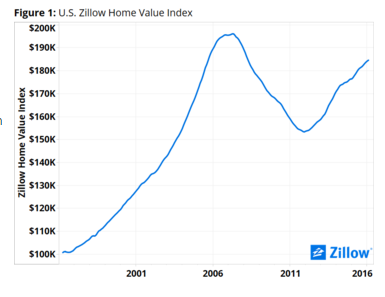

Zillow has some really good research on the topic. You would think that rising home prices and rising rents would be a sign of more families buying. Yet it is more of a sign of continued manipulation in the market. It is also a sign of outside money, either from big investors, Wall Street, or foreign money pushing up values and crowding out regular families from buying. The Fed has set the stage. By creating a low interest rate environment, big pools of money are hungry for yield in nearly any sector.

First take a look at home prices:

Source: Zillow

The trend is clear and at least in the short-term, prices seem to nearing a plateau. It is certainly being reflected in rents:

[image]https://www.doctorhousingbubble.com/wp-content/uploads/2016/04/rent-index.png[/image]

But for most people, incomes are not rising at this pace:

[image]https://www.doctorhousingbubble.com/wp-content/uploads/2016/04/income-by-tiers.png[/image]

Incomes absolutely matter for the economy. It is naïve to say otherwise. In fact, this is a big reason why so many people are voting for outside candidates. Many people simply feel the American dream slipping away.

Even in high priced areas like California, most people are living on the financial edge even if their incomes are higher. Just take a look at what renters and homeowners spend as a percentage of their income on housing per month:

[image]https://www.doctorhousingbubble.com/wp-content/uploads/2016/04/mortgage-and-rent-spent.png[/image]

Home buyers of crap shacks are spending 43% of their income on the mortgage while renters spend a jaw dropping 51% of their income on rents. This is why L.A. is the most unaffordable rental market in the country.

And Zillow also looked at the price to income ratio:

[image]https://www.doctorhousingbubble.com/wp-content/uploads/2016/04/price-to-income.png[/image]

Notice how things got all out of whack starting in the 2000s? This is when housing turned into a speculative asset class right along with hot tech stocks. At this point, we’ve hit a wall and that is why the homeownership rate has hit a generational low. It is also looking like rents are hitting an interim high. There is only so much you can squeeze out of the market when incomes are stuck. And since we have millions of new properties converted to rentals, what happens when the economy hits that first hiccup since early 2009? If your income dries up, no rental money is going to come in. And we now have 10 million more rental households than we did a decade ago.

The manipulation in the market is a problem because builders are reluctant to build even though price signals and demand would suggest otherwise. They look at demographics and income figures and realize people simply can’t afford homes at these prices. There is still a housing crisis in America. All it means is that more income is being sucked into a largely unproductive sector of our economy.