Authored by Gail Tverberg via Our Finite World blog,

Economists, including Ben Bernanke, give all kinds of reasons for the Great Depression of the 1930s. But what if the real reason for the Great Depression was an energy crisis?

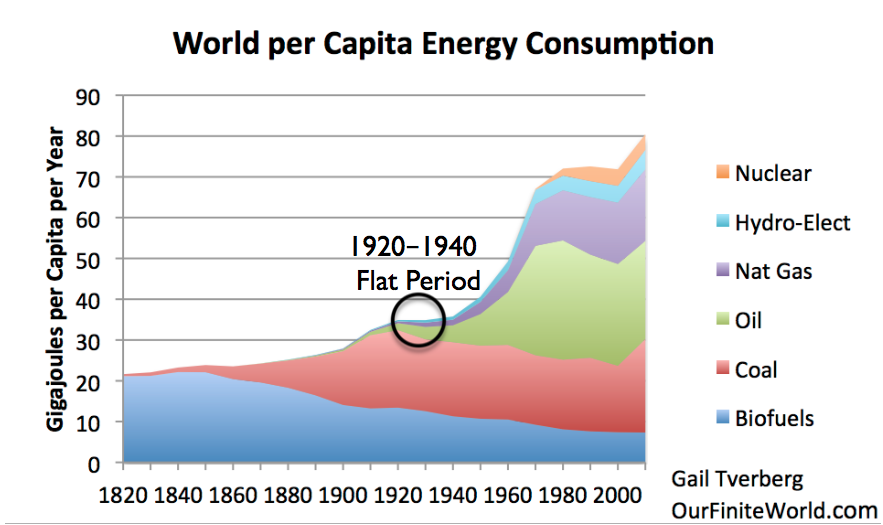

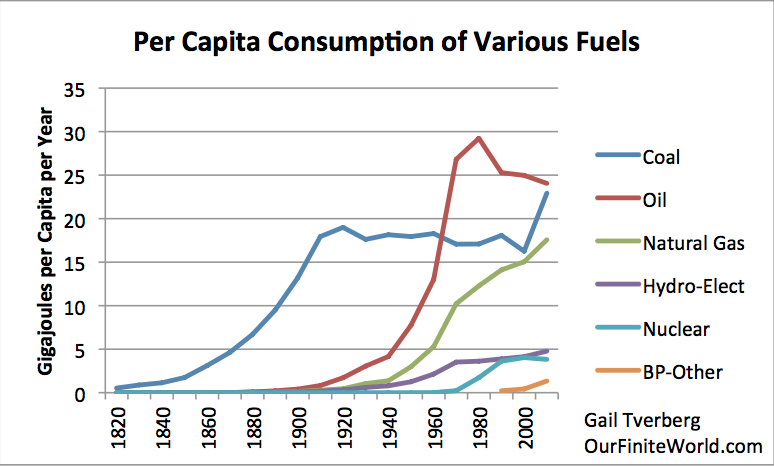

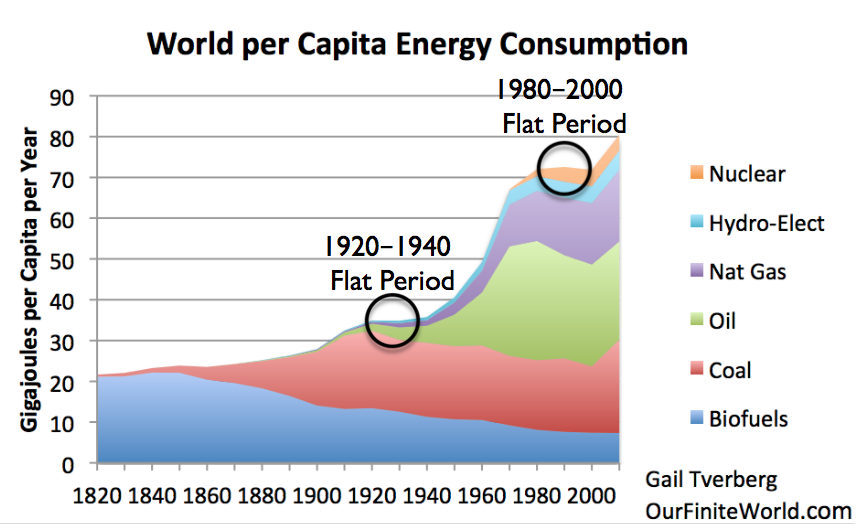

When I put together a chart of per capita energy consumption since 1820 for a post back in 2012, there was a strange “flat spot” in the period between 1920 and 1940. When we look at the underlying data, we see that coal production was starting to decline in some of the major coal producing parts of the world at that time. From the point of view of people living at the time, the situation might have looked very much like peak energy consumption, at least on a per capita basis.

Figure 1. World Energy Consumption by Source, based on Vaclav Smil estimates from Energy Transitions: History, Requirements and Prospects (Appendix) together with BP Statistical Data for 1965 and subsequent, divided by population estimates by Angus Maddison.

Even back in the 1820 to 1900 period, world per capita energy had gradually risen as an increasing amount of coal was used. We know that going back a very long time, the use of water and wind had never amounted to very much (Figure 2) compared to burned biomass and coal, in terms of energy produced. Humans and draft animals were also relatively low in energy production. Because of its great heat-producing ability, coal quickly became the dominant fuel.

Figure 2. Annual energy consumption per head (megajoules) in England and Wales during the period 1561-70 to 1850-9 and in Italy from 1861-70. Figure by Wrigley

In general, we know that energy products, including coal, are necessary to enable processes that contribute to economic growth. Heat is needed for almost all industrial processes. Transportation needs energy products of one kind or another. Building roads and homes requires energy products. It is not surprising that the Industrial Revolution began in Britain, with its use of coal.

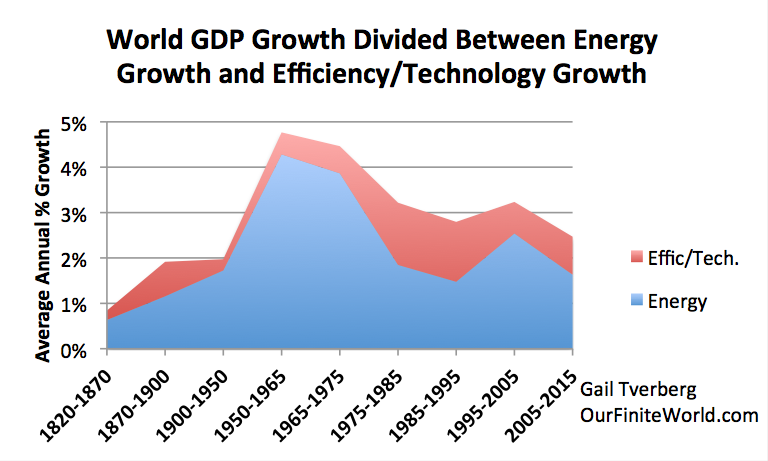

We also know that there is a long-term correlation between world GDP growth and energy consumption.

Figure 3. X-Y graph of world energy consumption (from BP Statistical Review of World Energy, 2017) versus world GDP in 2010 US$, from World Bank.

The “flat period” in 1920-1940 in Figure 1 was likely problematic. The economy is a self-organized networked system; what was wrong could be expected to appear in many parts of the economy. Economic growth was likely far too low. The chance for conflict among nations was much higher because of stresses in the system–there was not really enough coal to go around. These stresses could extend to the period immediately before 1920 and after 1940, as well.

A Peak in Coal Production Hit UK, United States, and Germany at Close to the Same Time

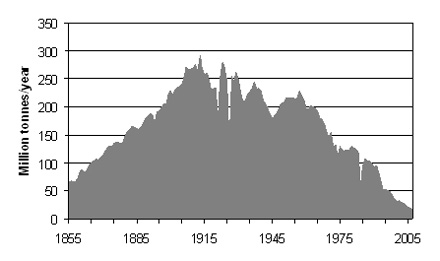

This is a coal supply chart for UK. Its peak coal production (which was an all time peak) was in 1913. The UK was the largest coal producer in Europe at the time.

Figure 3. United Kingdom coal production since 1855, in figure by David Strahan. First published in New Scientist, 17 January 2008.

The United States hit a peak in its production only five years later, in 1918. This peak was only a “local” peak. There were also later peaks, in 1947 and 2008, after coal production was developed in new areas of the country.

Figure 4. US coal production, in Wikipedia exhibit by contributor Plazak.

By type, US coal production is as shown on Figure 5.

Figure 5. US coal production by type, in Wikipedia exhibit by contributor Plazak.

Evidently, the highest quality coal, Anthracite, reached a peak and began to decline about 1918. Bituminous coal hit a peak about the same time, and dropped way back in production during the 1930s. The poorer quality coals were added later, as the better-quality coals became less abundant.

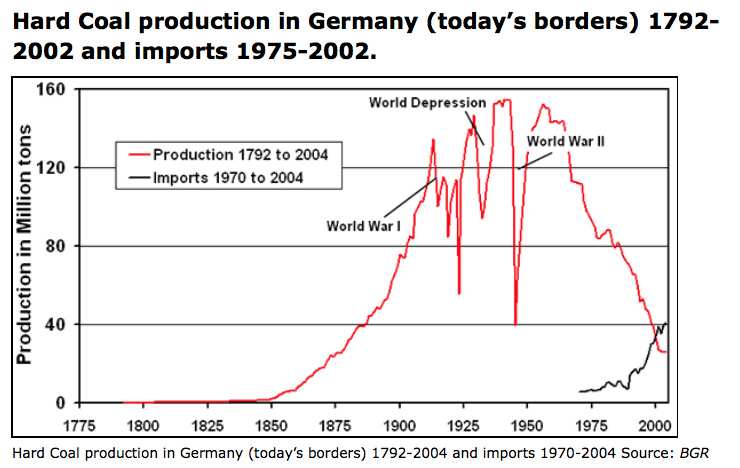

The pattern for Germany’s hard coal shows a pattern somewhat in between the UK and the US pattern.

Figure 6. Source GBR.

Germany too had a peak during World War I, then dropped back for several years. It then had three later peaks, the highest one during World War II.

What Affects Coal Production?

If there is a shortage of coal, fixing it is not as simple as “inadequate coal supply leads to higher price,” quickly followed by “higher price leads to more production.” Clearly the amount of coal resource in the ground affects the amount of coal extraction, but other things do as well.

[1] The amount of built infrastructure for taking the coal out and delivering the coal. Usually, a country only adds a little coal extraction capacity at a time and leaves the rest in the ground. (This is how the US and Germany could have temporary coal peaks, which were later surpassed by higher peaks.) To add more extraction capacity, it is necessary to add (a) investment needed for getting the coal out of the ground as well as (b) infrastructure for delivering coal to potential users. This includes things like trains and tracks, and export terminals for coal transported by boats.

[2] Prices available in the marketplace for coal. These fluctuate widely. We will discuss this more in a later section. Clearly, the higher the price, the greater the quantity of coal that can be extracted and delivered to users.

[3] The cost of extraction, both in existing locations and in new locations. These costs can perhaps be reduced if it is possible to add new technology. At the same time, there is a tendency for costs within a given mine to increase over time, as it becomes necessary to access deeper, thinner seams. Also, mines tend to be built in the most convenient locations first, with best access to transportation. New mines very often will be higher cost, when these factors are considered.

[4] The cost and availability of capital (shares of stock and sale of debt) needed for building new infrastructure, and for building new devices made possible by new technology. These are affected by interest rates and tax levels.

[5] Time lags needed to implement changes. New infrastructure and new technology are likely to take several years to implement.

[6] The extent to which wages can be recycled into demand for energy products. An economy needs to have buyers for the products it makes. If a large share of the workers in an economy is very low-paid, this creates a problem.

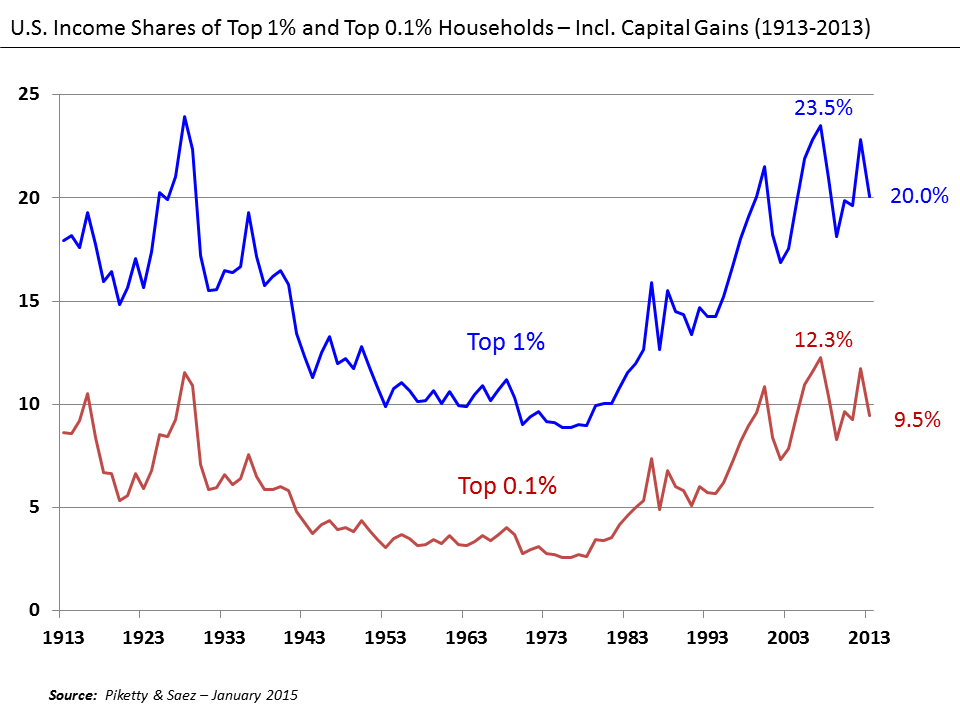

If there is an energy shortage, many people think of the shortage as causing high prices. In fact, the shortage is at least equally likely to cause greater wage disparity. This might also be considered a shortage of jobs that pay well. Without jobs that pay well, would-be workers find it hard to purchase the many goods and services created by the economy (such as homes, cars, food, clothing, and advanced education). For example, young adults may live with their parents longer, and elderly people may move in with their children.

The lack of jobs that pay well tends to hold down “demand” for goods made with commodities, and thus tends to bring down commodity prices. This problem happened in the 1930s and is happening again today. The problem is an affordability problem, but it is sometimes referred to as “low demand.” Workers with inadequate wages cannot afford to buy the goods made by the economy. There may be a glut of a commodity (food, or oil, or coal), and commodity prices that fall far below what producers need to make a profit.

Figure 7. U. S. Income Shares of Top 10% and Top 1%, Wikipedia exhibit by Piketty and Saez.

The Fluctuating Nature of Commodity Prices

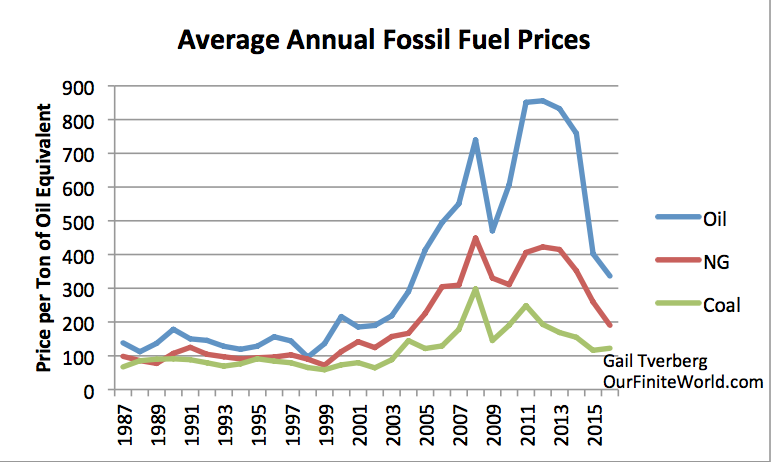

I have noted in the past that fossil fuel prices tend to move together. This is what we would expect, if affordability is a major issue, and affordability changes over time.

Figure 8. Price per ton of oil equivalent, based on comparative prices for oil, natural gas, and coal given in BP Statistical Review of World Energy. Not inflation adjusted.

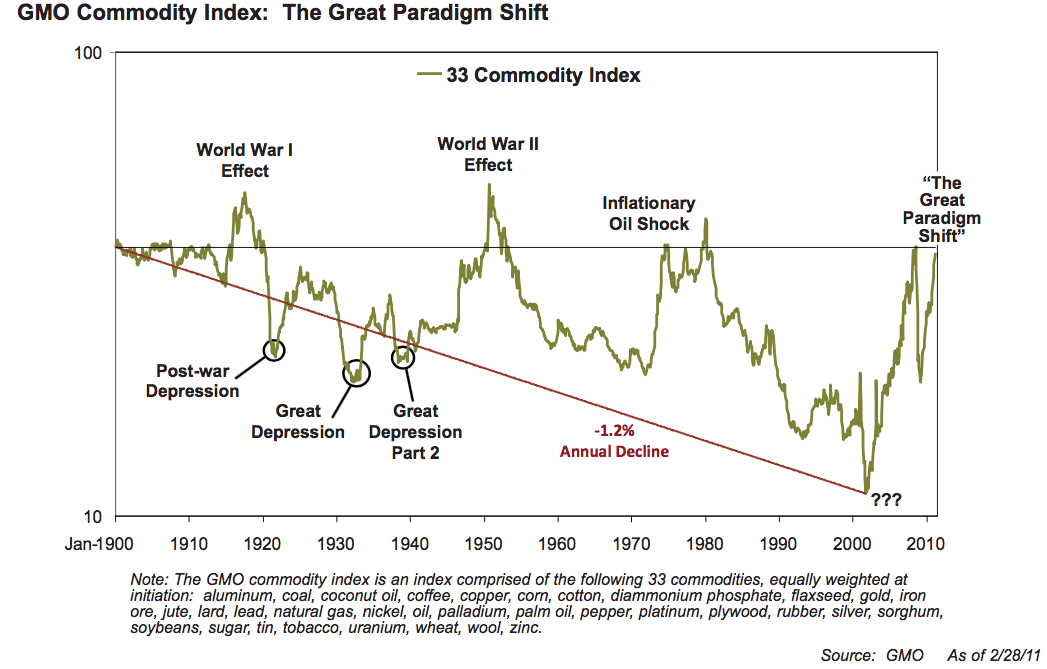

We would expect metal prices to follow fossil fuel prices, because fossil fuels are used in the extraction of ores of all kinds. Investment strategist Jeremy Grantham (and his company GMO) noted this correlation among commodity prices, and put together an index of commodity prices back to 1900.

Figure 9. GMO Commodity Index 1900 to 2011, from GMO April 2011 Quarterly Letter. “The Great Paradigm Shift,” shown at the end is not really the correct explanation, something now admitted by Grantham. If the graph were extended beyond 2010, it would show high prices in 2010 to 2013. Prices would fall to a much lower level in 2014 to 2017.

Reason for the Spikes in Prices. As we will see in the next few paragraphs, the spikes in prices generally arise in situations in which everyday goods (food, homes, clothing, transportation) suddenly became more affordable to “non-elite” workers. These are workers who are not highly educated, and are not in supervisory positions. These spikes in prices don’t generally “come about” by themselves; instead, they are engineered by governments, trying to stimulate the economy.

In both the World War I and World War II price spikes, governments greatly raised their debt levels to fund the war efforts. Some of this debt likely went directly into demand for commodities, such as to make more bombs, and to operate tanks, and thus tended to raise commodity prices. In addition, quite a bit of the debt indirectly led to more employment during the period of the war. For example, women who were not in the workforce were hired to take jobs that had been previously handled by men who were now part of the war effort. (These women were new non-elite workers.) Their earnings helped raise demand for goods and services of all kinds, and thus commodity prices.

The 2008 price spike was caused (at least in part) by a US housing-related debt bubble. Interest rates were lowered in the early 2000s to stimulate the economy. Also, banks were encouraged to lend to people who did not seem to meet usual underwriting standards. The additional demand for houses raised prices. Homeowners, wishing to cash in on the new higher prices for their homes, could refinance their loans and withdraw the cash related to the new higher prices. They could use the funds withdrawn to buy goods such as a new car or a remodeled basement. These withdrawn funds indirectly supplemented the earnings of non-elite workers (as did the lower interest rate on new borrowing).

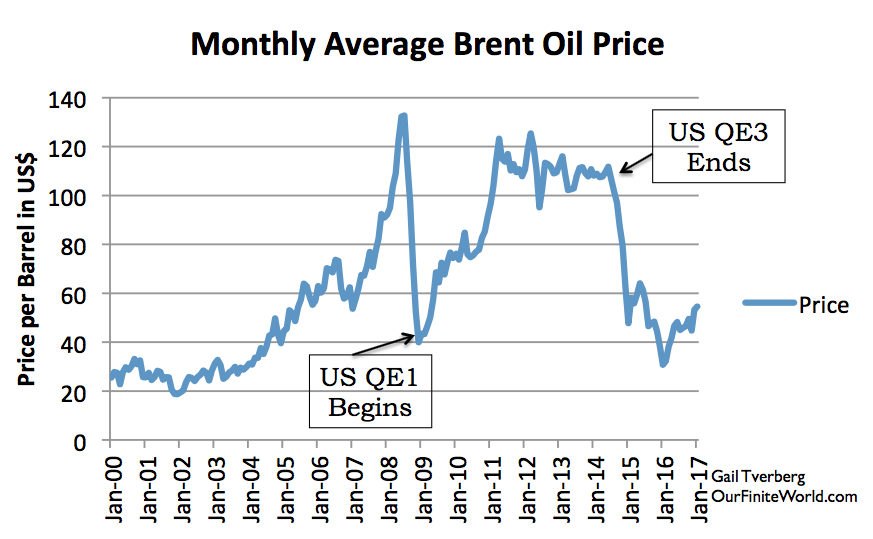

The 2011-2014 spike was caused by the extremely low interest rates made possible by Quantitative Easing. These low interest rates made the buying of homes and cars more affordable to all buyers, including non-elite workers. When the US discontinued its QE program in 2014, the US dollar rose relative to many other currencies, making oil and other fuels relatively more expensive to workers outside the US. These higher costs reduced the demand for fuels, and dropped fuel prices back down again.

Figure 10. Monthly Brent oil prices with dates of US beginning and ending QE.

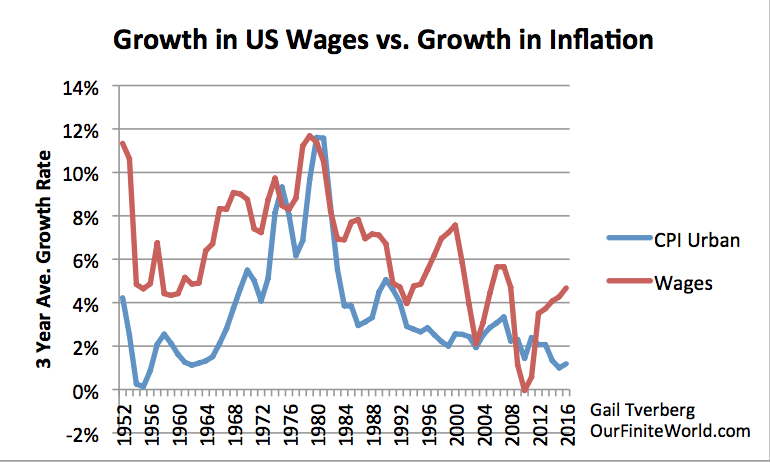

The run-up in oil prices (and other commodity prices) in the 1970s is widely attributed to US oil production peaking, but I think that the rapid run-up in prices was enabled by the rapid wage run-up of the period (Figure 11 below).

Figure 11. Growth in US wages versus increase in CPI Urban. Wages are total “Wages and Salaries” from US Bureau of Economic Analysis. CPI-Urban is from US Bureau of Labor Statistics.

The Opposing Force: Energy prices need to fall, if the economy is to grow. All of these upward swings in prices can be at most temporary changes to the long-term downward trend in prices. Let’s think about why.

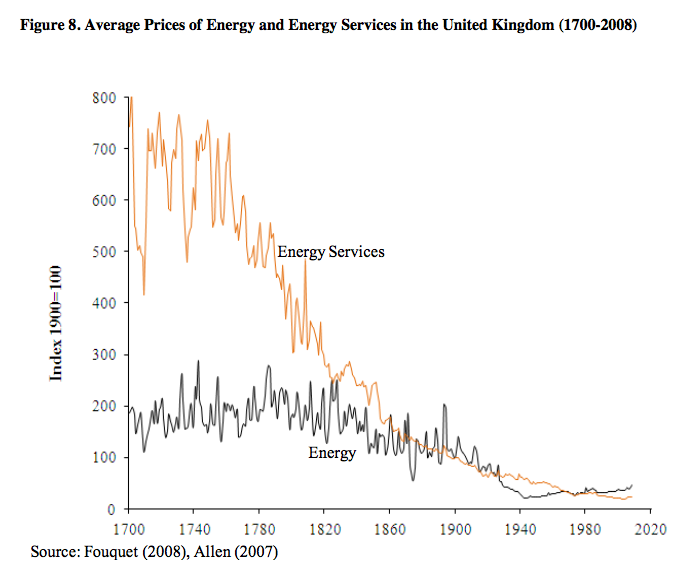

An economy needs to grow. To do so, it needs an increasing supply of commodities, particularly energy commodities. This can only happen if energy prices are trending lower. These lower prices enable the purchase of greater supply. We can see this in the results of some academic papers. For example, Roger Fouquet shows that it is not the cost of energy, per se, that drops over time. Rather, it is the cost of energy services that declines.

Figure 12. Total Cost of Energy and Energy Services, by Roger Fouquet, from Divergences in Long Run Trends in the Prices of Energy and Energy Services.

Energy services include changes in efficiency, besides energy costs themselves. Thus, Fouquet is looking at the cost of heating a home, or the cost of electrical services, or the cost of transportation services, in inflation-adjusted units.

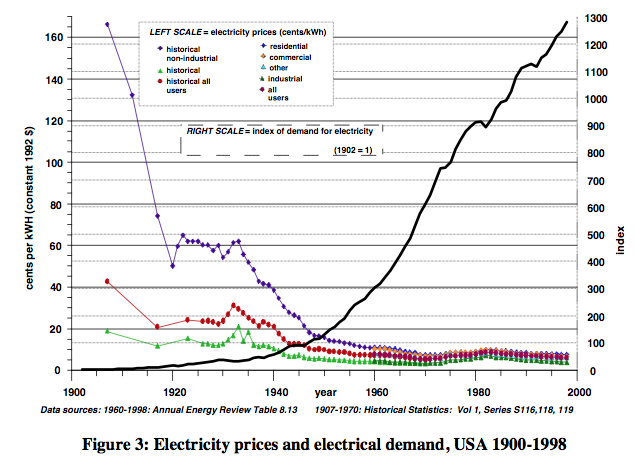

Robert Ayres and Benjamin Warr show a similar result, related to electricity. They also show that usage tends to rise, as prices fall.

Figure 13. Ayres and Warr Electricity Prices and Electricity Demand, from “Accounting for growth: the role of physical work.”

Ultimately, we know that the growth in energy consumption tends to rise at close to the same rate as the growth in GDP. To keep energy consumption rising, it is helpful if the cost of energy services is falling.

Figure 14. World GDP growth compared to world energy consumption growth for selected time periods since 1820. World real GDP trends for 1975 to present are based on USDA real GDP data in 2010$ for 1975 and subsequent. (Estimated by author for 2015.) GDP estimates for prior to 1975 are based on Maddison project updates as of 2013. Growth in the use of energy products is based on a combination of data from Appendix A data from Vaclav Smil’s Energy Transitions: History, Requirements and Prospects together with BP Statistical Review of World Energy 2015 for 1965 and subsequent.

How the Economic Growth Pump Works

There seems to be a widespread belief, “We pay each other’s wages.” If this is all that there is to economic growth, all that is needed to make the economy grow faster is for each of us to sell more services to each other (cut each other’s hair more often, or give each other back rubs, and charge for them ). I think this story is very incomplete.

The real story is that energy products can be used to leverage human labor. For example, it is inefficient for a human to walk to deliver goods to customers. If a human can drive a truck instead, it leverages his ability to deliver goods. The more leveraging that is available for human labor, the more goods and services that can be produced in total, and the higher inflation-adjusted wages can be. This increased leveraging of human labor allows inflation-adjusted wages to rise. Some might call this result, “a higher return on human labor.”

These higher wages need to go back to the non-elite workers, in order to keep the growth-pump operating. With higher-wages, these workers can afford to buy goods and services made with commodities, such as homes, cars, and food. They can also heat their homes and operate their vehicles. These wages help maintain the demand needed to keep commodity prices high enough to encourage more commodity production.

Raising wages for elite workers (such as managers and those with advanced education), or paying more in dividends to shareholders, doesn’t have the same effect. These individuals likely already have enough money to buy the necessities of life. They may use the extra income to buy shares of stock or bonds to save for retirement, or they may buy services (such as investment advice) that require little use of energy.

The belief, “We pay each other’s wages,” becomes increasingly false, if wages and wealth are concentrated in the hands of relatively few. For example, poor people become unable to afford doctors’ visits, even with insurance, if wage disparity becomes too great. It is only when wages are fairly equal that all can afford a wide range of services provided by others in the economy.

What Went Wrong in 1920 to 1940?

Very clearly, the first thing that went wrong was the peaking of UK coal production in 1913. Even before 1913, there were pressures coming from the higher cost of coal production, as mines became more depleted. In 1912, there was a 37-day national coal strike protesting the low wages of workers. Evidently, as extraction was becoming more difficult, coal prices were not able to rise sufficiently to cover all costs, and miners’ wages were suffering. The debt for World War I seems to have helped raise commodity prices to allow wages to be somewhat higher, even if coal production did not return to its previous level.

Suicide rates seem to behave inversely compared to earning power of non-elite workers. A study of suicide rates in England and Wales shows that these were increasing prior to World War I. This is what we would expect, if coal was becoming increasingly difficult to extract, and because of this, the returns for everyone, from owners to workers, was low.

Figure 15. Suicide rates in England and Wales 1861-2007 by Kyla Thomas and David Gunnell from International Journal of Epidemiology, 2010.

World War I, with its increased debt (which was in part used for more wages), helped the situation temporarily. But after World War I, the Great Depression set in, and with it, much higher suicide rates.

The Great Depression is the kind of result we would expect if UK no longer had enough coal to make the goods and services it had made previously. The lower production of goods and services would likely be paired with fewer jobs that paid well. In such a situation, it is not surprising that suicide rates rose. Suicide rates decreased greatly with World War II, and with all of the associated borrowing.

Looking more at what happened in the 1920 to 1940 period, Ugo Bardi tells us that prior to World War I, UK exported coal to Italy. With falling coal production, UK could no longer maintain those exports after World War I. This worsened relations with Italy, because Italy needed coal imported from UK to rebuild after the war. Ultimately, Italy aligned with Germany because Germany still had coal available to export. This set up the alliance for World War II.

Looking at the US, we see that World War I caused favorable conditions for exports, because with all of the fighting, Europe needed to import more goods (including food) from the United States. After the war ended in 1918, European demand was suddenly lower, and US commodity prices fell. American farmers found their incomes squeezed. As a result, they cut back on buying goods of many kinds, hurting the US economy.

One analysis of the economy of the 1920s tells us that from 1920 to 1921, farm prices fell at a catastrophic rate. “The price of wheat, the staple crop of the Great Plains, fell by almost half. The price of cotton, still the lifeblood of the South, fell by three-quarters. Farmers, many of whom had taken out loans to increase acreage and buy efficient new agricultural machines like tractors, suddenly couldn’t make their payments.”

In 1943, M. King Hubbert offered the view that all-time employment had peaked in 1920, except to the extent that it was jacked up by unusual means, such as war. In fact, some historical data shows that for four major industries combined (foundries, meat packing, paper, and printing), the employment index rose from 100 in 1914, to 157 in 1920. By September 1921, the employment index had fallen back to 89. The peak coal problem of UK had been exported to the US as low commodity prices and low employment.

It was not until the huge amount of debt related to World War II that the world economy could be stimulated enough so that total energy production per capita could continue to rise. The use of oil especially became much greater starting after World War II. It was the availability of cheap oil that allowed the world economy to grow again.

Figure 16. Per capita energy consumption by fuel, separately for several energy sources, using the same data as in Figure 1.

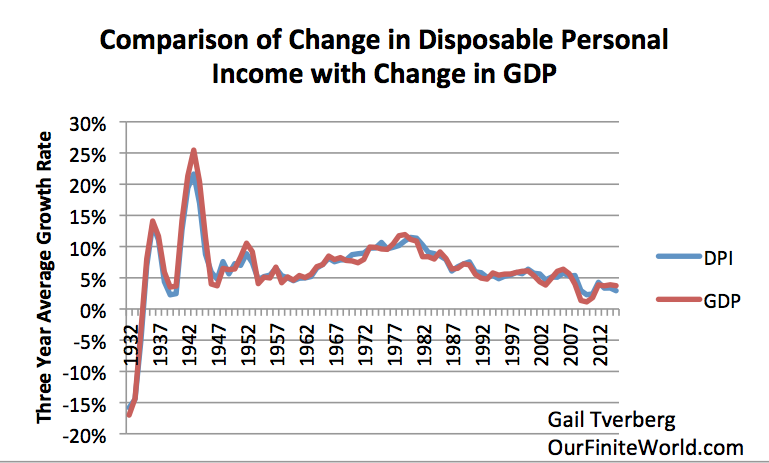

The stimulus of all the debt-enabled spending for World War II seems to have been what finally encouraged the production of the oil needed to pull the world economy out of the problems it was having. GDP and Disposable Personal Income could again rise (Figure 17.)

Figure 17. Comparison of 3-year average change in disposable personal income with 3-year change average in GDP, based on US BEA Tables 1.1.5 and 2.1.

Furthermore, total per capita energy consumption began to rise, with growing oil consumption (Figure 1). This growth in energy consumption per capita seems to be what allows the world economy to grow.

I might note that there is one other exceptional period: 1980 to 2000. Space does not allow for an explanation of the situation here, but falling per capita energy consumption seems to have led to the collapse of the former Soviet Union in 1991. This was a different situation, caused by lower oil consumption related to efficiency gains. This was a situation of an oil producer being “squeezed out” because additional oil was not needed at that time. This is an example of a different type of economic disruption caused by flat per capita energy consumption.

Figure 18. World per Capita Energy Consumption with two circles relating to flat consumption. World Energy Consumption by Source, based on Vaclav Smil estimates from Energy Transitions: History, Requirements and Prospects (Appendix) together with BP Statistical Data for 1965 and subsequent, divided by population estimates by Angus Maddison.

Conclusion

There have been many views put forth about what caused the Depression of the 1930s. To my knowledge, no one has put forth the explanation that the Depression was caused by Peak Coal in 1913 in UK, and a lack of other energy supplies that were growing rapidly enough to make up for this loss. As UK “exported” this problem around the world, it led to greater wage disparity. US farmers were especially affected; their incomes often dropped below the level needed for families to buy the necessities of life.

The issue, as I have discussed in previous posts, is a physics issue. Creating GDP requires energy; when not enough energy (often fossil fuels) is available, the economy tends to “freeze out” the most vulnerable. Often, it does this by increased wage disparity. The people at the top of the hierarchy still have plenty. It is the people at the bottom who find themselves purchasing less and less. Because there are so many people at the bottom of the hierarchy, their lower purchasing power tends to pull the system down.

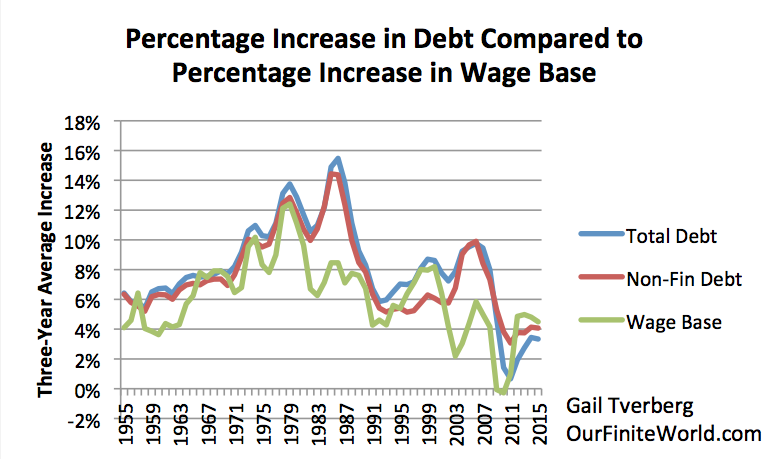

In the past, the way to get around inadequate wages for those at the bottom of the hierarchy has been to issue more debt. Some of this debt helps add more wages for non-elite workers, so helps fix the affordability problem.

Figure 19. Three-year average percent increase in debt compared to three year average percent increase in non-government wages, including proprietors’ income, which I call my wage base.

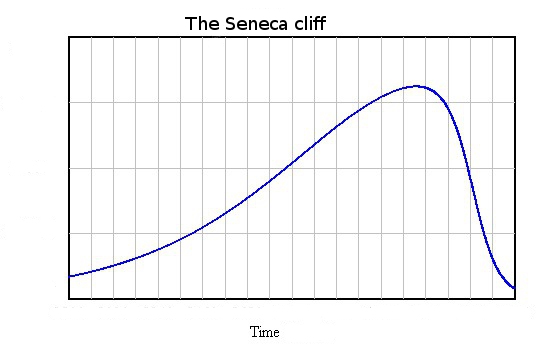

At this time, we seem to be reaching the point where, even with more debt, we are running out of cheap energy to add to the system. When this happens, the economic system seems more prone to fracture. Ugo Bardi calls the situation “reaching the inflection point in a Seneca Cliff.”

Figure 20. Seneca Cliff by Ugo Bardi

We were very close to the inflection point in the 1930s. We were very close to that point in 2008. We seem to be getting close to that point again now. The model of the 1930s gives us an indication regarding what to expect: apparent surpluses of commodities of all types; commodity prices that are too low; a lack of jobs, especially ones that pay an adequate wage; collapsing financial institutions. This is close to the opposite of what many people assume that peak oil will look like. But it may be a better representation of what we really should expect.