![]()

See this visualization first on the Voronoi app.

Use This Visualization

Does the Sahm Rule Point to a U.S. Recession?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

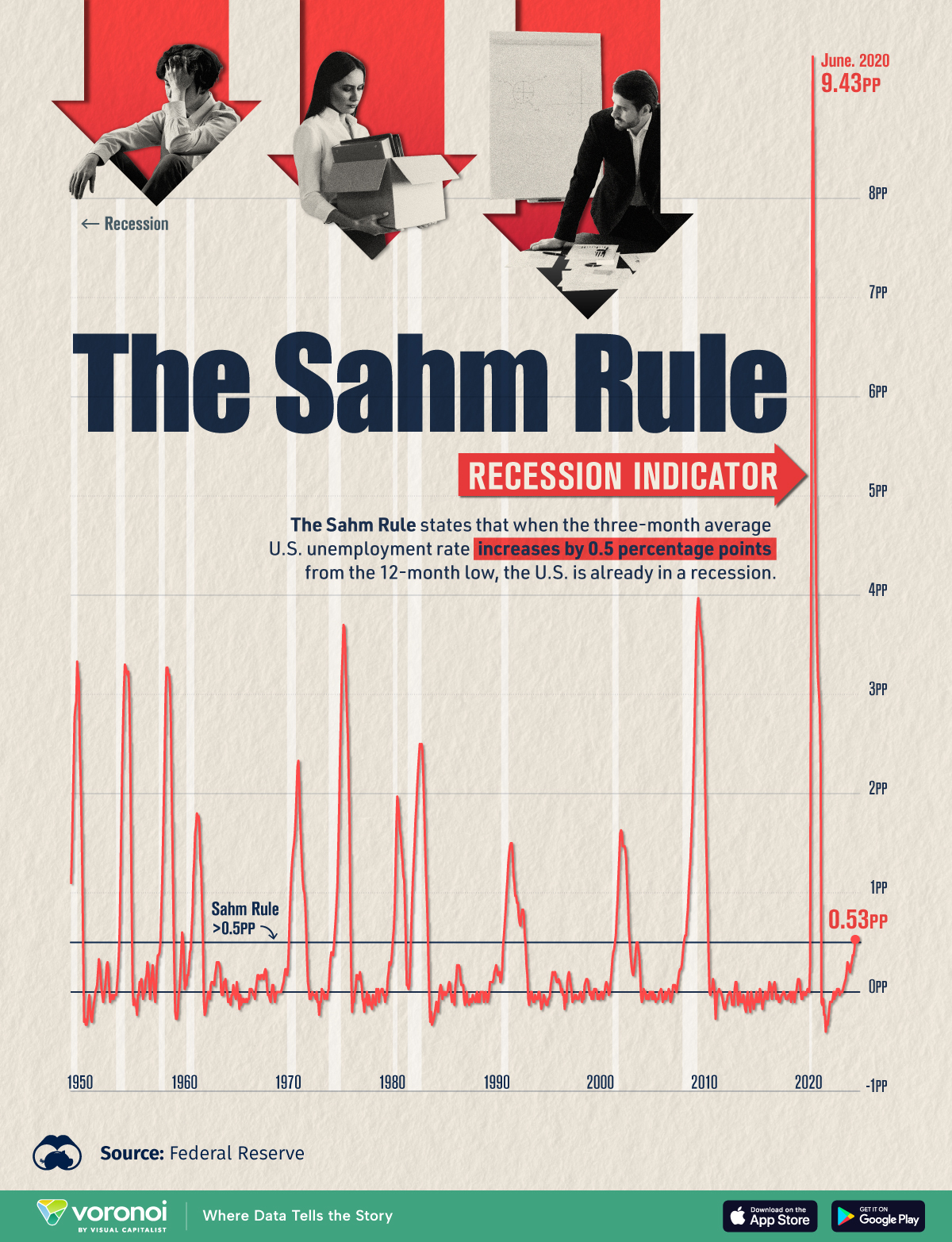

The Sahm Rule, an indicator that has signaled every U.S. recession since 1949, flashed red in July amid a weaker jobs report.

Created in 2019 by economist Claudia Sahm, the rule states that when the three-month average U.S. unemployment rate increases by 0.5 percentage points from the 12-month low, the U.S. is already in a recession. Yet, this signal may be overstated due to the unique labor market dynamics being seen today.

This graphic shows the Sahm Rule over modern history, based on data from the Federal Reserve.

When Has the Sahm Indicator Been Triggered?

Below, we show the historical accuracy of the Sahm Rule, highlighting how the indicator has crossed the threshold of 0.5 percentage points during virtually all past U.S. recessions:

| Date | Sahm Rule (pp) | Unemployment Rate | Recession Date | Recession Starts |

|---|---|---|---|---|

| Mar 1949 | 1.1 | 5.0% | Nov 1948 | 4 months prior |

| Nov 1953 | 0.63 | 3.5% | Jul 1953 | 4 months prior |

| Oct 1957 | 0.50 | 4.5% | Aug 1957 | 2 months prior |

| Nov 1959 | 0.60 | 5.8% | Apr 1960 | 5 months later |

| Mar 1970 | 0.77 | 4.4% | Dec 1960 | 3 months prior |

| Jul 1974 | 0.60 | 5.5% | Nov 1973 | 8 months prior |

| Feb 1980 | 0.53 | 6.3% | Jan 1980 | 1 month prior |

| Nov 1981 | 0.60 | 8.3% | Jul 1981 | 4 months prior |

| Oct 1990 | 0.57 | 5.9% | Jul 1990 | 3 months prior |

| Jun 2001 | 0.50 | 4.5% | Mar 2001 | 3 months prior |

| Feb 2008 | 0.53 | 4.9% | Dec 2007 | 2 months prior |

| Apr 2020 | 4.00 | 14.8% | Feb 2020 | 2 months prior |

| Jul 2024 | 0.53 | 4.3% | Unknown | Unknown |

Source: Bank of America, Federal Reserve

As the above table shows, there was one time when a triggering of the Sahm Rule took place outside of a recession in 1959, with a recession happening five months after.

It’s also worth noting that the actual unemployment rate typically doesn’t matter. Instead, it’s the change from its 12-month low that has the greatest influence on recession dynamics. This can be attributed to demographic factors impacting the unemployment rate over time, such as an aging population. Additionally, the rate of change can lead economic dynamics to shift quickly. More unemployed workers can weaken consumer demand, in turn leading unemployment to rise.

While the unemployment rate has been near historic lows, it has inched higher due to the nature of today’s U.S. workforce. In 2024, the rise in unemployment is due to an expanding labor pool, driven in part by workers migrating to America who haven’t found a job yet. Notably, an influx of unemployed entrants into the labor pool is driving half of this increase in the percentage points, triggering the Sahm Rule. By contrast, previous recessions saw rising unemployment being fueled by layoffs.

Learn More on the Voronoi App ![]()

To learn more about this topic from a U.S. job market perspective, check out this graphic on the biggest tech layoffs so far in 2024.

The post Does the Sahm Rule Point to a U.S. Recession? appeared first on Visual Capitalist.