Submitted by Charles Hugh-Smith of OfTwoMinds blog,

Is there anyone on the planet who's actually stupid enough to believe these New Normal charts are healthy and sustainable?

Anyone questioning the sustainability and rightness of The New Normal is immediately attacked by the mainstream-media defenders of the crumbling status quo. Not only is everything that broke in 2008 fixed, everything's going great globally, and anyone who dares question this narrative in a tin-foil hat conspiracy nut or simply an annoyingly doom-and-gloomer who recalcitrantly refuses to accept the positive glories of official statistics: low unemployment, rising valuations of stock market Unicorns, etc.

But the New Normal is anything but normal; all the readings of artificial life-support and manipulation are off the charts. If the New Normal were indeed a return to normalcy, we'd see a rapid and sustained decline in official life-support of the economy.

Instead, we see official life-support efforts rising to new and dangerous levels. The only reason stocks are at nose-bleed valuations globally is massive, sustained intervention on multiple levels.

We also see increasing dependence on debt to sustain increasingly weak growth. The New Normal is all about diminishing returns on additional debt.

The New Normal is also about the loss of institutional credibility. The Federal Reserve denies it makes policy decisions based on the stock market, but as soon as stocks start tumbling, the Fed's leadership hits the airwaves with a media blitzkrieg, frantically assuring the world that the Fed will do "whatever it takes" to keep stocks at absurdly overvalued levels forever.

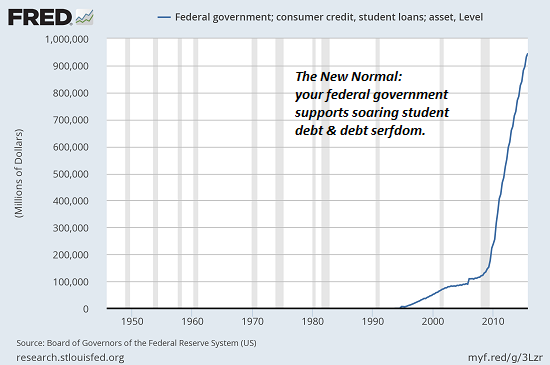

It once cost the equivalent of a new auto to attend a highly regarded public university. Now they cost the equivalent of a new house--and a mansion at that. In the pre-New Normal world of academia, the highest paid employees were senior professors (other than the university president).

Now under-assistant deans are paid $250,000 each while new tenured professors scrape by on $75,000, and most of the teaching (the actual purpose of the university, ahem) is done by academic serfs paid $35,000 to $45,000 a year, with few benefits and no pensions. (A fancy title masks the serfdom: adjunct professors.)

Meanwhile, the quality and value of the education has reached such low levels, a large percentage of student debt-serfs gain no real knowledge and many don't even graduate.

Here's how all those billions of dollars in administrative salaries get paid: with debt enabled by the federal government. If this looks remotely sustainable or healthy to you, please get your eyes checked immediately:

Diminishing returns on soaring debt is the hallmark of The New Normal. Bank credit has shot up like a rocket, but GDP has been subpar:

[image]https://www.oftwominds.com/photos2016/bank-credit2-16a.png[/image]

The recent surge of hope in global stock markets is largely the result of soaring credit expansion in China. The New Normal boils down to this: paper over non-performing loans (NPL) and debt that will never be paid back with new loans.

Debt and (not much) deleveraging (McKinsey & Company)

China's New Credit Surges to Record on Seasonal Lending Binge

[image]https://www.oftwominds.com/photos2016/China-lending-spree.png[/image]

China's debt to GDP is another New Normal manifestation of diminishing returns on new debt: every government and central bank is dumping more credit into their economies in the vain hope that more credit will spark "organic growth." Unfortunately for the New Normal cheerleaders, more credit chokes "organic growth."

[image]https://www.oftwominds.com/photos2016/global-debt3-16a.jpg[/image]

The New Normal can only be propped up by massive central bank purchases of stocks and bonds. Look at the assets that have been purchased by the Bank of Japan in the past four years: up from 1.2 trillion yen to 4 trillion yen.

[image]https://www.oftwominds.com/photos2016/BoJ-assets.png[/image]

The New Normal means central bank balance sheets only go up, they never come down. Everyone knows that if central banks tried to sell even a sliver of their trillions in assets, global markets would promptly crash.

[image]https://www.oftwominds.com/photos2016/fed-balance5-16a.png[/image]

The New Normal is stagnant income for the bottom 95% and fewer people working. In The New Normal "recovery," the percentage of the population with a job has advanced all the way back up to where it was 40 years ago, in the late 1970s.

[image]https://www.oftwominds.com/photos2016/employment-population3-16b.png[/image]

[image]https://www.oftwominds.com/photos2016/wage-inequality3-16a.jpg[/image]

Is there anyone on the planet who's actually stupid enough to believe these New Normal charts are healthy and sustainable? I doubt it. Rather, the apologists, toadies, apparatchiks and flacks are being well-paid to cheerlead, and the "leadership" (using the term lightly) of the discredited institutions are terrified of what will happen when people finally catch on.

The New Normal is not sustainable. Ramping up intervention and new debt to ever-more unprecedented levels will only serve to destabilize the economy and society-- a foolishly dangerous path indeed.

* * *

My new book is #3 on Kindle short reads -> politics and social science: Why Our Status Quo Failed and Is Beyond Reform ($3.95 Kindle ebook, $8.95 print edition) For more, please visit the book's website.