By EconMatters

This has not been a good year for emerging markets. Since many of the emerging economies are commodity-reliant (mainly crude oil), the oil price plunge has also crashed their currencies, which prompted money fear and flight.

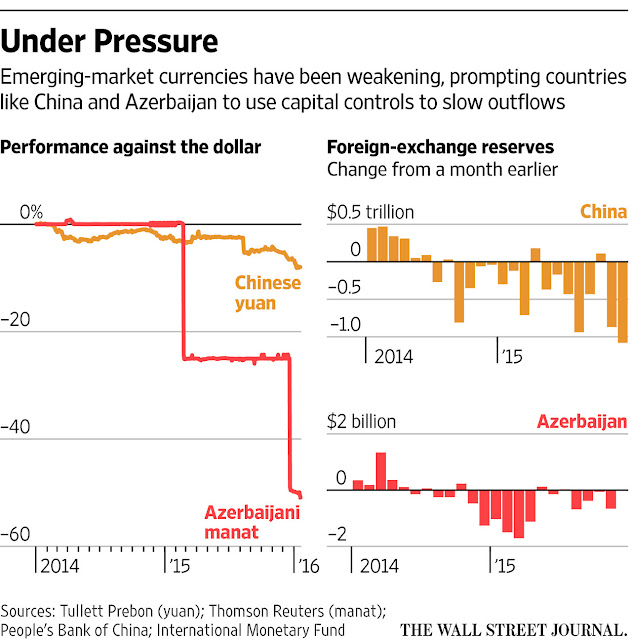

WSJ quoted the Institute of International Finance that emerging markets suffered record net outflows of $732 billion in 2015, with China accounting for the bulk of that. The Russian ruble, Mexican peso and Colombian peso all hit record lows against the dollar. Overall, emerging-market currencies fell 3% in the first two weeks of 2016.

Watch: Oil Markets Go Green (Video, Jan. 21,2016)

According to WSJ, Azerbaijan said this week it would slap a 20% tax on any transaction that takes money out of the country. Saudi Arabia told banks with branches there to stop allowing traders to short Saudi's currency, the riyal. Nigeria recently halted imports of goods including rice and toothpicks and imposed spending limits on credit and debit cards denominated in foreign currency.

The Mighty Beijing instituted a restriction similar to Saudi Arabia’s on forward currency bets and suspended applications for certain outbound investments. India, Venezuela and Egypt also have responded by applying some form of capital controls.

The capital controls are supposed to discourage the outflow of money and the shorts piling in on their currencies. But this is also scaring away potential foreign investors and hurting businesses that need to hedge. Basically capital controls can not rectify the underlying economic weakness and the policy uncertainty will also increase the risk premium of doing business there.

Emerging markets used to be a bright spot for investors after the financial crisis. But china teetering on recession, and the collapse in oil and other commodity prices has reversed the trend.

So far, these policies have mixed results. India’s capital controls back in 2013 did help the country's currency and rebuild its foreign reserves. But right now capital flight continues in China, Venezuela and Egypt while their reserves also dwindle because their currencies all are pegged to the dollar to some degrees.

Some money managers are willing to stick it out hoping for a payday somewhere down the road. The bottom line lies in how emerging markets manage a massive outflow of capital, weakness in their currencies and economies, and a swollen debt burden will be the determining factors in the fate of their nation and ultimately investor's bets.

© EconMatters All Rights Reserved | Facebook | Twitter | YouTube | Email Alert | Kindle