Gold Up 8% In First Half 2017; Builds On 8.5% Gain In 2016

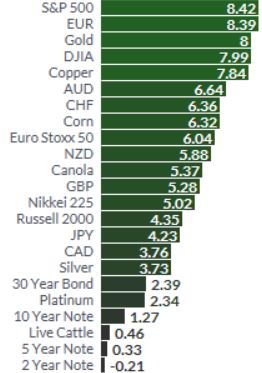

- Gold up 8% in first half 2017; builds on 8.5% gain in 2016- U.S. dollar down 6.5% - worst quarter in seven years- Gold higher in all currencies except Draghi's euro - Gold outperforms bonds; similar gains as stock indices- S&P 500 and Dax outperform gold marginally- World stocks (MSCI World) up 10%; gold outperforms Eurostoxx (+6%) & FTSE (+2.3%)- Silver up 3.7% in first half ; builds on 15% gain in 2016- Stocks, bonds, property buoyed by stimulus- Resilience in gold as world struggles to hold confidence- "If one hasn’t diversified this would be a good time to do that" - Shiller

Editor: Mark O'Byrne

Finviz.com

From President Trump taking office, Fed policy tightening to European and UK elections, Brexit rumblings and growing Middle Eastern risks, the first half of 2017 gave witness to a few trends which look set to impact markets in the coming months.

Gold and silver are amongst the best performing assets in 2017, with gains of 8% and 4% respectively and stayed resilient despite poor sentiment.

Demand drivers such as geopolitical uncertainty, a weak dollar and low interest rates continue to provide support for the precious metals as does renewed robust demand in the Middle East, India and China.

[image]https://www.goldcore.com/ie/wp-content/uploads/sites/19/2017/07/gold-currencies-H1-2017.jpg[/image]

Given 2016 finished with a sell-off in the precious metals, both gold and silver have remained impressively resilient in the face of overwhelmingly bearish sentiment in much of the media and with the retail investing public in the U.S. and most of the western world.

Gold rose in value in all currencies except the euro in which it fell 1.2%.

This is compared to say the likes of crude oil which has been under pressure of late and experienced a 20% correction. Not even the world's two top oil producers agreeing in May to prolong their ongoing output cut from the first half of 2017 to the end of the first quarter of 2018 has been enough to prop up the price.

For silver fans, the last few weeks have been disappointing as silver has dropped 4.9%, while gold has dropped only 1.9%. Silver often mimics gold but of late industrial traits in the metal have affected its price more than usual.

We may have seen a turnaround this week however as silver has traded near a two-week highs as a stumbling dollar provided a boost to both precious metals.

Trump’s arrival in January set off quite a Trump rally in the first quarter of the year however this was not able to be maintained. Multiple distractions have meant that Trump’s policy agenda has been thrown off course and delayed.

The Trump rally in the first quarter appears to be stalling badly as false promises come to fruition and he struggles to execute policies in the face of powerful vested interests in corporate America and on Wall Street.

The world is changing rapidly posing risks to any sort of conventional economic recovery.

As a McKinsey study highlighted this week, ‘Even if we rebuild factories here and you build plants here, they’re just not going to employ thousands of people -- that just doesn’t happen,” said report co-author and McKinsey Global Institute Director James Manyika. “Find a factory anywhere in the world built in the last 5 years -- not many people work there.”

Robert Shiller, Nobel Laureate economist, told CNBC this week that investors should be cautious about investing in US stocks in such ‘an unusual market.’ The CAPE index he devised thirty years ago is at ‘unusual highs’ which is concerning. The Yale professor advised,

‘One should have a little of everything if one hasn’t diversified this would be a good time to do that.’

Trump delays and scandal has weakened the US currency and benefited gold. Despite this record-high equity prices and bond prices with higher U.S. bond yields appear to have kept a lid on gold and silver prices which would normally have seen greater gains in an environment of such uncertainty.

Speaking of currencies, strength in the euro has meant investors are currently paying the least for gold than they have in earlier months as the currency climbs amid speculation that the ECB plans to reduce monetary stimulus.

Gold priced in euros is currently down more than 10% from its 2017 peak in April. However, further euro gains against the US dollar would likely support the sentiment surrounding gold and could lead to gold breaking out in dollar terms above the key $1,300/oz level.

[image]https://www.goldcore.com/ie/wp-content/uploads/sites/19/2017/07/euro-gold-ytd-2017.jpg[/image]Gold in Euros (5 Years)

Positivity around the euro is unlikely to last as fears regarding contagion in the eurozone begin to resurface.

The government of Italy’s bailout of two Italian banks of a sum equal to the country’s defence budget will be enough to remind markets that a couple of positive election results is not enough to support the eurozone which is just balancing on a precipice of unsustainable debt levels.

Eurozone banks in Spain, Portugal, Greece and Ireland remain vulnerable.

Central banks elsewhere continue to affect sentiment around precious metals and sometimes in an unexpected fashion. Federal Reserve rate policy was expected to weaken gold, however rate hikes prior to June prompted gold to climb as opposed to tumble, as one might expect. Across markets interest rates remain historically low and government bond yields are low to negative.

Worries over this situation are exacerbated further as disparities between how central banks move forward are becoming clear. For example the U.S. Federal Reserve is starting to raise interest rates but some major central banks continue to keep rates low and print more money.

As a result, gold and silver both remain far more attractive stores of value.

Brexit has and will continue to provide support for both metals. Gold has outperformed sterling this year (+2%) as the currency continues to suffer thanks to uncertainty regarding the divorce talks between the sovereign country and the European economic union.

The country’s assumed fail safe London property market is rapidly coming undone as 75% of houses sell for below asking price.

Goldman Sachs explained this week that the bank is bullish on the yellow due to ‘global growth momentum likely having peaked’ and gold therefore representing a ‘good hedge for equity.’

More importantly it pointed towards peak gold mine supply in 2017 as a reason for gold to head above it’s commodity team year-end target of $1,250.

Supply of gold will continue to be anaemic while demand remains robust as the likes of China, India and Russia buy up physical gold. Yuan weakening and a slowing property market has helped to drive demand in China, while India saw its gold imports rise fourfold in May compared to last year.

Considering Robert Shiller’s comments, the reasons for diversification continue to grow every day, mainly due to fear trades and poor economic management. Where should we start?

Worsening relations in the Middle East, worries over North Korea’s nuclear program and therefore US-China relations, Brexit uncertainty, the gaping difference between central banks’ monetary policies, lack of progress in US congress and finally the looming threat of inflation following on from years of QE around the world.

Whilst gold and silver may not have performed to the same extent they did in the first-half of 2016, we can be assured as they have held themselves well despite a bearish environment in terms of U.S. and western sentiment. There seems little cause for the precious metals to be pushed lower in the medium to long-term.

The primary cause of the global financial crisis was insolvent banks and massive debt in all segments of society. This has yet to be addressed in any sustainable manner.

Arguably, the financial position of banks and even more so western sovereign nations is in a far worse place than in 2008 whilst political instability is very real and poses very real risks to markets and risk assets.

Gold and silver's continuing gains reflect both the massive global financial bubble and increasing geopolitical dangers.

Investment and savings diversification is now more important than ever.

News and Commentary

Gold steady ahead of U.S. Independence day holiday (Reuters.com)

Asia Stocks Mixed While Oil Gains for Eighth Day (Bloomberg.com)

Industrials Push Rebound in U.S. Stocks; Oil Gains (Bloomberg.com)

U.S. Consumers Sour on Outlook While Happy With Their Finances (Bloomberg.com)

UK household savings ratio plunges to all time low (Nasdaq.com)

[image]https://www.goldcore.com/ie/wp-content/uploads/sites/19/2017/07/total-return-of-asset-classes-10-yr-usd-2017.06.28.gif[/image]Source: bmgbullion

Blowing bubbles: New world economic order (ABC.net.au)

The Coming Carmageddon (DailyReckoning.com)

World’s Most Dangerous Man (DailyReckoning.com)

U.S. Gold Exports Surge As Its Gold Trade Deficit Continues (SRSRoccoReport.com)

Bitcoin Nears Bear Market Territory (Fortune.com)

Gold Prices (LBMA AM)

03 Jul: USD 1,235.20, GBP 952.09 & EUR 1,085.00 per ounce30 Jun: USD 1,243.25, GBP 957.43 & EUR 1,090.83 per ounce29 Jun: USD 1,246.60, GBP 959.88 & EUR 1,093.14 per ounce28 Jun: USD 1,251.60, GBP 976.25 & EUR 1,101.91 per ounce27 Jun: USD 1,250.40, GBP 980.31 & EUR 1,111.36 per ounce26 Jun: USD 1,240.85, GBP 975.56 & EUR 1,109.32 per ounce23 Jun: USD 1,256.30, GBP 987.70 & EUR 1,125.27 per ounce

Silver Prices (LBMA)

03 Jul: USD 16.48, GBP 12.72 & EUR 14.49 per ounce30 Jun: USD 16.47, GBP 12.69 & EUR 14.44 per ounce29 Jun: USD 16.83, GBP 12.98 & EUR 14.76 per ounce28 Jun: USD 16.78, GBP 13.08 & EUR 14.78 per ounce27 Jun: USD 16.66, GBP 13.07 & EUR 14.79 per ounce26 Jun: USD 16.53, GBP 12.98 & EUR 14.79 per ounce23 Jun: USD 16.71, GBP 13.12 & EUR 14.97 per ounce

Recent Market Updates

- Pensions Timebomb In America – “National Crisis” Cometh- London Property Bubble Bursting? UK In Unchartered Territory On Brexit and Election Mess- Shrinkflation – Real Inflation Much Higher Than Reported- Goldman, Citi Turn Positive On Gold – Despite “Mysterious” Flash Crash- Worst Crash In Our Lifetime Coming – Jim Rogers- Go for Gold – Win a beautiful Gold Sovereign coin- Only Gold Lasts Forever- Your Future Wealth Depends on what You Decide to Keep and Invest in Now- Inflation is no longer in stealth mode- James Rickards: Gold Will Start Heading Higher On “Dwindling” Supply- Billionaires Invest In Gold- Brexit and UK election impact UK housing- In Gold we Trust: Must See Gold Charts and Research

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.