![]()

See this visualization first on the Voronoi app.

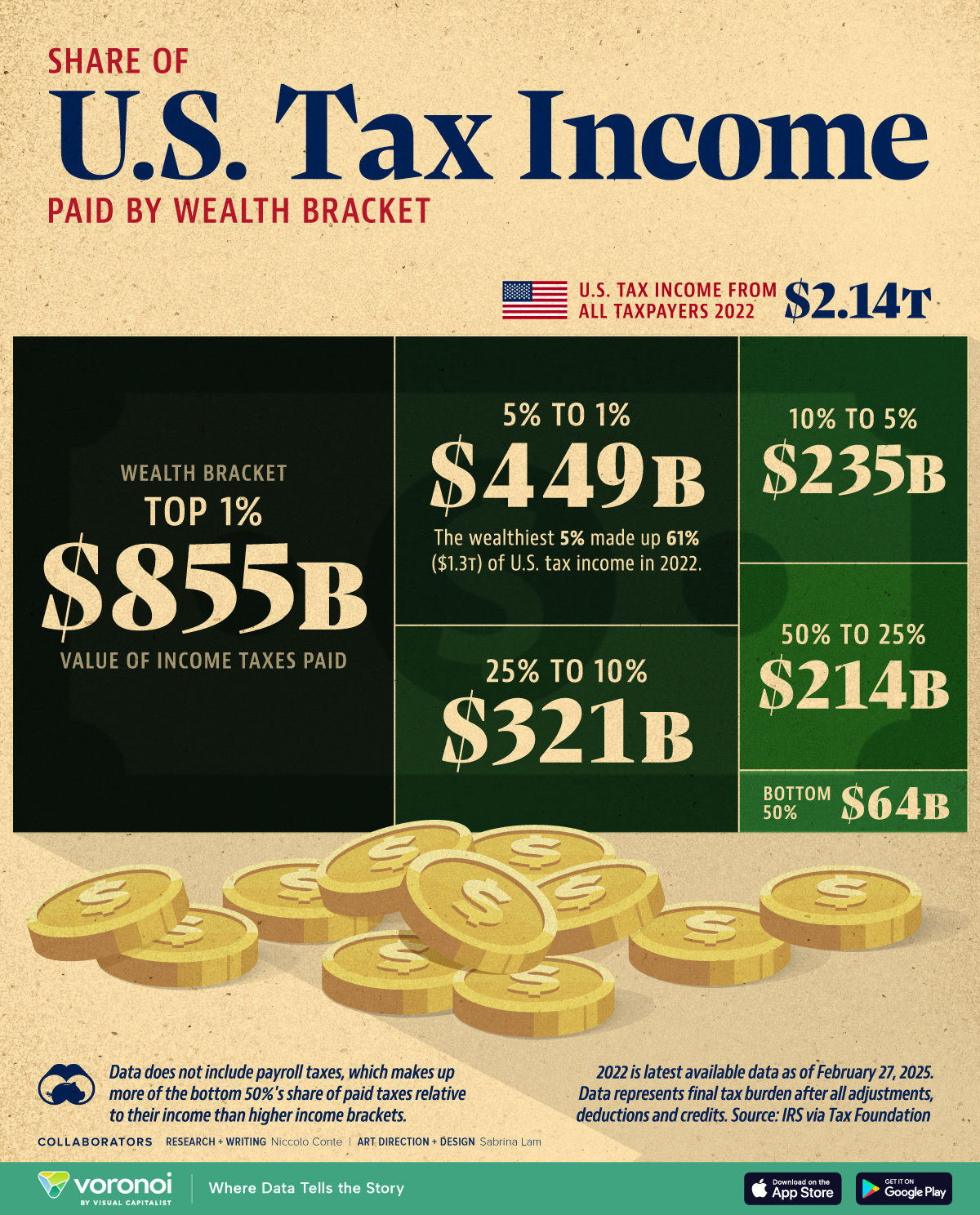

U.S. Income Tax Revenue by Wealth Bracket

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- The U.S. federal government collected $2.14 trillion in income taxes in 2022, funded primarily from the highest wealth brackets.

- The average income tax rate for the top 1% of earners stood at 26.1%.

- Overall, the bottom 50% of earners contributed 3% of total income taxes paid. However, the data does not include payroll taxes which make up a higher share of paid taxes relative to their income than higher income brackets.

The top 1% of U.S. earners paid 40% of federal income taxes in 2022, based on the latest available data.

This share has risen from 33.2% in 2001. Meanwhile, the share paid by the bottom 50% of earners fell from 4.9% to 3% over the same period—likely reflecting the growing concentration of wealth at the top, which has boosted tax contributions from high-income individuals.

This graphic shows federal income tax revenue by wealth bracket, based on analysis of IRS data from the Tax Foundation.

Breaking Down America’s Income Tax Revenue

Below, we show the share of total federal income taxes paid by wealth tier in 2022:

| Income | Share of Total Income Taxes Paid | Value of Income Taxes Paid |

|---|---|---|

| Top 1% | 40% | $854.5B |

| 5% to 1% | 21% | $448.6B |

| 10% to 5% | 11% | $235.0B |

| 25% to 10% | 15% | $320.5B |

| 50% to 25% | 10% | $213.6B |

| Bottom 50% | 3% | $64.1B |

| Total | $2.14T |

Americans earning over $663,000, considered the top 1%, paid $854.5 billion in income taxes, the highest share overall.

The average income tax rate for this tier was 26.1%, across more than 1.5 million income tax returns in 2022. Individuals in this bracket paid $561,523, on average, in their income tax filings.

For those falling in the top 5% to 1% of all U.S. earners, income tax revenue amounted to $448.6 billion, the second-highest share. Taxpayers falling into this bracket earned between $261,591 and $663,164 and paid 23.1% on average in income tax.

Meanwhile, the bottom half of earners funded the smallest share of total income tax revenue, with an average income tax rate of 3.7%. These represent earners of $50,339 or less, spanning across 76.9 million American taxpayers.

Learn More on the Voronoi App ![]()

To learn more about this topic from a global perspective, check out this graphic on top marginal income tax rates around the world.

The post How Much Does Each U.S. Wealth Bracket Pay in Income Taxes? appeared first on Visual Capitalist.