By EconMatters

The Title says I am long stupidity, which I am, but I am also long Corruption, Excessive Government Debt, Excessive Risk Taking in Financial Markets, Excessive Complacency, Terrible Trade Wars, Protectionism. I am So Long Government and Central Bank Incompetence, Long Inflation, Long The Massive Credit Bubble Blowing Up, and Long the entire financial system collapsing.

The reason for this rational belief is because the entire financial and government system is built upon such lunacy, corruption, outright stupidity, and overall bad practices. The entire system is guaranteed to fail, you cannot input such stupidity, and get out good results in the end. It is guaranteed to fail, it is a logical certainty.

This isn`t even a debatable issue or something an analyst would apply a probability model towards, it is a 100% guaranteed outcome result of such poor inputs into the equation. Every single input into the health of the financial system is a patently flawed strategy, not one input is sound and sustainable, 2+2 doesn`t equal NEGATIVE ZERO GRAVITY.

Therefore, the entire financial system is going to crash, as it should with such stupidity and massive incompetence. The only question is how best to play this systemic crash this time around while avoiding counterparty risk issues which occurred during the 2008 financial crash.

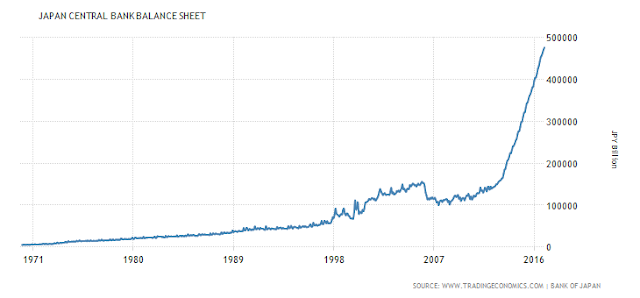

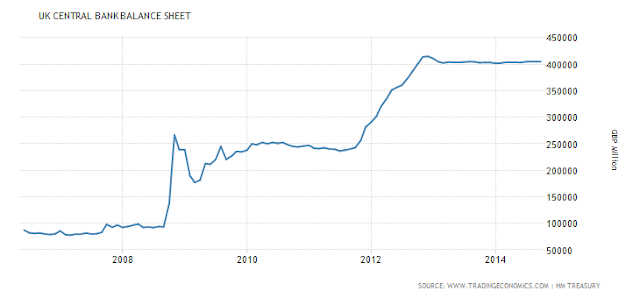

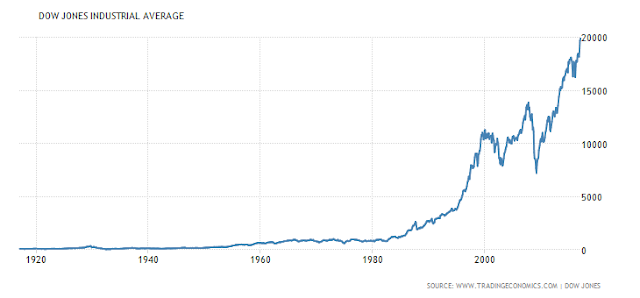

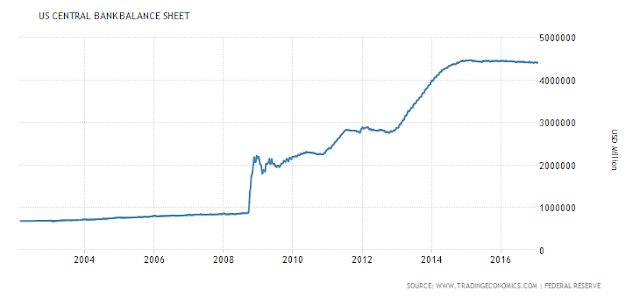

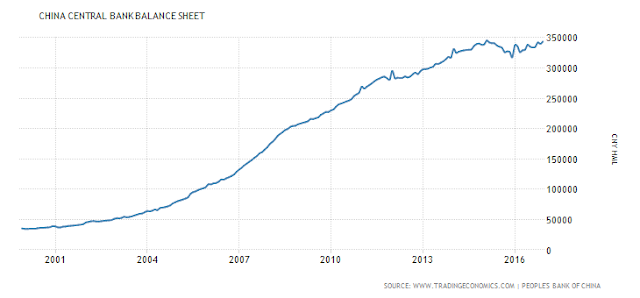

The other question is what blame and culpability do Central Bankers get this time around for creating this financial asset bubble, and doubling down on the very strategy that caused the 2008 financial crisis? Nobody could be this incompetent, clueless, reckless, and stupid in their actions, so it has to be outright corruption. And as such these Central Bankers need to start reaping what they sow in creating these financial asset bubbles that ultimately lead to financial system failures like in 2000, 2007, and 2017!

https://www.youtube.com/watch?v=wvYn_mLKWGY

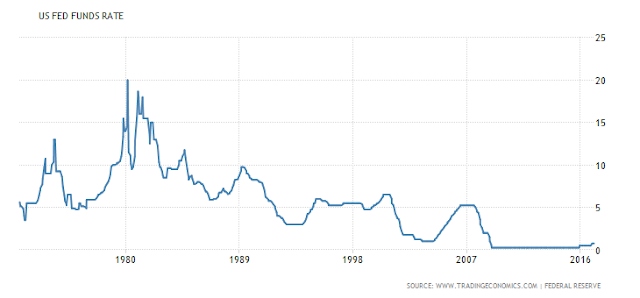

Central Bankers your only job should be to stop creating artificial financial market asset bubbles, that put the entire global economy at substantial risk because the market conditions caused by unsustainable and extremely risky input monetary policies are guaranteed to lead to unstable results because the very nature of them being artificial in nature and unsustainable! Financial Market Bubbles will occur plenty enough on their own due to excessive speculation, but these are manageable.

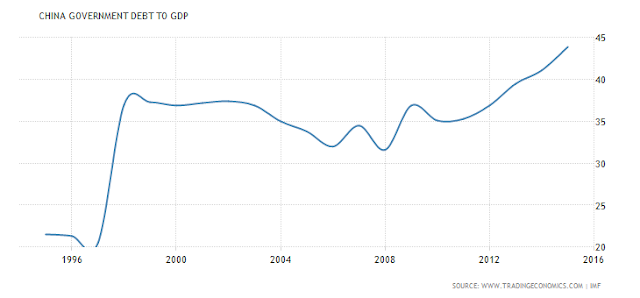

When central bankers encourage excessive risk taking by market participants however through extreme monetary policy initiatives like ZIRP for a decade represents, this presents risks that are unmanageable to the entire global interconnected financial system. This is where we are at right now, the crux of the issue, and it will end very badly for all countries from China, Japan and Europe to the United States.

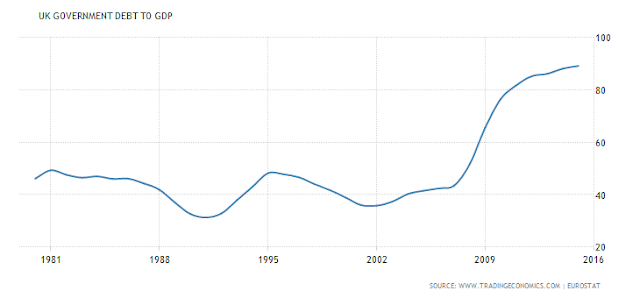

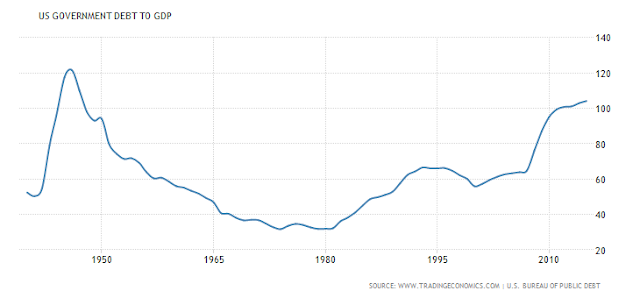

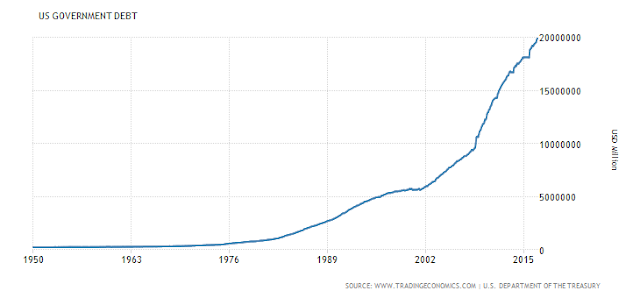

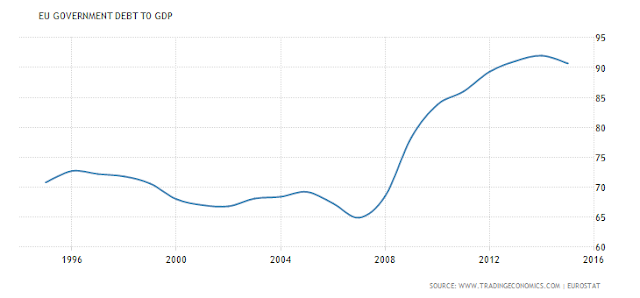

Just look at all the government and private debt accumulated on balance sheets around the globe for the last decade, and tell me with a straight face a) this is sustainable, and b) doesn`t have severe consequences for the global economy going forward. Think in terms of the Greek Debt Crisis writ large and applied to the entire global financial system. This is what Central Bankers need to be worried about and not a blip of improvement in the labor market or a tick up or down in inflation, it is financial market stability, and the massive financial asset bubbles they artificially created in markets with ZIRP!

© EconMatters All Rights Reserved | Facebook | Twitter | YouTube | Email Digest | Kindle