Submitted by David Stockman via Contra Corner,

Our point yesterday was that the Fed and its Wall Street fellow travelers are about to get mugged by the oncoming battering rams of global deflation and domestic recession.

When the bust comes, these foolish Keynesian proponents of everything is awesome will be caught like deer in the headlights. That’s because they view the world through a forecasting model that is an obsolete relic—one which essentially assumes a closed US economy and that balance sheets don’t matter.

By contrast, we think balance sheets and the unfolding collapse of the global credit bubble matter above all else. Accordingly, what lies ahead is not history repeating itself in some timeless Keynesian economic cycle, but the last twenty years of madcap central bank money printing repudiating itself.

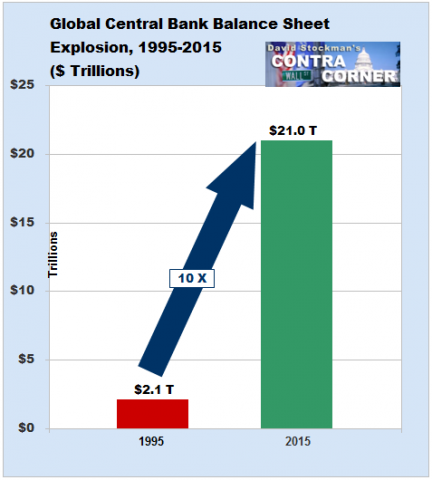

Ironically, the gravamen of the indictment against the “all is awesome” case is that this time is different——radically, irreversibly and dangerously so. High powered central bank credit has exploded from $2 trillion to $21 trillion since the mid-1990’s, and that has turned the global economy inside out.

Under any kind of sane and sound monetary regime, and based on any semblance of prior history and doctrine, the combined balance sheets of the world’s central banks would total perhaps $5 trillion at present (5% annual growth since 1994). The massive expansion beyond that is what has fueled the mother of all financial and economic bubbles.

Owing to this giant monetary aberration, the roughly $50 trillion rise of global GDP during that period was not driven by the mobilization of honest capital, profitable investment and production-based gains in income and wealth. It was fueled, instead, by the greatest credit explosion ever imagined——$185 trillion over the course of two decades.

As a consequence, household consumption around the world became bloated by one-time takedowns of higher leverage and inflated incomes from booming production and investment. Likewise, the GDP accounts were drastically ballooned by a spree of malinvestment that was enabled by cheap credit, not the rational probability of sustainable profits.

In short, trillions of reported global GDP—–especially in the Red Ponzi of China and its EM supply chain—–represents false prosperity; the income being spent and recorded in the official accounts is merely the feedback loop of the central bank driven credit machine.

[image]https://davidstockmanscontracorner.com/wp-content/uploads/2015/09/Capture14-447x480.png[/image]

But now we are at the credit bubble apogee. Nearly every major economy of the world is being freighted down with debilitating levels of debt. By some sober estimates upwards of 20% of China’s monumental $30 trillion debt pile may be non-performing, and that means that the parallel credit mountains among its supplier base are equally imperiled.

Indeed, the credit ponzi at the heart of the global economy has reached the classic breaking point. Last year China generated nearly $2 trillion in additional debt, but nearly all of it went to paying interest on existing obligations. It is only a matter of time before the $30 trillion house of debt cards there comes violently tumbling down.

Nor is this just an EM world disability. The old age colony on the Japanese archipelago has a 400% debt to GDP ratio, and most of the world by McKinsey’s reckoning a year ago is not far behind.

Accordingly, the defining condition in the years ahead will be the inverse of the 20-year credit bubble. At peak debt, the world’s economies will struggle with delinquencies, defaults, write-offs, plunging profits, impaired assets and collapsing valuation multiples.

This means that for the first time in nearly a century global GDP will shrink in nominal terms——even as the debt mountain reaches its final ascent. In fact, dollar denominated global GDP is already contracting, and is projected to be down this year by the stunning sum of $3.8 trillion or 5%. Figure 1. Gross Planet Product at current prices (trillions of dollars, 1980 – 2015)

[image]https://davidstockmanscontracorner.com/wp-content/uploads/2015/12/van-bergelijk-fig1-4-dec.png[/image]

Source: IMF World Economic Outlook Database, October 2015.

Needless to say, the Keynesian narrative denies that the above displayed 5% dip for 2015 is relevant or, more importantly, that it marks the beginning of an unprecedented downward plunge that may last for years to come.

Instead, our learned PhDs assure that the world economy is growing at a swell 3-4% rate on a currency and inflation adjusted basis. Indeed, in terms of purchasing power parity (PPP) most of the world has purportedly never had it better.

Here’s the thing. The world runs on dollars, not on the statistical abstractions like purchasing power parity that are spit out of academic macroeconomic models. In fact, upwards of $4 trillion in currency trades occur daily in futures, options and forward markets, and virtually all of them are in nominal dollar pairs or dollar referenced crosses.

There are no trades in “real” dollars, currency adjusted GDP or units of PPP. And that’s profoundly important because the entire $225 trillion global debt bubble is anchored in dollars.

That is, it is either denominated in dollars directly such as the $60 trillion of domestic credit market debt or the $10 trillion of dollar dominated off-shore bonds; or it is denominated in the “near-dollars” generated by off-shore banking systems and domestic bond markets.

Stated differently, euros, yen, yuan, won, ringgit and even Saudi riyals are near-dollars. The currently outstanding debt denominated in all of these currencies arose in domestic credit markets that were fundamentally shaped by the dollar policies of their respective central central banks.

The short-hand essence of it is that the Fed printed and the PBOC, ECB, BOJ and all the rest printed, too. Overwhelmingly, this was done in the name of export mercantilism under which currencies were pegged to the dollar to keep exchange rates artificially low so that exports would continue to flow.

Needless to say, this relentless exchange rate pegging caused foreign central banks to accumulate massive dollar reserves, and to propagate domestic credit within their own banking and financial system on a reciprocating basis. In sequestering dollars, for instance, the PBOC created massive amounts of new RMB.

And so the world’s mountain of dollar and near-dollar debt grew like topsy.

Thus, the PBOC did not increase its so-called FX reserves by 80X after 1994 because Mr. Deng and his successors were saving FX for a rainy day; they were bailing dollars earned from their export machine and pumping RMB back into their domestic credit market at an historically insane pace.

Likewise, Saudi Arabia earned massive amounts of inflated dollars as the global credit and CapEx bubble created an unquenchable thirst for oil and unprecedented windfall rents at $100 per barrel. But the Saudi central bank kept its currency rigidly pegged at 3.8 riyal/dollar, thereby causing an enormous expansion of its balance sheet and domestic credit.

Indeed, domestic Saudi bank lending grew at 20-40% annual rates during the first oil bubble, which peaked at $150 per barrel in 2008, and continued to expand at 10-20% annual rates until the world oil price break in June 2014.

At the end of the day, the Fed led central bank money printing spree of the past two decades resulted in what is functionally a massive dollar short. Once the Fed stopped expanding its balance sheet when QE officially ended in October 2014, it was only a matter of time before all the “near-dollars” of the world would come under enormous downward pressure in the FX markets.

Our Keynesian witch doctors believe that sinking currencies are a wonderful thing, of course. They claim making your country poorer is a good way to stimulate export growth and a virtuous cycle of spending and growth.

But there is another thing. It is also a good way to generate capital flight and an eventual need to shrink internal banking and credit markets in order to stop a total FX meltdown. That’s exactly what is happening in China and throughout the EM today.