Published

1 hour ago

on

October 10, 2025

| 23 views

-->

By

Jenna Ross

Graphics & Design

- Zack Aboulazm

The following content is sponsored by Citizens Bank

Mapped: Check Fraud by State

Key Takeaways

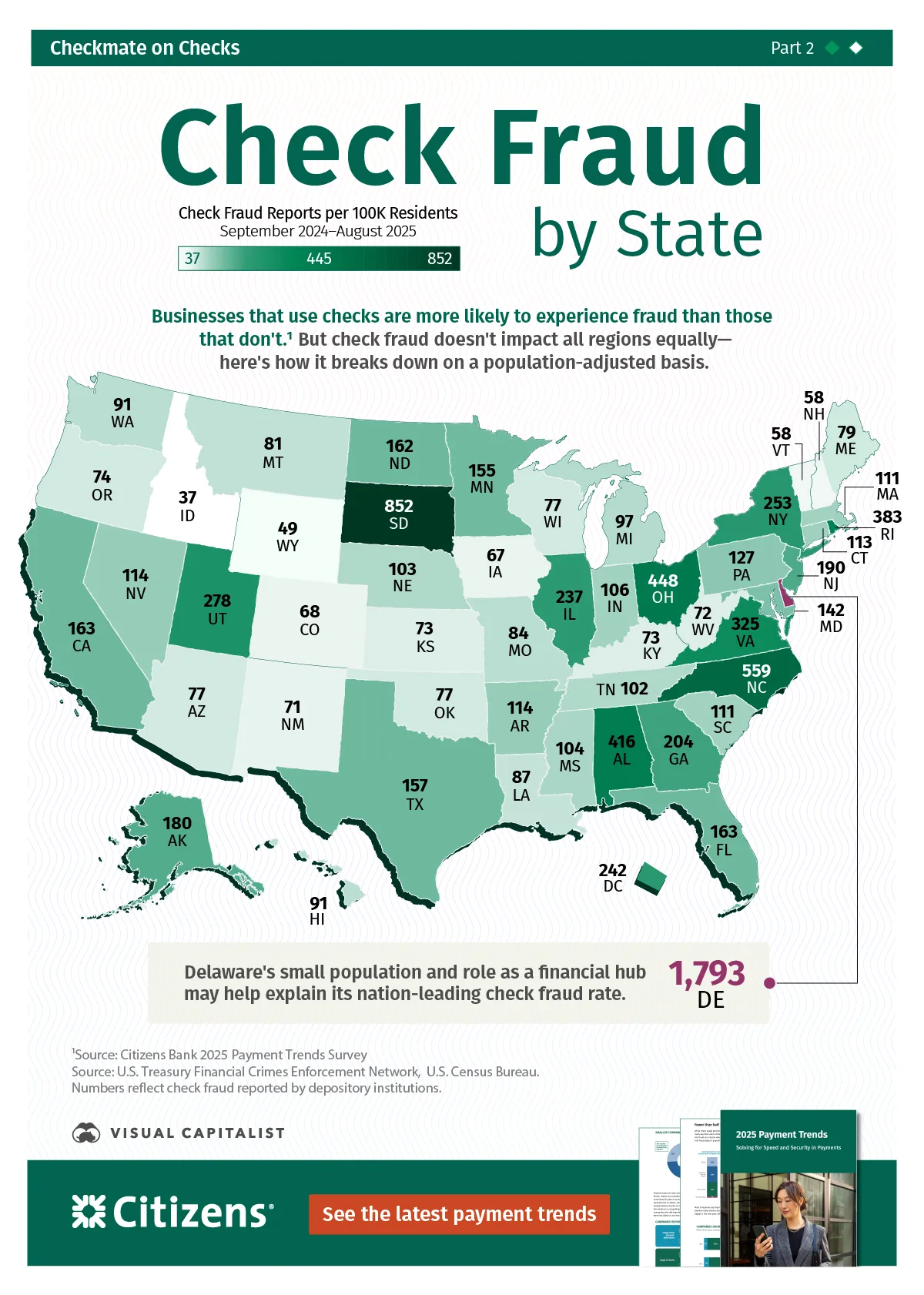

- On a population-adjusted basis, check fraud is highest in Delaware and South Dakota.

- The lowest rates of fraud are in Idaho and Wyoming.

Check fraud is by far the most common type of fraud. In fact, it’s reported nearly twice as often as credit and debit card incidents and 2.5 times more often than automated clearing house (ACH) cases. But which states are hit the hardest?

Created in partnership with Citizens Bank, this graphic is the second in our Checkmate on Checks series and breaks down check fraud on a population-adjusted basis.

A State-by-State Look at Check Fraud

We looked at check fraud that depository institutions reported to the Financial Crimes Enforcement Network. Given that states with higher populations would naturally experience more fraud reports, we’ve adjusted the data to show reports per 100,000 residents.

| State | Check Fraud Reports per 100K Residents |

|---|---|

| Delaware | 1,793 |

| South Dakota | 852 |

| North Carolina | 559 |

| Ohio | 448 |

| Alabama | 416 |

| Rhode Island | 383 |

| Virginia | 325 |

| Utah | 278 |

| New York | 253 |

| District of Columbia | 242 |

| Illinois | 237 |

| Georgia | 204 |

| New Jersey | 190 |

| Alaska | 180 |

| California | 163 |

| Florida | 163 |

| North Dakota | 162 |

| Texas | 157 |

| Minnesota | 155 |

| Maryland | 142 |

| Pennsylvania | 127 |

| Arkansas | 114 |

| Nevada | 114 |

| Connecticut | 113 |

| South Carolina | 111 |

| Massachusetts | 111 |

| Indiana | 106 |

| Mississippi | 104 |

| Nebraska | 103 |

| Tennessee | 102 |

| Michigan | 97 |

| Washington | 91 |

| Hawaii | 91 |

| Louisiana | 87 |

| Missouri | 84 |

| Montana | 81 |

| Maine | 79 |

| Oklahoma | 77 |

| Arizona | 77 |

| Wisconsin | 77 |

| Oregon | 74 |

| Kansas | 73 |

| Kentucky | 73 |

| West Virginia | 72 |

| New Mexico | 71 |

| Colorado | 68 |

| Iowa | 67 |

| New Hampshire | 58 |

| Vermont | 58 |

| Wyoming | 49 |

| Idaho | 37 |

Source: U.S. Treasury Financial Crimes Enforcement Network, U.S. Census Bureau. Fraud data are the latest available from September 2024–August 2025, and population data are as of 2024.

Delaware and South Dakota have the highest fraud rates. Both have relatively small populations and favorable regulations that have made them financial hubs.

At the other end of the scale, Idaho and Wyoming have the lowest levels of fraud related to checks on a population-adjusted basis. Both states have very low population density, which would make them less of a target in the rising trend of mail theft.

What Companies Say About Check Usage

Nearly half of companies still use checks, though this has decreased from 59% in 2024. Companies say checks are critical due to contractor, employee, and vendor preferences, along with fraud concerns.

However, these fraud concerns may be misguided. Companies that use checks were more likely to experience fraud and, as mentioned at the start of this article, check fraud is by far the most common type that financial institutions report.

Notably, many businesses do plan to transition to faster, more secure digital payments in the near future. In fact, a third of companies plan to switch to exclusively digital payments within the next year.

See the latest payment trends in the free report from Citizens Bank.

More from Citizens Bank

-

Business2 weeks ago

Charted: The End of the Line For Checks?

Find out just how much check use has dropped in the last 25 years, as people move to faster and more secure digital payment methods.

-

Technology8 months ago

AI Stocks: The Capital-Raising Surge

AI stocks captured investors’ interest in 2024, drawing a third of all VC funding. So, which companies are securing the biggest investments?

-

Financing10 months ago

Public vs. Privately-Held Companies: The Shifting Landscape

Over the last 25 years, the number of public companies has dropped while the number of privately-held companies has risen.

Subscribe

Please enable JavaScript in your browser to complete this form.Join 375,000+ email subscribers: *Sign Up