Published

15 mins ago

on

May 8, 2025

| 11 views

-->

By

Jenna Ross

Graphics & Design

- Lebon Siu

The following content is sponsored by Terzo

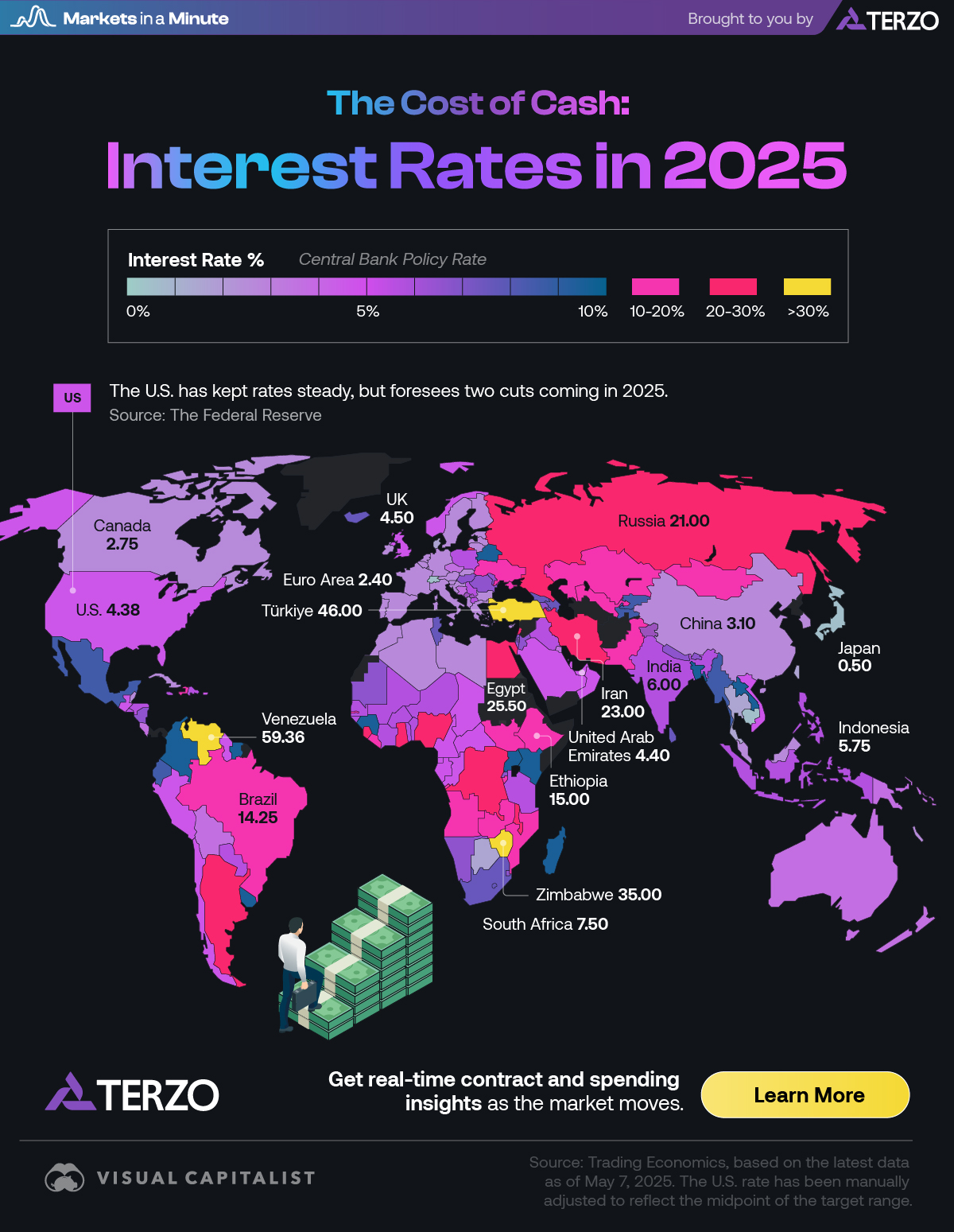

Mapped: Interest Rates by Country in 2025

Key Takeaways

- The U.S. has kept the interest rate steady, but foresees two cuts coming in 2025.

- Venezuela has the highest interest rate of 59.4% as the country continues to battle high inflation.

- Switzerland and Fiji have the lowest interest rates of 0.25%.

Amid economic uncertainty, how are central banks setting interest rates? Business leaders are watching to see whether rates will be lowered, held, or raised.

In this Markets in a Minute graphic, in partnership with Terzo, we show rates around the world.

Interest Rates by Country

Using data from Trading Economics, here are current rates set by countries’ central banks.

| Country | Interest Rate (%) |

|---|---|

| Fiji | 0.25 |

| Switzerland | 0.25 |

| Japan | 0.50 |

| Cambodia | 0.78 |

| Seychelles | 1.75 |

| Thailand | 1.75 |

| Denmark | 1.85 |

| Botswana | 1.90 |

| Barbados | 2.00 |

| Taiwan | 2.00 |

| Singapore | 2.23 |

| Bulgaria | 2.24 |

| Belize | 2.25 |

| Cuba | 2.25 |

| Morocco | 2.25 |

| Sweden | 2.25 |

| Euro Area | 2.40 |

| Cape Verde | 2.50 |

| Albania | 2.75 |

| Canada | 2.75 |

| South Korea | 2.75 |

| Algeria | 3.00 |

| Libya | 3.00 |

| Malaysia | 3.00 |

| New Caledonia | 3.00 |

| China | 3.10 |

| Bolivia | 3.44 |

| New Zealand | 3.50 |

| Trinidad and Tobago | 3.50 |

| Czech Republic | 3.50 |

| Bahamas | 4.00 |

| Costa Rica | 4.00 |

| Kuwait | 4.00 |

| Papua New Guinea | 4.00 |

| Australia | 4.10 |

| Bosnia and Herzegovina | 4.14 |

| United Arab Emirates | 4.40 |

| United States | 4.38 |

| Cameroon | 4.50 |

| Gabon | 4.50 |

| Guatemala | 4.50 |

| Israel | 4.50 |

| Mauritius | 4.50 |

| Norway | 4.50 |

| United Kingdom | 4.50 |

| Vietnam | 4.50 |

| Equatorial Guinea | 4.50 |

| Republic of the Congo | 4.50 |

| Hong Kong | 4.75 |

| Macau | 4.75 |

| Peru | 4.75 |

| Chad | 5.00 |

| Central African Republic | 5.00 |

| Chile | 5.00 |

| Guyana | 5.00 |

| Oman | 5.00 |

| Saudi Arabia | 5.00 |

| Qatar | 5.10 |

| Bahrain | 5.25 |

| Poland | 5.25 |

| Macedonia | 5.35 |

| Benin | 5.50 |

| Brunei | 5.50 |

| Burkina Faso | 5.50 |

| Guinea Bissau | 5.50 |

| Iraq | 5.50 |

| Ivory Coast | 5.50 |

| Mali | 5.50 |

| Niger | 5.50 |

| Philippines | 5.50 |

| Senegal | 5.50 |

| Togo | 5.50 |

| El Salvador | 5.59 |

| Dominican Republic | 5.75 |

| Honduras | 5.75 |

| Indonesia | 5.75 |

| Serbia | 5.75 |

| India | 6.00 |

| Jamaica | 6.00 |

| Paraguay | 6.00 |

| Tanzania | 6.00 |

| Nicaragua | 6.25 |

| Bhutan | 6.38 |

| Hungary | 6.50 |

| Jordan | 6.50 |

| Moldova | 6.50 |

| Nepal | 6.50 |

| Romania | 6.50 |

| Rwanda | 6.50 |

| Armenia | 6.75 |

| Mauritania | 6.75 |

| Namibia | 6.75 |

| Maldives | 7.00 |

| Swaziland | 7.00 |

| Azerbaijan | 7.25 |

| Lesotho | 7.25 |

| South Africa | 7.50 |

| Tunisia | 7.50 |

| Iceland | 7.75 |

| Georgia | 8.00 |

| Sri Lanka | 8.00 |

| Tajikistan | 8.25 |

| Ecuador | 8.40 |

| Kyrgyzstan | 9.00 |

| Mexico | 9.00 |

| Myanmar | 9.00 |

| Uruguay | 9.25 |

| Colombia | 9.25 |

| Belarus | 9.50 |

| Madagascar | 9.50 |

| Uganda | 9.75 |

| Bangladesh | 10.00 |

| Kenya | 10.00 |

| Laos | 10.00 |

| Sao Tome and Principe | 10.00 |

| Suriname | 10.00 |

| Guinea | 10.25 |

| Pakistan | 11.00 |

| Mozambique | 11.75 |

| Burundi | 12.00 |

| Mongolia | 12.00 |

| South Sudan | 12.00 |

| Uzbekistan | 14.00 |

| Brazil | 14.25 |

| Zambia | 14.50 |

| Ethiopia | 15.00 |

| Ukraine | 15.50 |

| Kazakhstan | 16.50 |

| Gambia | 17.00 |

| Haiti | 17.00 |

| Liberia | 17.00 |

| Angola | 19.50 |

| Lebanon | 20.00 |

| Russia | 21.00 |

| Iran | 23.00 |

| Sierra Leone | 24.75 |

| Congo | 25.00 |

| Egypt | 25.50 |

| Malawi | 26.00 |

| Nigeria | 27.50 |

| Ghana | 28.00 |

| Argentina | 29.00 |

| Zimbabwe | 35.00 |

| Turkey | 46.00 |

| Venezuela | 59.36 |

Data as of May 7, 2025. The U.S. rate has been manually adjusted to reflect the midpoint of the target range.

The U.S. has kept the target range at 4.25-4.50%. In their decision, the Federal Reserve cited that although an influx of imports caused a GDP decline, economic activity has “continued to expand at a solid pace.” The Federal Reserve also noted that the unemployment rate has stabilized at a low level, but that inflation remains somewhat elevated and economic uncertainty has increased.

In their latest economic projections in March, the Federal Reserve forecast that there will likely be two rate cuts by the end of 2025, bringing the target range down to 3.75-4.00%.

The Lowest and Highest Rates

Switzerland and Fiji have the lowest rate of 0.25%. The Swiss National Bank (SNB) lowered its rate by a quarter point in March, citing increasing uncertainty over the global impact of U.S. trade policies. The country’s inflation has since fallen to 0% in April, and the SNB has indicated they are ready to cut rates further to maintain price stability.

On the other hand, Venezuela (59.4%) and Türkiye (46.0%) have the highest rates globally. Central banks in both countries are responding to high inflation and dropping currency values against the U.S. dollar.

Smart Insights for a Changing Market

Interest rates are just one of the changing variables that affect company finances. As the market moves, get real-time contract and spending insights.

Learn more about how Terzo’s AI insights can help your business.

Related Topics: #central bank #inflation #interest rates #federal reserve #Terzo

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "Mapped: Interest Rates by Country in 2025";

var disqus_url = "https://www.visualcapitalist.com/sp/ter01-mapped-interest-rates-by-country-in-2025/";

var disqus_identifier = "visualcapitalist.disqus.com-177695";

You may also like

-

Money3 hours ago

Visualized: Post-Pandemic GDP Growth Recovery, by Region

While the U.S. has beaten pre-pandemic GDP growth expectations in 2025, other major economies are lagging.

-

Money2 days ago

Charted: Real Interest Rates by Country in 2025

Russia has the highest real interest rate, followed by Brazil and Mexico.

-

Money2 days ago

Charted: What the World’s Paying for Eggs

Switzerland tops the list.

-

Money3 days ago

Mapped: Best and Worst U.S. States for Saving Money in 2025

Trade disruptions and a looming recession? We’re now in a saving money era. But which Americans are best-positioned to succeed?

-

GDP6 days ago

Charted: Falling GDP Growth Forecasts for 2025

Global GDP growth is projected to slow to 2.8% in 2025, with Mexico and the U.S. facing the sharpest downgrades.

-

Money1 week ago

Charted: How Daily Incomes Have Changed in Top Economies (1994-2024)

Tracking per capita daily median incomes between 1994 and 2024 for 20 countries reveals where the most income growth has occurred.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up