![]()

See this visualization first on the Voronoi app.

Use This Visualization

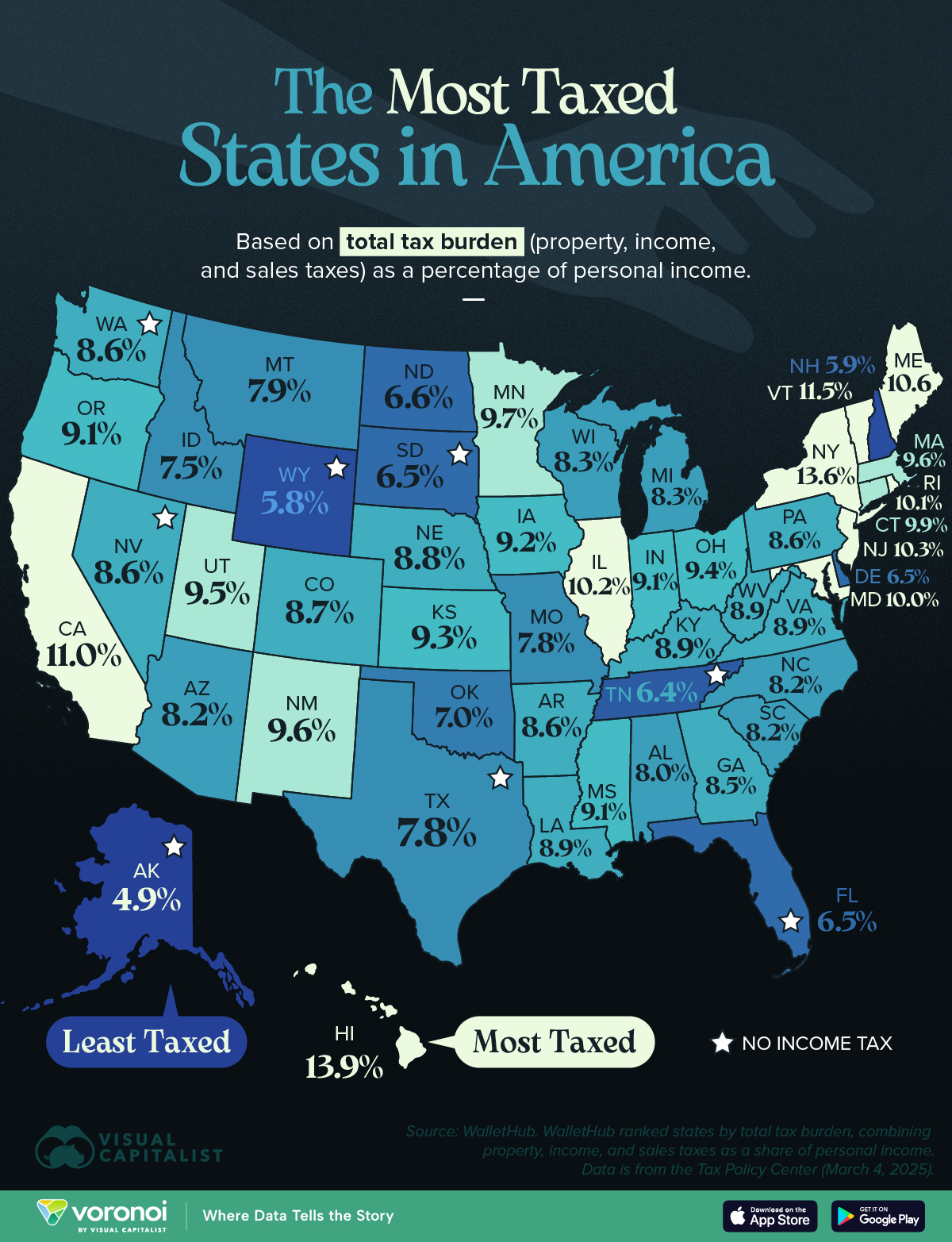

Mapped: The Most Taxed States in America

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- Hawaii has the highest overall tax burden, while Alaska has the lowest.

- Vermont has the highest property tax burden, while Alabama has the lowest.

- New York has the highest individual income tax burden, while eight states (including Texas, Florida, and Washington) have none.

- On average, red states have a lower tax burden than blue states.

This graphic is based on research by WalletHub, which ranked states by total tax burden, combining property, income, and sales taxes as a share of personal income. Data is from the Tax Policy Center as of March 2025.

Hawaii Tops the Nation in Total Tax Burden

Hawaii holds the highest total tax burden in the United States, with residents contributing nearly 14% of their income to state and local governments. This includes 4.2% in income taxes, 2.6% in property taxes, and a substantial 7.2% in sales and excise taxes.

| Rank | State | Total Tax Burden |

|---|---|---|

| 1 | Hawaii | 13.9% |

| 2 | New York | 13.6% |

| 3 | Vermont | 11.5% |

| 4 | California | 11.0% |

| 5 | Maine | 10.6% |

| 6 | New Jersey | 10.3% |

| 7 | Illinois | 10.2% |

| 8 | Rhode Island | 10.1% |

| 9 | Maryland | 10.0% |

| 10 | Connecticut | 9.9% |

| 11 | Minnesota | 9.7% |

| 12 | New Mexico | 9.6% |

| 13 | Massachusetts | 9.6% |

| 14 | Utah | 9.5% |

| 15 | Ohio | 9.4% |

| 16 | Kansas | 9.3% |

| 17 | Iowa | 9.2% |

| 18 | Indiana | 9.1% |

| 19 | Mississippi | 9.1% |

| 20 | Oregon | 9.1% |

| 21 | Louisiana | 8.9% |

| 22 | Kentucky | 8.9% |

| 23 | Virginia | 8.9% |

| 24 | West Virginia | 8.9% |

| 25 | Nebraska | 8.8% |

| 26 | Colorado | 8.7% |

| 27 | Nevada | 8.6% |

| 28 | Washington | 8.6% |

| 29 | Arkansas | 8.6% |

| 30 | Pennsylvania | 8.6% |

| 31 | Georgia | 8.5% |

| 32 | Wisconsin | 8.3% |

| 33 | Michigan | 8.3% |

| 34 | Arizona | 8.2% |

| 35 | North Carolina | 8.2% |

| 36 | South Carolina | 8.2% |

| 37 | Alabama | 8.0% |

| 38 | Montana | 7.9% |

| 39 | Missouri | 7.8% |

| 40 | Texas | 7.8% |

| 41 | Idaho | 7.5% |

| 42 | Oklahoma | 7.0% |

| 43 | North Dakota | 6.6% |

| 44 | Delaware | 6.5% |

| 45 | Florida | 6.5% |

| 46 | South Dakota | 6.5% |

| 47 | Tennessee | 6.4% |

| 48 | New Hampshire | 5.9% |

| 49 | Wyoming | 5.8% |

| 50 | Alaska | 4.9% |

In contrast, Alaska has the lowest overall tax burden. Residents there pay no state income tax, only 3.5% of their income in property taxes, and just 1.5% in sales and excise taxes—resulting in a total tax burden of only 4.9%.

Individual Income Tax

Topping the list is New York, followed closely by California, Maryland, Oregon, and Hawaii. These states tend to have more progressive tax systems and offer extensive public services and infrastructure, which are often funded by higher income taxes.

On the other hand, five states—Alaska, Florida, Nevada, South Dakota, and Tennessee—are tied for having the lowest individual income tax burdens, all ranked 43rd. This is because these states do not levy a state income tax at all.

Property Tax

At the top of the list are Vermont, New Hampshire, and New Jersey—states known for higher living costs and robust public services, which often rely on property taxes for funding. Rounding out the top five are New York and Maine.

On the opposite end, states like Alabama, Arkansas, and Oklahoma have the lowest property tax burdens, with Tennessee and Delaware also ranking near the bottom.

Learn More About Cost of Living From the Voronoi App ![]()

If you enjoyed this post, be sure to check out this graphic, which ranks the income a family needs to live comfortably in every U.S. state.

The post Mapped: The Most Taxed States in America appeared first on Visual Capitalist.