Can I share this graphic?Yes. Visualizations are free to share and post in their original form across the web—even for publishers. Please link back to this page and attribute Visual Capitalist.

When do I need a license?Licenses are required for some commercial uses, translations, or layout modifications. You can even whitelabel our visualizations. Explore your options.

Interested in this piece?Click here to license this visualization.

▼ Use This Visualizationa.bg-showmore-plg-link:hover,a.bg-showmore-plg-link:active,a.bg-showmore-plg-link:focus{color:#0071bb;}

The Briefing

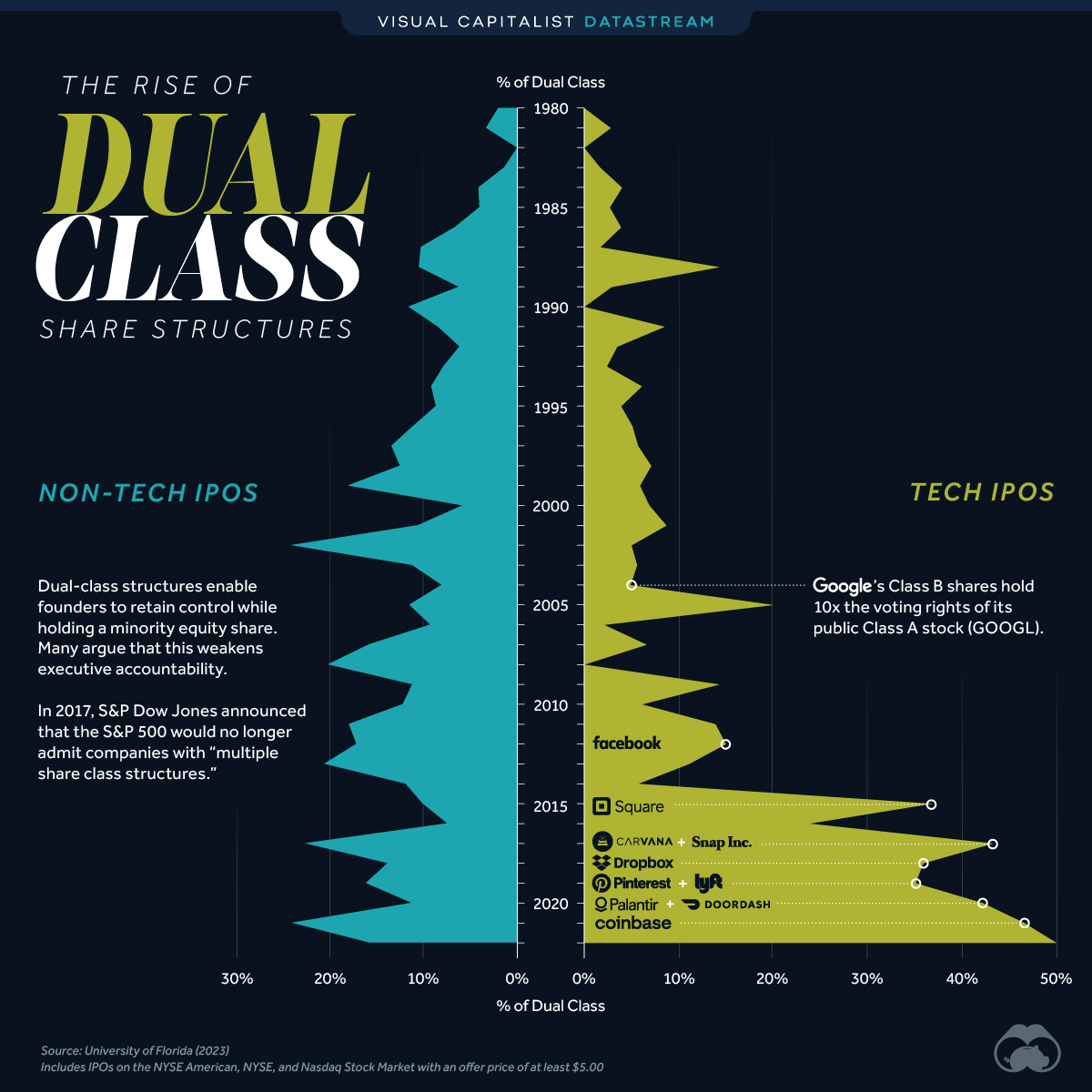

- Dual-class structures give executives greater voting rights over public shareholders

- U.S. tech companies have increasingly adopted this structure since the mid 2010s

More U.S. Tech Companies are Adopting Unequal Voting Structures

Shareholders of public companies often receive the right to vote on corporate policies like issuing dividends or initiating mergers.

Some companies opt for a dual-class share structure, where one class is offered to the public, and another is reserved for founders and executives. Many argue that this weakens accountability, as executives can simply overrule the wishes of outside investors.

The following table lists the number of U.S. companies that have IPO’d with a dual-class share structure. This data was compiled by Jay R. Ritter, Cordell Professor of Finance at the University of Florida.

| Year | Non-tech IPOs | % of Dual Class (non-tech) |

Tech IPOs | % of Dual Class (tech) |

|---|---|---|---|---|

| 1980 | 49 | 2% | 22 | 0% |

| 1981 | 120 | 3% | 72 | 3% |

| 1982 | 35 | 0% | 42 | 0% |

| 1983 | 278 | 1% | 173 | 2% |

| 1984 | 121 | 4% | 50 | 4% |

| 1985 | 149 | 4% | 37 | 3% |

| 1986 | 316 | 7% | 77 | 4% |

| 1987 | 226 | 10% | 59 | 2% |

| 1988 | 77 | 10% | 28 | 14% |

| 1989 | 81 | 6% | 35 | 3% |

| 1990 | 78 | 12% | 32 | 0% |

| 1991 | 215 | 8% | 71 | 9% |

| 1992 | 297 | 6% | 115 | 4% |

| 1993 | 383 | 8% | 127 | 2% |

| 1994 | 287 | 9% | 115 | 6% |

| 1995 | 257 | 9% | 205 | 4% |

| 1996 | 401 | 11% | 276 | 5% |

| 1997 | 300 | 13% | 174 | 6% |

| 1998 | 170 | 12% | 113 | 7% |

| 1999 | 106 | 18% | 370 | 6% |

| 2000 | 120 | 6% | 260 | 7% |

| 2001 | 57 | 11% | 23 | 9% |

| 2002 | 46 | 24% | 20 | 5% |

| 2003 | 45 | 11% | 18 | 6% |

| 2004 | 112 | 8% | 61 | 5% |

| 2005 | 115 | 11% | 45 | 20% |

| 2006 | 109 | 9% | 48 | 2% |

| 2007 | 83 | 16% | 76 | 7% |

| 2008 | 15 | 20% | 6 | 0% |

| 2009 | 27 | 11% | 14 | 14% |

| 2010 | 58 | 12% | 33 | 6% |

| 2011 | 45 | 18% | 36 | 14% |

| 2012 | 53 | 17% | 40 | 15% |

| 2013 | 113 | 20% | 45 | 11% |

| 2014 | 153 | 12% | 53 | 6% |

| 2015 | 80 | 10% | 38 | 37% |

| 2016 | 54 | 7% | 21 | 24% |

| 2017 | 76 | 22% | 30 | 43% |

| 2018 | 95 | 14% | 39 | 36% |

| 2019 | 75 | 16% | 37 | 35% |

| 2020 | 120 | 11% | 45 | 42% |

| 2021 | 193 | 24% | 118 | 47% |

| 2022 | 32 | 16% | 6 | 50% |

Includes IPOs on the NYSE American, NYSE, and Nasdaq Stock Market with an offer price of at least $5.00.

The biggest takeaway from this dataset is that dual-class structures have become much more prevalent among U.S. tech firms. Starting in the mid 2010s, this trend includes noteworthy IPOs such as Facebook (2012), Square (2015), Pinterest (2019), and Coinbase (2021).

In the case of Coinbase, a separate class of shares reserved for founders and insiders has 20 times the voting power of regular, publicly available shares. According to Fast Company, this gives insiders 53.5% of the overall votes.

How do Dual-Class Share Structures Impact Performance?

Ritter’s report also analyzed the three-year returns on 9,089 IPOs from 1980 to 2021. Once again, this only includes IPOs on the NYSE American, NYSE, and Nasdaq Stock Market with an offer price of at least $5.00.

Returns were calculated through the end of December 2021.

| Category | Share structure | # of IPOs | 3-Yr Buy-and-hold Return | Market-adjusted Return |

|---|---|---|---|---|

| Tech | Dual-class | 295 | 41.0% | 20.0% |

| Tech | Single | 3,009 | 19.6% | -14.6% |

| Non-tech | Dual-class | 584 | 24.1% | -12.7% |

| Non-tech | Single | 5,201 | 17.9% | -23.9% |

In both categories (tech or non-tech), IPOs with dual-class voting structures outperformed over the three year period. This outperformance was significantly higher for tech companies.

Where does this data come from?

Source: University of Florida (2023)

Data note: Buy-and-hold returns are calculated from the first close until the earlier of the three-year anniversary or the delisting date (the end December of 2022 for IPOs from 2020 and 2021). Market-adjusted returns are the difference between the asset’s return and the index’s return. The index in this case is the CRSP value-weighted index, which includes NYSE American, NYSE, and Nasdaq stocks.

The post More U.S. Tech Companies are Adopting Unequal Dual-Class Voting Structures appeared first on Visual Capitalist.