Published

1 hour ago

on

July 24, 2025

| 21 views

-->

By

Jenna Ross

Graphics & Design

- Jennifer West

The following content is sponsored by Plasma

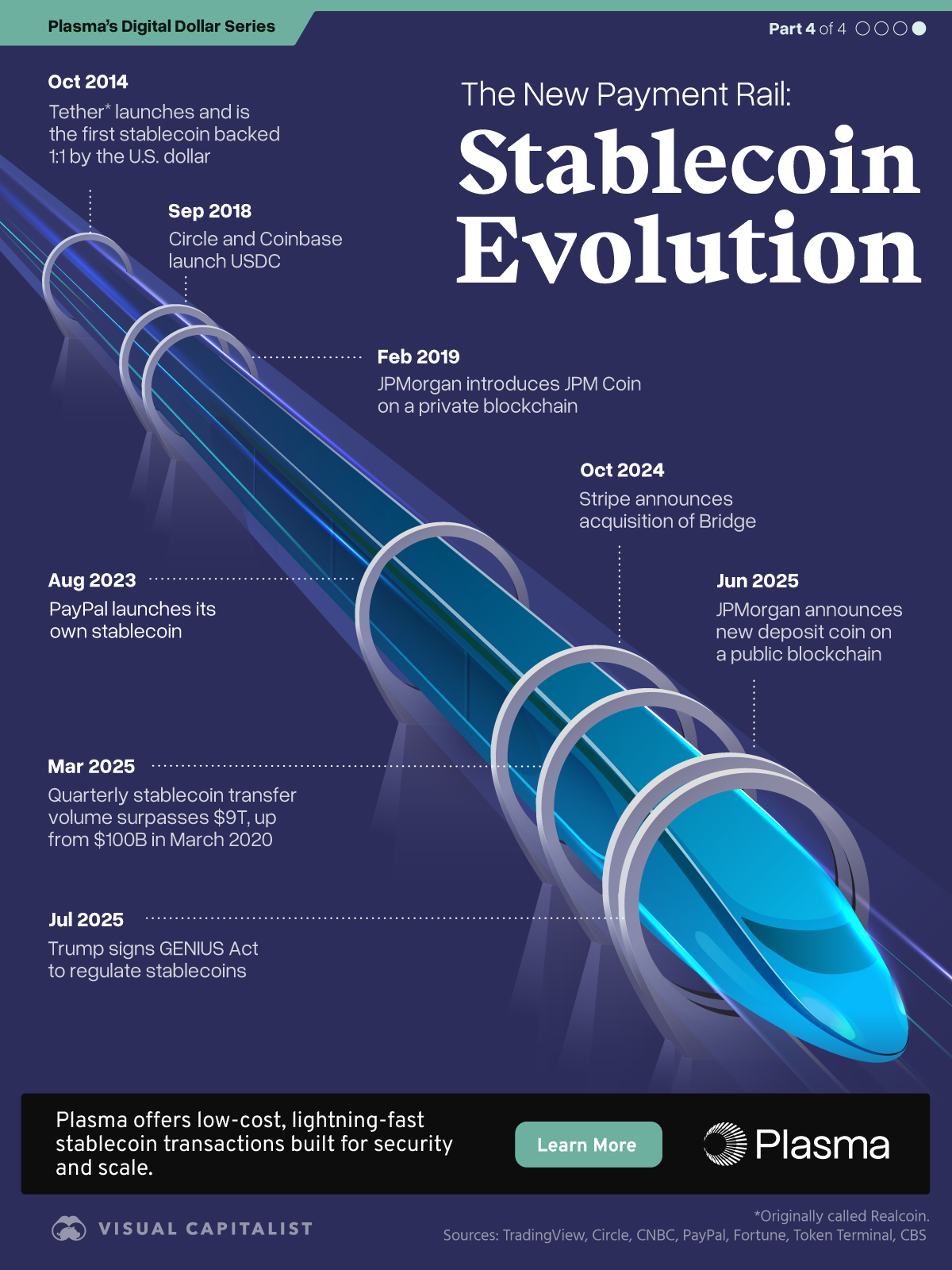

Stablecoin Evolution: Milestones of the New Payment Rail

Key Takeaways

- Tether was the first stablecoin backed 1:1 by the U.S. dollar and was launched in October 2014.

- Since then, financial companies like JPMorgan and PayPal have begun introducing digital coins.

- The U.S. government passed the GENIUS Act in July 2025, creating regulations for stablecoins.

Stablecoins are going mainstream. With the signing of the GENIUS Act, the U.S. now has a regulatory stablecoin framework—capping off a decade-long shift in how money moves.

From early experiments to institutional adoption, the last piece of our Digital Dollar Series with Plasma highlights key milestones in the evolution of stablecoins.

Stablecoin Beginnings

Five years after the introduction of cryptocurrency with Bitcoin, a less volatile digital dollar was created. The value of stablecoins is pegged to another asset, with the vast majority tied to the U.S. dollar.

This stability makes them a suitable payment rail, which is the infrastructure or systems that allow people and businesses to transfer money between one another.

Below, we share some pivotal moments during the early days.

- October 2014: Tether, originally called Realcoin, launches. It is the first stablecoin backed 1:1 by the U.S. dollar.

- September 2018: Circle and Coinbase launch USD Coin, known as USDC.

- February 2019: JPMorgan introduces JPM Coin on a private blockchain, the first digital coin used by a major U.S. bank.

- August 2023: PayPal launches its own stablecoin available to consumers, merchants, and developers.

Notably, these pilot projects and new ventures were just the beginning.

Modern Momentum

Stablecoin momentum has been accelerating in recent months, propelled by activity among financial companies and the government.

- October 2024: Stripe announces its $1.1 billion acquisition of Bridge, a stablecoin startup making it easier for businesses to integrate digital dollars.

- March 2025: Quarterly transfer volume for stablecoins surpasses $9 trillion, up from $100 billion in March 2020.

- June 2025: JPMorgan announces a new deposit coin available to institutional clients on Coinbase’s public blockchain Base.

- July 2025: Trump signs the GENIUS act, the first major law establishing a regulatory framework for stablecoins.

With legislation in place, banks, nonbanks, and credit unions will be able to issue their own stablecoins. What will the next decade of digital dollar innovation bring?

Learn how Plasma offers low-cost, lightning-fast stablecoin transactions built for security and scale.

More from Plasma

-

Technology2 weeks ago

Is the U.S. Dollar Primed for a Digital Rebound?

U.S. dollar influence is shrinking in some spaces, but stablecoins could give the currency a new chapter of global dominance.

-

Money3 weeks ago

Ranked: The Biggest Currency Drops So Far in 2025

In the first half of 2025, one currency dropped over 50% against the U.S. dollar. What led to the decline?

-

Technology2 months ago

Ranked: Countries With the Highest Remittance Costs

To send money across borders, workers can be charged high remittance fees—over 50% of the amount transferred in some cases.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up