Authored by David Stockman via Contra Corner blog,

The financial system is loaded with anomalies, deformations and mispricings - outcomes which would never occur on an honest free market. For example, the junk bond yield at just 2% in Europe is now below that of the "risk-free" US treasury bond owing solely to the depredations of the ECB.

Indeed, madman Draghi has purchased $2.6 trillion of securities since launching QE in March 2015, and during the interim has actually bought more government debt than was issued by all the socialist governments of the EU-19 combined!

Outrunning Europe's deficit-addicted welfare states is quite a feat in itself, but that wasn't the half of it. The ECB's printing press became so parched for government debt to buy that it has ended up owning more than $120 billion of corporate bonds. In some recent cases, the ECB has actually taking down 20% or more of new corporate issues---an action that surely leaves the fastidious founders of its Bundesbank prodecessor turning in their graves.

In turn, the ECB's Big Fat Thumb on the investment grade scale stampeded fund managers into the junk market in quest of yield, especially for BB rated paper which makes up 75% of the European high yield market. So doing, these return hungry managers have crushed the the yield on the Merrill Lynch junk bond index, driving it down from 6.4% in early 2106 to an incredible 2.002% last week.

That is to say, leveraged speculators in European junk have made 100% plus returns over the last 20 months on dodgy paper that should be yielding double or triple its current rate.

In fact, the current lunatic euro-trash yield is completely off the historical charts. Euro-junk rarely yielded under 5% in the past, and had spiked to upwards of 10% at the time of Draghi's "whatever it takes" ukase, which, in turn, was modest compared to the 25% blow-0ff high during the depths of the financial crisis.

Then again, there has rarely been a greater gift to speculators. The front-runners who took Draghi at his word back in 2012 have made 1000% returns. On bonds!

Needless to say, these utterly false price signals would never occur on the free market. Yet by attracting tens of billions of yield-seeking capital into radically mispriced securities in pursuit of the giant windfalls depicted above, the ECB has not only set-up speculators for massive losses, but also badly distorted the macro-economy in the process.

That is, after years of ZIRP Europe's business sector has become populated with debt-ridden zombies which survive only because their interest carry costs have essentially been eliminated. Consequently, the free market's essential function of pruning the deadwood and re-allocating inefficiently used resources has been stopped cold on much of the continent.

But to add insult to injury, Draghi has given these zombies the financial equivalent of mouth-to-mouth respiration. That is, the ECB has made junk bond yields so cheap that debt-encumbered businesses have been able to further extend and pretend----that is, refinance higher cost bank lines and earlier bond issues with 2% money; it's just another example of a central bank driven refi machine at work.

Even the US debt junkies have gotten in on the act---with North American issuers estimated to place more than $125 billion in the euro-debt market during 2017---including upwards of $20 billion of high yield bonds. The pitifully low yield on these issues, in turn, has been arbed across the Atlantic, meaning further suppression of rates in the New York dollar markets.

Needless to say, any free market economist worth his salt recognizes the long-run folly of subsidizing loss making companies. But there is also a larger and more immediate repercussion for the day-traders and robo-machines which prowl the casino in search of instant riches.

To wit, the central bank fueled scramble for yield among bond managers----and especially those running open-end bond funds-----has created a giant trading trap. Owing to the explosion of corporate, real estate and sovereign debt since the turn of the century, there are now trillions of bonds held by investment vehicles subject to daily redemptions.

At the same time, the drastic shrinkage of dealer balance sheets since the traumas of 2008 and the subsequent avalanche of Dodd-Frank regulatory harassment means that true liquidity has all but disappeared from the bond market----and most especially the high yield sector which has nearly doubled in size since the crisis.

What that adds up to----trillions of paper funded with what amounts to mutual fund demand deposits in a market with drastically shrunken dealer liquidity---is not hard to imagine. Namely, the punters who have been pleasured with vast riches by the ECB are now getting 2% yields for the privilege of evenutally being crushed by what will be the mother of all bank runs.

Not only has the absolute yield level on junk been badly distorted by the ECB's heavy handed buying (it now owns upward of 12% all euro-area corporate bonds), but the all important spread against the risk free rate has also been crushed. In recent months it actually broke through 150 basis points, representing half the level prevailing as recently as June 2016.

Stated differently, Draghi----like all other Keynesian central bankers----is pleased to believe that he is deftly guiding the great macro-variables of GDP, inflation, growth and wages. In fact, the ECB's heavy intrusion in money and capital markets have demolished the price signaling mechanisms of the financial system, turning yields, spreads and asset prices into momentum-driven noise.

And "noise" is the word for it because sustained central bank financial repression infects and deforms all financial information.

Indeed, this kind of fake financial information is what causes the talking heads of bubblevision to ignore the aforementioned mispricings and spread narrowings. They believe it's all warranted.

That is to say, credit loss rates have plunged into subterranean levels---so what's to worry? Arguably, even today miserly 5.6% yield in the US junk market (see below) more than covers inflation and realized default rates of 2-3% recorded during recent years.

Except they don't. What the graph below actually shows is the cyclically punctuated impact of the great game of kicking the financial can. Central bank financial repression engenders a scramble for yield during the expansion phase of the cycle which permits all except the most hopeless borrowers to refinance, thereby avoiding default by hitting the restart button.

This extend and pretend "refi" cycle is identical to what happened to the subprime mortgage market prior to the housing crash. Default rates were unusually low as long as the cripples could be refinanced, but when new mortgage funding dried up Warren Buffett's famous aphorism about naked swimmers exposed by a receding tide came true in spades.

Default rates suddenly soared, causing the mortgage crisis to spring to life seemingly out of nowhere. In effect, interest rate repression causes default rate suppression, thereby turning standard financial information into misleading statistical noise.

The world's $4 trillion junk debt market is the next poster boy for exactly that kind of springing default surge. If you look at maturity schedules, in fact, you see a huge bow-wave building-up from 2018-2022. Subtract seven years for the standard bond term and you get exactly the valley in default rates shown below for 2011 thru 2016. That is, the refi machine was working overtime.

Most everyone paid or PIK'd (paid in kind) because the yield starved market was desperately hungry for product. So hungry, in fact, that nearly $200 billion of junk has been issued to fund dividends to LBO sponsors.

Moreover, even the slight default rate bulge in 2016 was not due to the refi machine faltering so much as it reflected some very big and concentrated defaults in the shale patch.

Even then, it is crucially important to understand that the historical long-term default average of 4% is not nearly what it is cracked-up to be. That's because the modern age of original issue junk finance (as opposed to "fallen angels" in the secondary markets that Michael Milken pioneered before 1984) is essentially coterminous with the Greenspan era of Bubble Finance.

Accordingly, the two big spikes in the chart below represent a case of defaultus interuptus. Before the markets could be fully purged of the rotten credits which had built up earlier, the Fed flooded Wall Street with liquidity in 2001-2003 and again in 2008-09, thereby igniting a bid for deeply discounted junk as measured by yields that hit 20% or higher.

In turn, as yields were driven back toward the normal range early speculators pocketed enormous capital gains, triggering an additional surge of capital into the market. At length, ample demand for junk bonds enabled a renewed cycle of extend and pretend.

But here's the thing. The Fed is out of dry powder and stranded close to the zero-bound, as is the ECB, the BOJ, the BOE and most other central banks. Accordingly, this time there will be no massive central bank reflation and no consequent rip-your-face-off rally in busted junk.

That is to say, it will be a case of "no ticky, no washy". When the current bow wave of maturities unfolds over the next five years, the refi machine is likely to be severely disabled, if not shutdown entirely in the context of central bank balance sheet normalization and rising yields.

Yet in the absence of extend and pretend refi, defaults will rise significantly, thereby triggering capital flight from the junk market. And then there will follow a downward spiral of busted maturities and even further increases in the default rate.

In short, the go-forward default rate is like to be a lot more than the 4% historical average, and its likely to hang around the basket for years to come. At that point, noise will give way to signal. But not of a good kind for speculators.

[image]https://www.peritusasset.com/wp-content/uploads/2016/12/JPM-Projected-Default-Rates-2017.png[/image]

Needless to say, if bond yields should equal inflation, credit losses and return, there's no room for all three in the current 5.6% yield on the US junk bond index. Indeed, the chart below exhibits a double whammy of Fed financial repression. The 10--year treasury yield at 2.33% today barely covers inflation---to say nothing of an after-tax return.

But only three points of spread on top of that is completely ludicrous. It can't begin to compensate for the drastically heightened risks of a business expansion which is already 101 months old and default rates that are fixing to spring out of their extend and pretend disguise.

In this context, we must note again that the GOP is missing what ails the American economy by a country mile. Republicans have become like the proverbial carpenter whose only tool is a hammer. So everything in the economic world looks like a nail---that is, a situation that can be remedied by a tax cut.

Not at all. The entire signaling system of American capitalism has been destroyed by the Fed. The lowest interest rates and capital cost in recorded history have not caused an explosion of capital spending and growth-enhancing productivity as intended.

In fact, real net business investment is still 35% below its turn of the century level, but that isn't due to high or rising taxes or inadequate after-tax returns.

[image]https://davidstockmanscontracorner.com/wp-content/uploads/2016/12/12.08.16_Chart11-480x307.jpg[/image]

To the contrary, capital is being artificially diverted into unprodutive speculative arenas. Central bank yield suppression has spurred massive amounts of financial engineering in the C-suites in response to the demand for never ending appreciation of secondary assets in the casino. As we indicated yesterday:

..... the growth and jobs problem in America originates in the Fed, not the IRS code; and that by focusing on the latter----even as it punts on the former---- the GOP is truly earning its moniker as the Stupid Party.

That is, Trump and the GOP Senate potentially have five seats to fill on the Fed and could therefore end the current baleful regime of massive, fraudulent money printing and the destructive falsification of financial asset prices which inherently results therefrom.

So doing, they could bring honest price discovery, risk exposure, financial discipline and efficient two-way markets back into the Wall Street casino. Allowing free markets to clear the price of money, debt and stocks, in turn, would quickly shut down the financial engineering mania that now obsesses the corporate C-suites and which has caused trillions of corporate cash flow and balance sheet capacity to be diverted to stock buybacks, M&A deals and LBOs.

Needless to say, restoration of honest price discovery on Wall Street is not going to happen any time soon with a "low interest guy" in the Oval Office and another one soon to take the helm at the Fed. Indeed, Jerome Powell voted for the destructive financial repression described above 44 consecutive times during his tenure on the Fed since early 2012.

Accordingly, what passes for financial markets will remain in fantasy-land for a time longer, deluded by the fake signals embedded in the in-coming economic and financial noise. As one bond manager noted in response to the hiccup in the high yield market during the past 10 days, why worry?

“There’s stress in significant pieces of the markets, like health care and telecom, and I am not ignoring them,” Ken Monaghan, director of global high yield at Amundi Pioneer, said in an interview. “But we aren’t seeing some sort of cataclysmic event on the horizon, and I am not expecting many sleepless nights anytime soon.”

Well, here's why sleepless nights are exactly what will be coming down the pike right soon. Among many things that would not exist in an honest financial market are most LBO's. These are the ultimate financial engineering scheme enabled by cheap junk debt and a central bank safety net under extreme leverage.

Moreover, crashing LBOs were a material component of the crash back in 2008, but self-evidently no lessons were learned. Virtually all of the $10-$40 billion zombies from that era were eventually refinanced and "restructured" in a soaring junk bond market.

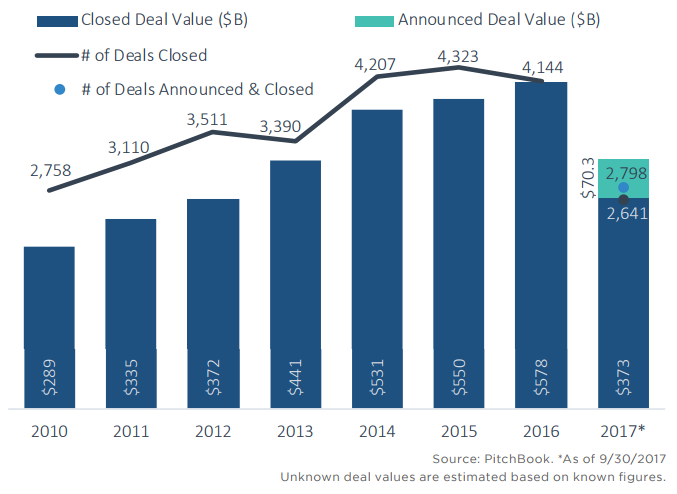

Not surprisingly, LBO volumes have been steadily building---although the number of companies left in America that have not been squeezed lean and mean by existing options chasing managements are few and far between. In fact, an increasing share of buyouts are second and third generation LBOs-----the work of private equity punters swapping their debt mules.

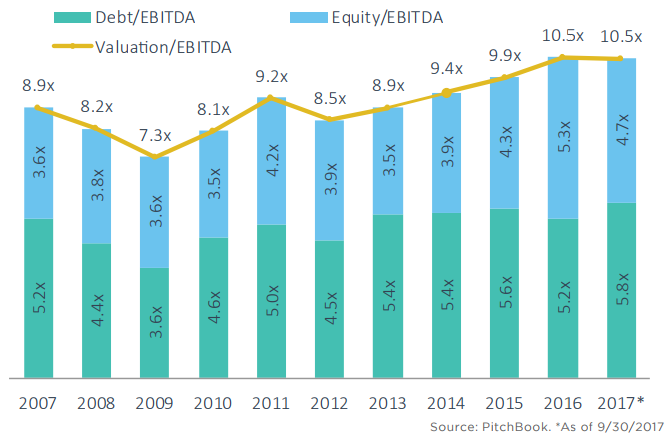

And they are doing so at the highest prices in history--without regard for the cardinal fact that the era of falling yields and relentlessly declining cap rates is over. Even if these LBOs made economic sense, which they don't, they should be exhibiting falling valuation multiples as the era of QT and monetary normalization sets in.

Stated differently, the private equity boys are pricing deals based on the artificially low cost of the junk debt in their capital structures---plus an equity multiple that assumes that current stock market bubble will never correct. Indeed, as shown below, the equity multiple of 4.7X is now 30% higher than it was back in 2007 on the eve of the last great bubble collapse.

And that gets us back to our theme. The present world of monetary central planning and relentless financial repression has produced endless deformations and anomalies that would not exist on the free market. They are therefore not sustainable in the present world, either, because at the end of the day even central banks cannot defy the laws of economics and sound finance indefinitely.

So there will be crashing LBOs, bleeding junk bonds and plunging stock market indices in the roadway just ahead.

Indeed, that something is very wrong in Denmark, in fact, was dramatized by today's story de jure in the financial press. To wit, it seems that Warren Buffett, Jeff Bezos and Bill Gates have more net worth ($280 billion) than the bottom 50% of the US population; and that the Forbes 400 has more net worth than the bottom two-thirds of all American households.

That wouldn't happen on the free market, either.

So mind the junk. What is now unfolding is most definitely not your grandfather's kind of capitalist prosperity.