Written By Tessa Di Grandi

Graphics & Design

- Zack Aboulazm

Published February 8, 2023

•

Updated February 8, 2023

•

TweetShareShareRedditEmail

The following content is sponsored by KGP Auto

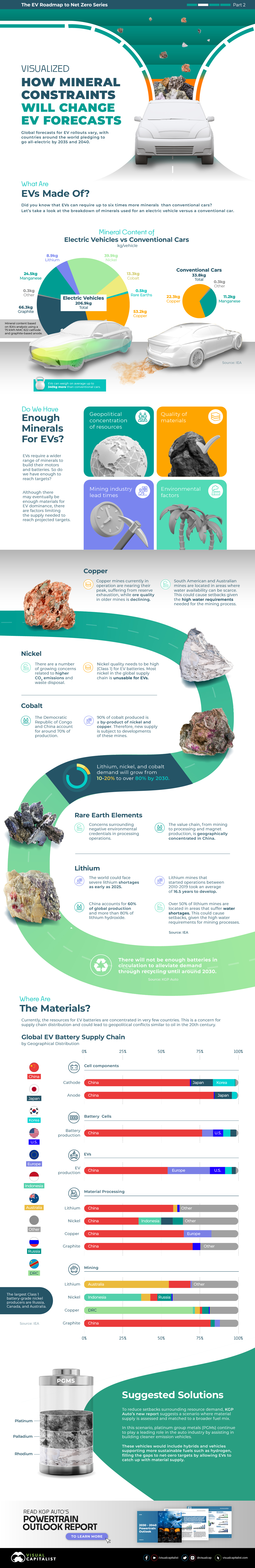

How Mineral Supply Will Change EV Forecasts

Did you know that EVs need up to six times more minerals than conventional cars?

EVs are mineral-intensive and are pushing up demand for critical battery metals. According to the International Energy Agency (IEA), lithium, nickel, and cobalt demand is expected to grow from 10%-20% to over 80% by 2030.

As countries around the world pledge to go all-electric by 2035 and 2040, do we have enough mineral supply for EV demand?

Factors such as geopolitical concentration of resources, quality of materials, mining industry lead times, and environmental factors will together determine whether we have the minerals we need.

Let’s take a look at how critical minerals are affected.

| Mineral | Constraints |

|---|---|

| Copper | Copper mines currently in operation are nearing their peak, suffering from reserve exhaustion, while ore quality in older mines is declining.

South American and Australian mines are located in areas where water availability can be scarce. |

| Nickel | There are a number of growing concerns related to higher CO2 emissions and waste disposal.

Nickel quality needs to be high (Class 1) for EV batteries. Most nickel in the global supply chain is unusable for EVs. |

| Cobalt | The Democratic Republic of Congo and China account for around 70% of production.

90% of cobalt produced is a by-product of nickel and copper, making new supply subject to the development of these mines. |

| Rare Earth Elements | Concerns surrounding negative environmental credentials in processing operations.

The value chain from mining to processing and magnet production is geographically concentrated in China. |

| Lithium | The world could face severe lithium shortages as early as 2025.

Lithium mines that started operations between 2010-2019 took an average of 16.5 years to develop. China accounts for 60% of global production and more than 80% of lithium hydroxide. Over 50% of lithium mines are located in areas that suffer water shortages. |

Recycling is a partial solution to alleviate critical mineral supply but will fall short of meeting the high levels of demand until around the 2030s.

The EV Supply Chain

Currently, the resources for EV batteries are concentrated in very few countries. This concentration is an increasing concern for supply chain distribution.

China is home to more than half of the world’s lithium, cobalt, and graphite processing and refining capacity, as well as three-quarters of all lithium-ion battery production capacity.

Europe accounts for more than one-quarter of worldwide EV assembly, but home to very little of the supply chain, with the region’s cobalt processing share accounting for 20% of the mix.

Meanwhile, both Korea and Japan control a sizable portion of the downstream supply chain after raw material processing. Korea accounts for 15% of worldwide cathode material production capacity. Japan produces 14% of cathode and 11% of anode material.

The United States accounts for just 10% of EV production and 7% of battery production capacity.

Suggested Solutions

To reduce setbacks surrounding resource demand, KGP Auto’s new report recommends that material supply is accessed and matched to a broader fuel energy mix.

In this scenario, platinum group metals (PGMs) continue to play a leading role in the auto industry by assisting in building cleaner emission vehicles.

These vehicles support more sustainable fuels such as hydrogen, filling the gaps to net-zero targets by allowing EVs to catch up with material supply

>> Read KGP Auto’s Powertrain Outlook Report to learn more.

Please enable JavaScript in your browser to complete this form.Subscribe to our free newsletter and get your mind blown on a daily basis: *Sign up

Related Topics: #minerals #electric vehicle #clean energy transition #metals and mining #supply chain constraints #KGP Auto

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "Visualized: The EV Mineral Shortage";

var disqus_url = "https://www.visualcapitalist.com/sp/how-mineral-supply-will-change-ev-forecasts/";

var disqus_identifier = "visualcapitalist.disqus.com-155025";

You may also like

-

Technology1 day ago

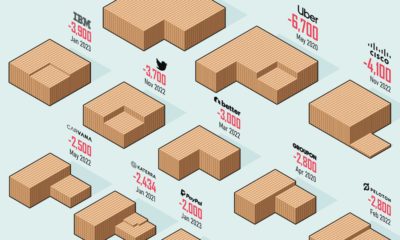

Ranked: America’s 20 Biggest Tech Layoffs Since 2020

How bad are the current layoffs in the tech sector? This visual reveals the 20 biggest tech layoffs since the start of the pandemic.

-

Datastream2 days ago

Super-Sized Bets for Football’s Big Game (2013-2022)

Expanding legalization has driven an increase in bets on football’s big game, with wagers more than doubling from 2021 to 2022. (Sponsored Content)

-

Datastream5 days ago

Ranked: The Top Online Music Services in the U.S. by Monthly Users

This graphic shows the percentage of Americans that are monthly music listeners for each service. Which online music service is most popular?

-

Markets5 days ago

Charted: Tesla’s Unrivaled Profit Margins

This infographic compares Tesla’s impressive profit margins to various Western and Chinese competitors.

-

Markets6 days ago

Mapped: GDP Growth Forecasts by Country, in 2023

The global economy faces an uncertain future in 2023. This year, GDP growth is projected to be 2.9%—down from 3.2% in 2022.

-

Technology1 week ago

Infographic: Generative AI Explained by AI

What exactly is generative AI and how does it work? This infographic, created using generative AI tools such as Midjourney and ChatGPT, explains it all.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 365,000+ subscribers who receive our daily email *Sign Up

The post Visualized: The EV Mineral Shortage appeared first on Visual Capitalist.