Via NorthmanTrader.com,

Still no break up or break down. The ping pong match continues as markets remain in range, but the tempting affair with new highs is again making the bullish pot stir following yet another rally toward the 2,100 level on the $SPX. The question is whether such an attraction will prove fatal as all new highs in the past 2 years have resulted in sizable pullbacks.

The most recent rally came at a critical time.

Recall I had outlined a technical red flag, specifically the weekly 50 MA crossing over the 100MA. I had outlined this in “The Golden Key” and most recently on CNBC as I covered the following key point:

If markets break below 2025-2030 support by the end of the month, then markets are at risk of repeating a major topping pattern. This level was key: “The S&P 500 must stay above the 2,025 to 2,030 range”

Following the segment the S&P 500 dropped to 2025.91 precisely and bounced. So the level was spot on. While May has not concluded at the time of this writing, it appears unlikely at this stage that we will close the month below this level.

What are the implications? Here’s what I’m seeing:

Firstly let’s recognize that despite the recent rally the MA crossover is still in effect:

The first conclusion I’m drawing from this is simple: The 2025 level has been validated as critical support and as long as markets are staying above this level bulls can feel relatively secure. Hence the building attraction of new highs coming and certitude that nothing bad will happen.

We won’t crash. Don’t you know:

Accompanied by certitude that new highs are coming:

Stocks will go up because sentiment is so bearish. pic.twitter.com/yB8DG1vcbD

— Northy (@NorthmanTrader) May 25, 2016

It may well all be true and as I’ve indicated repeatedly we can squeeze higher and even make new highs. As you may recall I’ve been outlining technical targets to the upside in both “The Big Move” and in the chart shown on CNBC. I reiterate: All these targets are still on the table as long as we remain in range. While that may seem like fence sitting it is nevertheless a reality as the battle between money supply and GAAP earnings rages on and we remain in range to date:

The main narrative in favor of new highs has shifted dramatically from last year. Last year’s bulls stuck to their 2200-2300 S&P targets in the face of declining breadth, deteriorating high yield and sinking oil prices. They didn’t matter then. Now they cite improvement in all three as a sign of their original targets coming to fruition after all. So now they matter. Ok. But fair enough, what was bad is now improving. Note however one narrative has completely disappeared from the landscape and that is: Earnings.

And this remains my gripe about this market along with the structural weakness of it all: It’s expensive as hell and getting more expensive by the day. This fact is largely being ignored by those attracted to new highs. But that can backfire as we know:

Let me put this GAAP issue in a historical context:

Let’s observe:

A. At Friday’s closing price of 24.25 the GAAP P/E ratio is now higher than during any bull market in the past 20 years. The only time it was higher was during crashes/recessions as earnings disappeared, or one time during the bubble of 2000 which led to a crash.

B. GAAP earnings are either increasing or decreasing during most cycles, but they have experienced 2 periods of flatlining before again moving higher. Currently we are declining not flatlining.

C. During periods when GAAP earnings are declining markets can experience strong counter trend rallies. See 2001 and 2002 and even into May 2008 we saw such moves.

I would also highlight that the 1998-2000 period saw a flatlining period prior to resumption of a trend higher in earnings facilitating the record new highs in 2000. This is not the case now.

Have GAAP earnings bottomed? Perhaps, but the evidence is still hope based as opposed to confirmed.

Consider that according to FactSet 72% of S&P 500 companies reporting so far have issued negative guidance for Q2 on top of declining earnings for Q1:

Also ignored:

The S&P price to sales ratio is at an all time high:

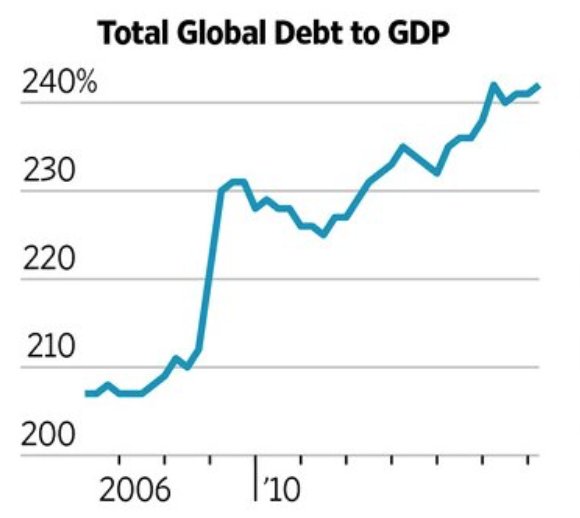

And global debt to GDP just keeps rising:

Which brings us to the here and now and some structural concerns:

First off note that the $VIX has again been pummeled to a pulp, there is zero fear or concern out there. However if we have learned anything over the past few years it is that the $VIX does not like to stay below its lower daily Bollinger band:

Also note that the MACD line is near center, which implies any $VIX spike here will likely get the MACD to cross easily back into bullish territory. The message: the $VIX may not be as weak as it appears and that makes this rally a bit suspect and open to a sudden peck on the cheek:

Next, note this recent rally not only came on some of the lowest volume of the year, but was also mostly driven by complete non participation: 3 major gap ups and open ramps, leaving gaps unfilled and most price discovery completely untouched by actual trading of size:

So here we are, the $VIX dropped below its daily Bollinger band and stocks pushed above their’s meaning they are no longer oversold but rather look stretched to the upside:

So we’re short term overbought, with 3 unfilled gaps below and lower highs still in place with stocks being the most expensive in years and yet $NYSE still below key resistance:

Ignore it all if you find yourself attracted to new highs. They may indeed come, just remember who gets hurt when the attraction proves fatal:

What would get me excited about new highs? Accelerating revenue/earnings growth and broad participation with the leaders, well, leading. At this stage of the game I see neither, but a market that’s 16.5% more expensive then same time last year. I see steam emerging.

Who’s ready for some tea?

Maybe not:

But we all know how this all ultimately ends: