Submitted by Gail Tverberg via Our Finite World blog,

Our economy is a mystery to almost everyone, including economists. Let me explain the way I see the situation:

(1) The big thing that pulls the economy forward is the time-shifting nature of debt and debt-like instruments.

If we want any kind of specialization, we need some sort of long-term obligation that will make that specialization worthwhile. If one hunter-gatherer specializes in finding flints that will start fires, that hunter-gatherer needs some sort of guarantee that others, who are finding food, will share some of their food with him, so that the group, as a whole, can prosper. Others, who specialize in gathering firewood, or in childcare, also need some kind of guarantee that their efforts will be rewarded.

At first, these obligations were enforced by social norms such as, “If you don’t follow the rules of the group, we will throw you out.” Gradually, reciprocal obligations became more formalized, and included more time shifting, “If you will work for me, I will pay you at the end of the month.” Or, “If you will pay my transportation costs to a land of more opportunity, I will repay you with 10% of my wages for the first five years.” Or, “I will sell you this piece of land, if you will pay me x amount per month for y years.”

In some cases, the loan (or loan-like agreements) takes the form of stock ownership of an enterprise. In this case, the promise is for future dividends, and the possibility of growth in the value of the stock, in return for the use of funds. Even though we generally refer to one type of loan-like agreement as “equity ownership” and the other as “debt,” they have a great deal of similarity. Funds are being provided to the enterprise, with the expectation of greater return in the future.

As another example, governments make promises for future benefits, such as Social Security, healthcare, and payments to the unemployed. These payments are not guaranteed, so are not considered debt. Even without a guarantee, they act in many ways like debt. Citizens plan their lives around these payments, even though they may be reduced or eliminated.

Surprisingly, even “cash” is debt. It is similar to a bond that pays zero interest and has no redemption date; this type of bond can also be easily transferred from person to person. Since cash can be hidden under mattresses, it too can be used as a device for time-shifting.

(2) The big thing that goes wrong in this time-shifting approach to operating the economy is the loss of what I would call an “opportunity gradient.”

As long as the future looks better than the past, it makes sense to make these debt-like obligations. But as soon as the future looks worse than in the present, the whole model falls apart. Even if the future looks exactly the same as the present, there is a problem, because taking on these long-term obligations has some overhead costs, such as administrative costs and a margin to cover the possibility of defaults on loans. These overhead costs need to be paid in some way. Because of this, there needs to be enough of an upward gradient to cover the necessary costs of the loans or the loan-like agreements. (This is part of what makes a Steady State Economy, advocated by many, an absurd idea.)

Once the energy gradient becomes negative, it becomes very difficult to get anyone to borrow money and to use the resulting debt to lead the economy forward. When the energy gradient becomes negative, young people are less inclined to get married, and tend to have fewer children. International organizations of countries (such as the European Union) have a harder time staying connected. The whole model of cooperation working better than “every country for itself” starts falling apart.

Just as human bodies often go downhill before dying, an economy that finds itself on a downward slope may very well be near collapse.

(3) The loss of an opportunity gradient comes from diminishing returns in many areas, including:

- Rising energy extraction costs

- Rising costs of mitigating pollution, as increasing resources are extracted and used; these pollution mitigation costs are really part of total extraction costs

- Reduced quantity of arable land per person

- Reduced fresh water per person, without high-cost treatment such as desalination

- Fewer investment opportunities that allow for true growth, such as providing tractors to farmers who previously used draft animals, or adding a new road that permits fast transit across a country for the first time

- Many more required “investments” that are simply for the purpose of offsetting deterioration in previously built infrastructure

Figure 1 illustrates the extent to which current business and government investment in the United States offsets either depreciation on old investments, or previous investment that was no longer needed for one reason or other–perhaps because manufacturing moved to China.

Figure 1. US Business and Government Capital Investment, based on Table 5.1 (Savings and Investment by Sector) of the US Bureau of Economic Analysis.

Between 2008 and 2015, only 17% of “Gross Capital Investment” actually became “Net Capital Investment.” With this small amount of true addition to capital investment, it shouldn’t be surprising that what seems to be “productive investment” doesn’t really raise productivity by much. It mostly raises the debt level, without necessarily providing a corresponding benefit to the economy.

(5) Increasing complexity is what acts to offset the many diminishing returns we face. Thus, the situation we face is an increasing battle between growing complexity and diminishing returns.

Many people would consider increasing complexity to be similar to improved technology, but increasing complexity really is broader than improved technology. Besides involving the development of new devices, it involves greater use of specialization, and more use of education. Businesses become larger and more international in scope, and governments offer more services. Organizations become more hierarchical as the economy becomes increasingly complex. With these types of approaches, it is sometimes possible to overcome problems associated with diminishing returns.

If an economy is already reaching limits because of the long-term battle between diminishing returns and rising complexity, the use of an increasingly hierarchical structure tends to lead to a society of “haves” and “have nots.” The people at the top of the hierarchy have more than enough. Those at the bottom of the hierarchy find it increasingly difficult to meet their basic needs for food, housing, and transportation. They find it difficult to afford the output of the economy. This is a problem we are increasingly facing today, because of the way our self-organized economy operates.

(6) Debt plays a greater role, as the economy becomes increasingly complex and uses more technology.

Debt, because of its time-shifting ability, acts almost like magic in allowing an economy with adequate resources to grow. In part, this is because improved technology allows more capital goods used by businesses and governments to be produced. Capital goods made in the year 2016 are designed to provide a long-term benefit into the future, over a future period of, say, 2016 to 2066. Paying workers making these goods becomes a problem unless the future benefit of these capital goods can somehow be brought forward to 2016, so that the workers making the capital goods can be paid. In fact, there is a whole supply chain of workers that needs to be paid. There is also a need to pay many other kinds of costs, including taxes for government services and dividends to shareholders. All of these costs can be paid, using the magic of debt to bring forward the hoped-for future income from the new technology.

Debt is also frequently used for convenience for large purchases, such as buying a house or car. Here, debt effectively promises that the buyer will have enough future income to make the planned payments. It thus brings forward the future income of the debtor, and, through the magic of debt securities, adds this future income to the balance sheet of some organization–a bank, an insurance company, a pension fund, or the purchaser of a bond related to this debt, as if the debtor had already earned the funds needed to pay for the large purchase.

Of course, the problem with using debt and other debt-like approaches to bring forward future revenue flows is the fact that we don’t really know what the benefit of a new capital device will be, and we don’t really know whether a particular individual will be able to continue paying his mortgage or other loan. Perhaps he will become ill; perhaps he will lose his job in a recession, and not be able to find another job that pays as well. With a mortgage, there is a backup possibility that the house can be sold, and its value be used to provide the necessary repayment, but we saw in the Great Recession that property values can drop, so this doesn’t necessarily work either.

The way today’s economy is structured assumes that these future payment streams can be counted on. The value of stocks and bonds are the “assets” of insurance companies and pension plans. Banks can only exist if the loans they make can really be repaid. Our whole financial system is dependent on the current system continuing as usual, with at most a small number of loan defaults, such as are priced into the system.

(7) Growing debt tends to raise commodity prices and encourage commodity production, while falling debt levels tend to lower commodity prices.

If an individual obtains a loan, he or she can buy a home, a car, or other high-priced object, such as a boat. If a business takes out a new loan, it can build a new factory or buy new equipment. Making these objects requires the use of a wide range of commodities, typically including many kinds of metals and energy products. Once these items are placed in service, they are likely to need to continue to consume energy products.

Adding more debt allows the economy to make more goods using commodities. The way the economy encourages more production of a commodity is by bidding up its price. With this higher price, ores of lower grade can be converted to metals, and higher cost energy products can be used to make the desired end products. Alternatively, the higher cost can be used to open new mines or new oil fields, to try to pull the cost of production back down again.

Of course, if debt levels start to shrink or even rise less quickly, the opposite effect tends to happen. Commodity prices tend to fall, because not as many mines and oil wells seem to be needed.

(8) Nurturing economic growth; the key to growth seems to be growing “Disposable Personal Income”

With the magic of borrowing and promising to pay back the borrowed amount with interest (or through share appreciation and dividends), it is possible to start with very little, and gradually create a large economy. The situation is almost like planting an “economic seed,” and nurturing it with (a) additional debt as needed, (b) a growing supply of cheap energy, and (c) a growing population of workers. As long as the debt grows rapidly, the supply of cheap energy grows rapidly, the population of available workers grows rapidly (without becoming too hierarchical), and the other types of diminishing returns listed in Section (3) don’t become too great a problem, the economy can grow and prosper.

One of the keys to producing economic growth seems to be getting sufficient funds back to workers as “disposable personal income.” Disposable personal income (DPI) is after-tax income that gets back to individuals one way or another: as wages, dividends, interest, or rents, or as transfer payments, such as pensions for the elderly and payments to the unemployed, or as government employment of some kind, such as payment for being in an army.

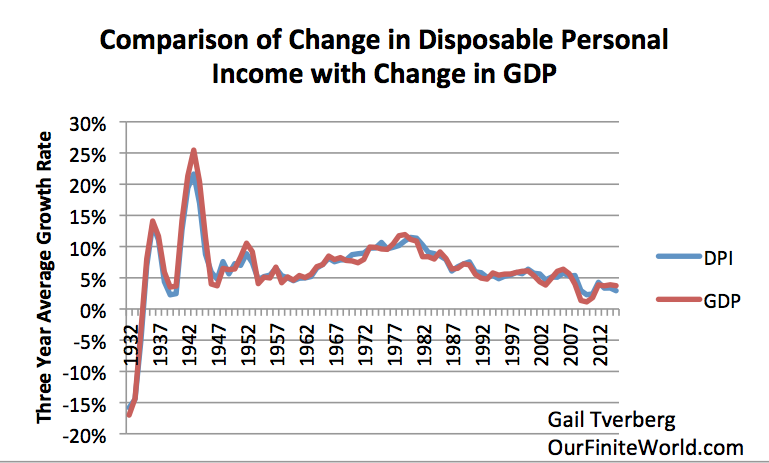

There is a popular belief that GDP is the Goods and Services that an economy can make. As far as I can see, GDP is the Goods and Services that the people living in the economy can afford to buy. There is clearly a common sense reason why this might be the case: an economy cannot grow, if the people living in the economy cannot afford to buy the goods and services that the economy produces. In the US economy, there is a .98 correlation between the growth in DPI (for all people in the economy combined) and the growth in the US GDP, as shown in Figure 2.

Figure 2. Comparison of 3-year average change in disposable personal income with 3-year average change in GDP, based on US BEA Tables 1.1.5 and 2.1.

The GDP used to compute growth rates is not inflation adjusted, nor is the DPI inflation adjusted. These amounts are thus different from the more commonly shown inflation-adjusted amounts.

The way I see things, the amount of inflation in commodity prices is to a significant extent determined by the match between how much disposable personal income is rising, and the quantity of goods and services being produced. As I have discussed previously, energy is essential for producing goods and services. A suitable quantity of energy products must be purchased, no matter how inexpensive or expensive the price of energy may be. If the energy purchased is very cheap, it is likely that the goods and services can be produced very inexpensively. The benefit of this cheap production of goods and services can encourage growth in many parts of the economy at the same time:

- Wages

- Profits to the owner(s); stock dividends

- Interest on debt

- Taxes

- The financial sector can flourish, with all kinds of new products

- Commodity price inflation

- Economic growth

The reason why this pattern happens is because the DPI of citizens (plus whatever amounts that governments and businesses can add to DPI) doesn’t necessarily match up with the cost of making those goods and services.

When energy prices are low, and when there are many opportunities for productive investments, the excess buying power can partly go into new productive capacity, leading to economic growth. Some of it can also go to provide higher wage growth. In fact, all of the items on the above list can be higher.

Figure 3. Average annual Brent equivalent oil price, in 2015 US$, from BP 2016 Statistical Review of World Energy.

When energy costs are at a high level (see Figure 3), all other parts get squeezed. Instead of seeing inflation in commodity prices, we start seeing deflation in commodity prices. In fact, deflation can bring energy prices below the cost of production. This effect, together with the end of US Quantitative Easing, likely explains the sharp drop in oil prices starting in mid-2014.

Figure 2 shows that, in recent years, the overall annual growth in US DPI and in GDP has been only about 4%. Growth of 4% doesn’t go very far when it needs to cover growing population (about 0.7% per year in the US), plus inflation, plus “real” growth in wages. No wonder commodity prices get squeezed! Because of diminishing returns, the cost of their production rises far more than the modest growth in DPI can afford to cover. Something gets squeezed: energy prices remain far below the cost of extraction.

(9) The 1980 Economic Turning Point

If we look back at Figure 2, we see that the recent peak in the growth of GDP and DPI occurred about 1980, at approximately 11% per year. At 11% there is room for many economic “goodies,” including funds for new investment, raising wages, and inflation.

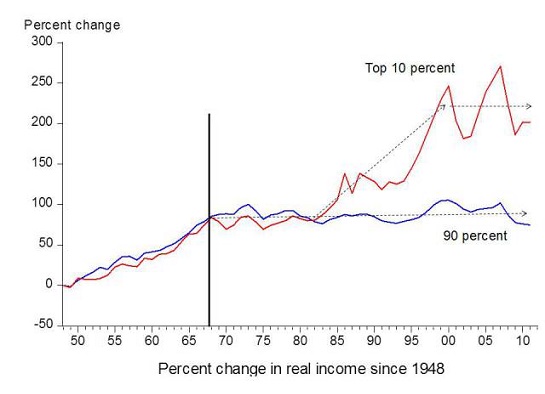

When growth in GDP and DPI started falling shortly after 1980, many changes occurred in the economy. For one thing, wage disparity in the US started increasing (Figure 4).

Figure 4. Chart comparing income gains of the top 10% to income gains of the bottom 90% by economist Emmanuel Saez. Based on an analysis of IRS data, published in Forbes.

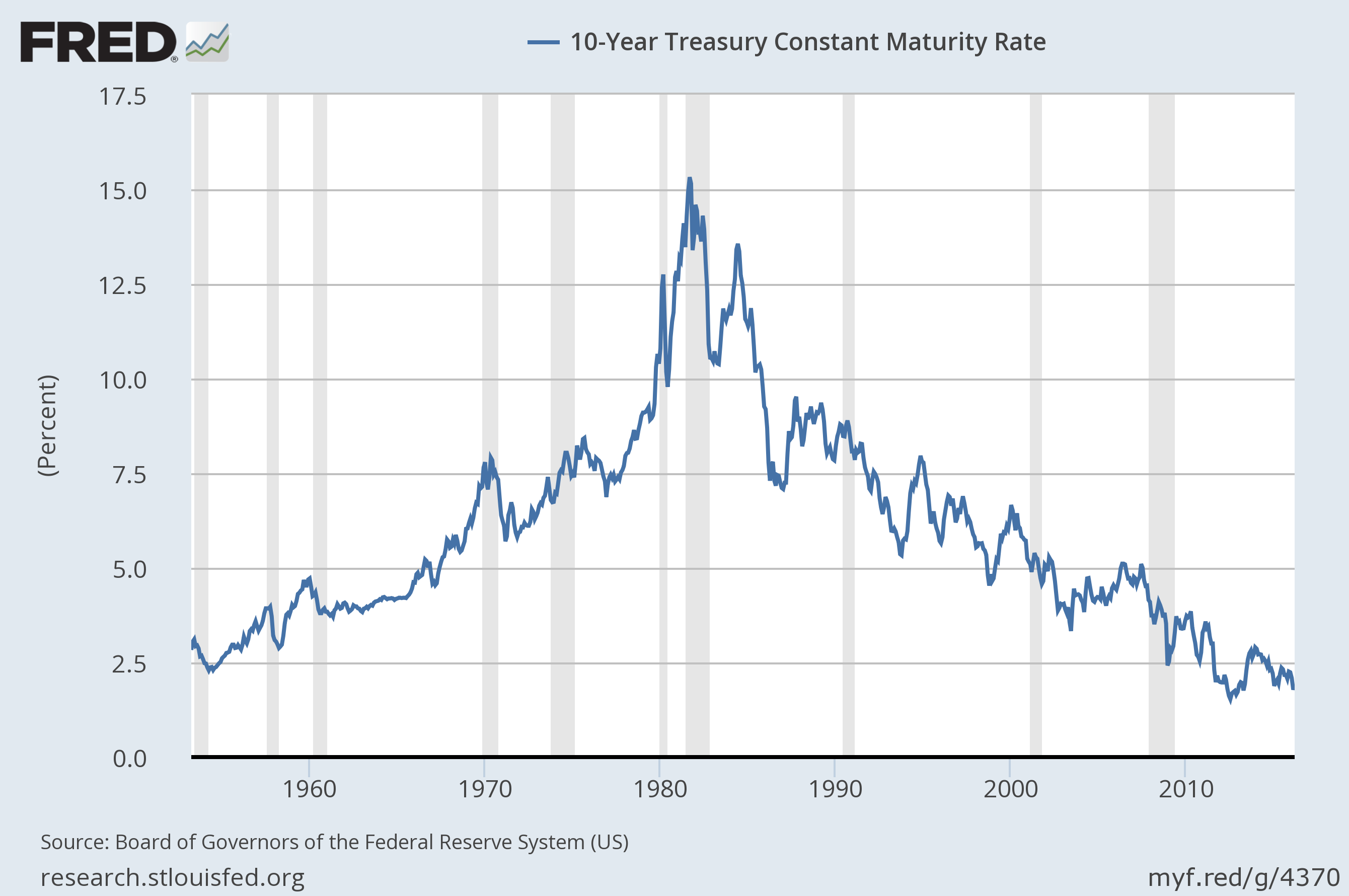

This was also about the time when US interest rates started to fall. Ten-year treasury rates hit a peak in 1981.

Figure 5. Ten-year treasury interest rates, based on St. Louis Fed data.

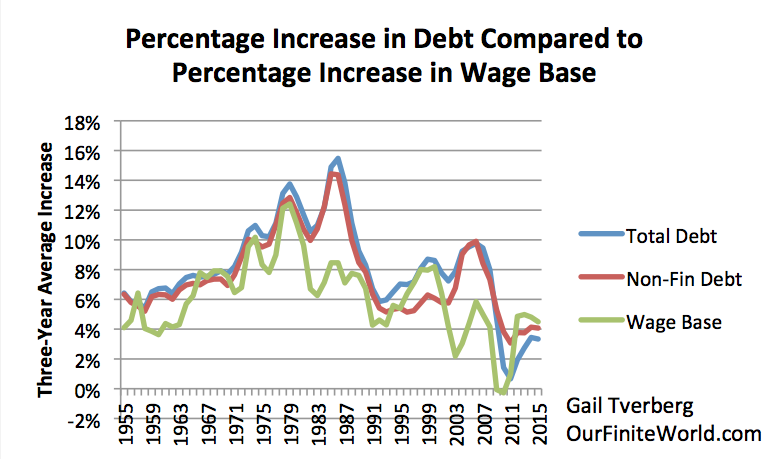

It also seems to be the time when increases in debt no longer automatically triggered a corresponding increase in the wages of non-government workers (Figure 6).

Figure 6. Three-year average increase in debt compared to three-year average increase in Wage Base, defined as non-governmental wages plus proprietors’ income.

In Figure 6, “Wage Base” is wages of non-governmental workers, including wages of proprietors, such as farmers. I consider my wage base to be “regular” wages, before all the government manipulations that produce the much higher DPI, which includes transfer payments, and wages paid under government programs. Figure 7 shows a comparison of the relative amounts. On Figure 7, note that the upward “blip” in the Wage Base occurred in the 1998-2000 period, when the price of oil was unusually low (Figure 3), leaving more for wages.

Figure 7. Personal Income, Disposable Personal Income, and Wage Base, as Percentage of GDP, Based on BEA tables 1.1.5 and 2.1.

(10) The Problem of Ever Rising Government Expenditures, and Government Receipts that Don’t Increase Enough

If we look at the historical pattern of governmental costs, we see that there has been a long-term upward trend in governmental costs. Figure 8 combines receipts and disbursements for all types of governments (federal, state, and local). The Wage Base, mentioned previously, is used as the denominator, because even taxes paid by businesses will indirectly affect prices paid by customers.

Figure 8. US government expenditures and receipts compared to wage base, based on BEA Table 3.1. Amounts include federal, state, and local taxes, and include funding for Social Security.

In Figure 8, Government expenditures peaked at over 90% of the wage base. Clearly these expenditures are only possible because they include a big increase in debt at the time of the bank bailouts and all of the stimulus activities.

The fact that government receipts have stalled at about 66% of the wage base since 1981 suggests that there is a problem in raising taxes above the current level. We may not even be able to maintain our current tax level, if required payments for health care coverage under the Affordable Care Act behave like another tax.

(11) The Recent Decline in US Debt Growth

If we compare the growth in total US debt (not just governmental debt) to the Wage Base (includes all non-government wages, including proprietors’ income), we see a rather surprising pattern (Figure 9):

Figure 9. US debt as compared to Wage Base, based on FRED and BIS data.

The ratio of debt to wages remained pretty constant until about 1980, when it began to rise sharply. This was about the time when wages started to diverge, and interest rates began to decline. Once oil prices fell to lower levels in the late 1980s, the non-financial debt level settled back, compared to wages. When oil prices began to rise in the early 2000s, the total debt level skyrocketed. These patterns suggest that debt growth is strongly related to the price of oil. Less debt is needed to keep the economy going when oil prices are very low; much more debt is needed when the cost of oil production is high.

Since 2008, we see a different pattern. The debt level is falling, despite record low interest rates. We discussed in Section 2 the need for an “Opportunity Gradient” to encourage borrowing. At this point, there does not seem to be a sufficient Opportunity Gradient to keep borrowing at the very high 2008 level, and even grow from this point. The failure of US debt to grow relative to wages is thus part of the reason why oil prices cannot be raised to a high enough level to make oil production profitable.

The low growth in US debt is likely a problem for the rest of the world, too. Since oil is priced in dollars, I expect that the US really needs to be a leader in debt growth, if the world economy is to grow. The US no longer seems to be trying to be a leader in debt growth; it ended Quantitative Easing in 2014, has raised interest rates once, and is now planning to raise interest rates again. This creates a problem for other countries, because their currencies tend to fall relative to the dollar, when US interest rates rise. If these other countries do attempt to raise their debt levels, their currency levels tend to fall relative to the US dollar, mostly negating the benefit of the debt increase when it comes to buying oil and other energy products. This makes it very difficult to use debt to provide new programs, such as guaranteed income plans for citizens.

(12) Conclusion

This analysis is based on US data, but it gives some insight into what is happening on a world basis. I would expect that Europe and Japan are in many ways not too different from the US. The world economy has done better, because it includes countries with more opportunities for investments that might truly be associated with economic growth.

The situation everywhere may very well be that growth is a temporary phenomenon. Rapid growth occurs for a while, but then it fades away. When it fades away, inflation tends to shift to deflation. This presents a huge problem, because our financial institutions are built using debt and debt-like instruments. When deflation hits, the “Opportunity Gradient” changes from favorable to unfavorable for future investment. This creates a much greater likelihood of future debt defaults, and discourages citizens from wanting to take out loans to finance new investments. All of these things are concerns for the future functioning of the economy.

The situation we seem to be encountering is that economies, both of the world and of individual countries, are dissipative systems. As such, they require energy. Similar to other dissipative systems (hurricanes, ecosystems, stars, plants and animals), they grow for a while, and eventually collapse.

Economies, as dissipative systems, seem to need several kinds of systems. Energy provides sustenance for an economy, in a way similar to the way food provides sustenance for humans. The debt system acts somewhat similarly to the way a human’s circulation system works; the time-transfer mechanism provides a pumping action similar to that of the heart. The pricing system acts very much like a human’s sensory system; it allows the system to discern whether the current opportunity gradient is sufficient to justify adding more debt. Thus, this analysis suggests that one way the system may fail is through commodity prices that fall too low. Most people have never considered the possibility that this could happen.

Intermittent renewables, such as wind and solar, might be considered as similar to a type of food that causes the sensory system of the economy to malfunction (similar to deafness or blindness). This happens because, as I discussed in a previous post, intermittent renewables disrupt the pricing system for electricity by dumping electricity on the grid without regard to whether the price signals indicate that the additional electricity is actually needed. As a result, prices for other types of electricity (such as nuclear and natural gas) become depressed, necessitating subsidies. This shows why overly simple models cannot be relied upon when evaluating possible solutions to our energy problems.

It would be nice if we could figure out a way to make our economy last forever, but it is doubtful that we can. Ultimately, the battle between diminishing returns and increased complexity seems likely to be settled in a way that causes the economy to collapse.