![]()

See this visualization first on the Voronoi app.

Use This Visualization

Why Can’t Americans Pay their Mortgage?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

A rising cost of living is making it difficult for Americans to pay off their mortgage debt, or even purchase a home altogether.

Yet interestingly, mortgage delinquencies are at near-record lows. In the first quarter of 2024, the proportion of single-family residential mortgages in delinquency fell to 1.7%. By comparison, delinquencies spiked more than 11% during the global financial crisis. This resilience is partly due to homeowners locking in low rates before interest rates surged, sheltering them from the higher cost of paying off debt.

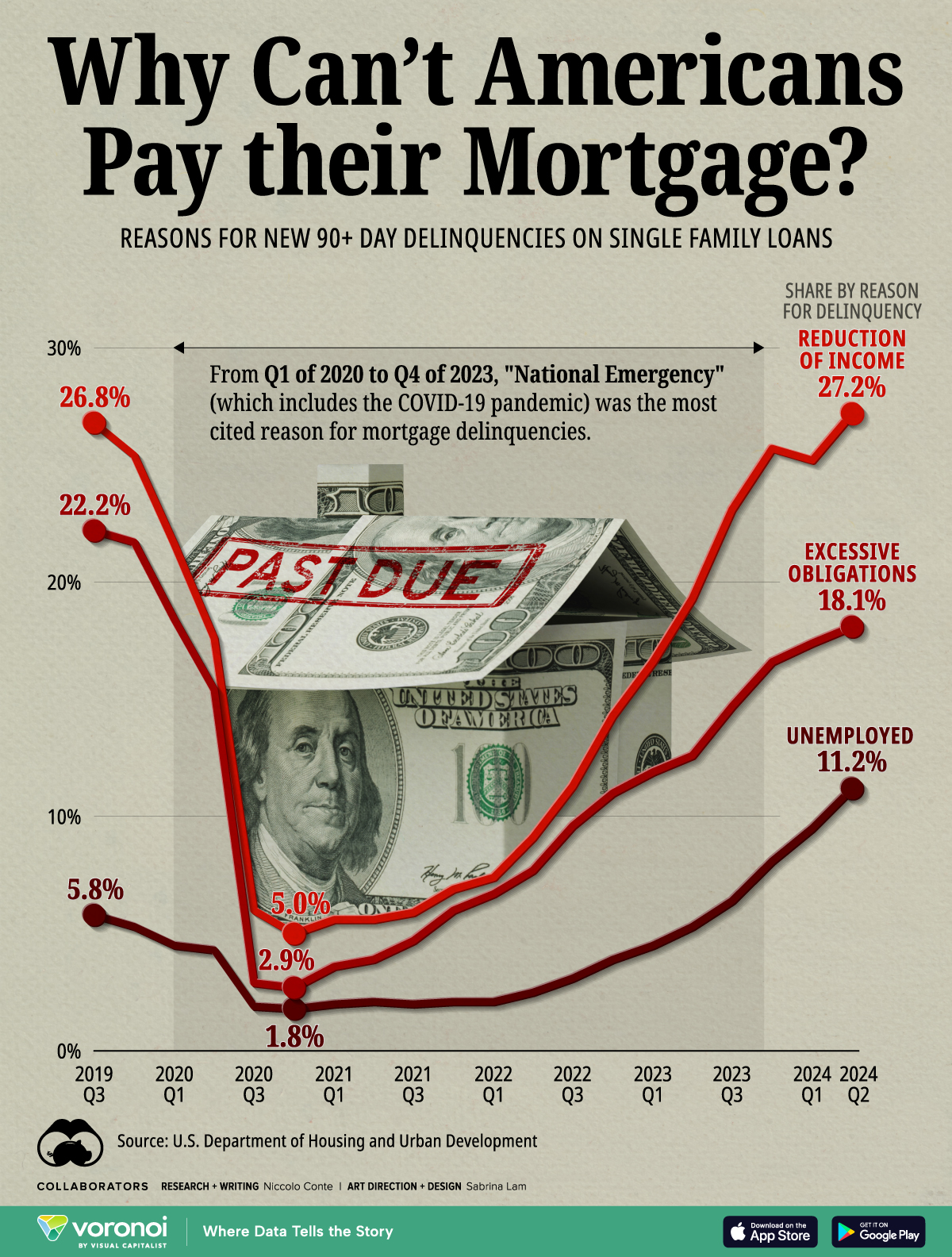

This graphic shows the financial reasons that Americans can’t pay their mortgage in 2024, based on data from the U.S. Department of Housing and Urban Development.

The Financial Reasons Driving Mortgage Delinquencies

Below, we show the financial reasons contributing to new mortgage delinquencies of 90 days or more on single-family homes:

| Fiscal Quarter | % Citing Reduction of Income | % Citing Unemployed | % Citing Excessive Obligations |

|---|---|---|---|

| 2024 Q2 | 27.2 | 11.2 | 18.1 |

| 2024 Q1 | 25.2 | 9.5 | 17.4 |

| 2023 Q4 | 25.7 | 8.1 | 16.6 |

| 2023 Q3 | 23.1 | 6.4 | 14.7 |

| 2023 Q2 | 19.3 | 5.3 | 12.6 |

| 2023 Q1 | 16.6 | 4.5 | 11.9 |

| 2022 Q4 | 14.3 | 3.9 | 11.0 |

| 2022 Q3 | 11.3 | 3.1 | 9.6 |

| 2022 Q2 | 9.1 | 2.5 | 7.7 |

| 2022 Q1 | 7.4 | 2.1 | 6.7 |

| 2021 Q4 | 6.9 | 2.1 | 6.0 |

| 2021 Q3 | 5.9 | 2.0 | 4.7 |

| 2021 Q2 | 5.6 | 2.1 | 3.9 |

| 2021 Q1 | 5.6 | 2.0 | 3.6 |

| 2020 Q4 | 5.0 | 1.8 | 2.7 |

| 2020 Q3 | 6.0 | 1.9 | 2.9 |

| 2020 Q2 | 17.6 | 4.3 | 15.4 |

| 2020 Q1 | 21.6 | 4.5 | 18.4 |

| 2019 Q4 | 25.4 | 5.3 | 21.7 |

| 2019 Q3 | 26.8 | 5.8 | 22.2 |

Despite a strong labor market, the share of Americans citing a “reduction of income” was the highest overall, sitting at pre-pandemic levels.

Often, cash-flow problems spurred by negative life events are the primary catalyst for mortgage delinquencies. A separate study shows that they were responsible for 70% of underwater mortgage defaults between 2008 and 2015, while strictly negative equity caused just 6% of these defaults. Underwater mortgages are defined as those where the principal owed on a home is worth more than the home value.

In many ways, this challenges the previously held belief that negative equity heavily triggered U.S. mortgage delinquencies during the global financial crisis.

Following next in line were excessive obligations, accounting for over 18% of responses in the second quarter of 2024. This figure has more than doubled over the last two years, at a time when credit card and auto loan delinquencies are at 10-year highs. In fact, Americans’ interest payments on non-mortgage debt now costs as much as mortgage interest payments for the first time ever.

Shielded from High Interest Rates

Looking ahead, the prospect of rising mortgage delinquencies remains uncertain.

Today, 96% of American homeowners have fixed mortgage rates, which often extend through the life of the loan. Many of these are more than 10 years, meaning that higher mortgage costs may not be a primary driver of bad loans for some time. Instead, rising unemployment or an economic downturn could have a more immediate and substantial impact on American homeowners in the future.

The post Why Can’t Americans Pay their Mortgage? appeared first on Visual Capitalist.