The Briefing

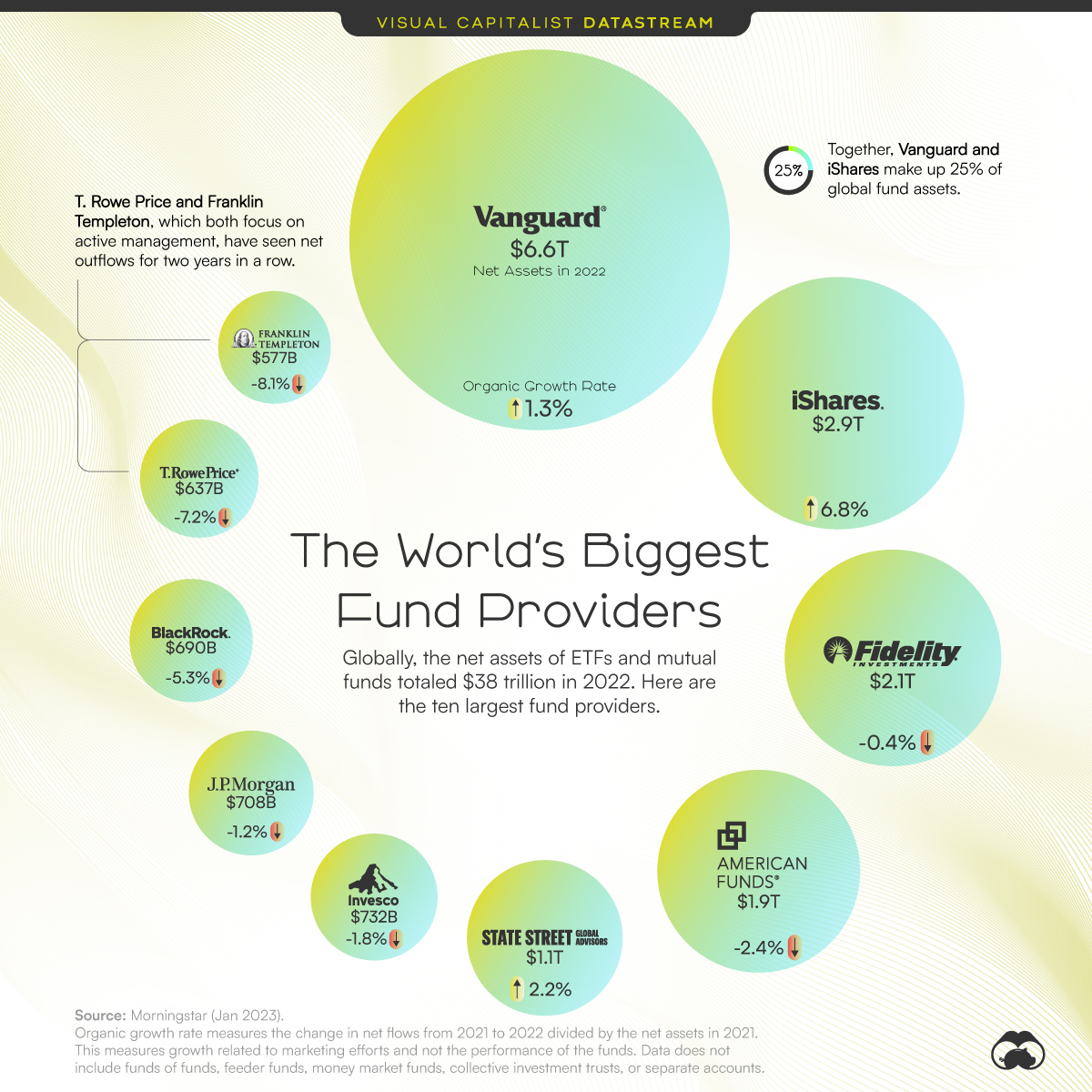

- The 10 largest mutual fund and ETF providers did not change from 2021 to 2022.

- Vanguard and iShares, the top two brands, both saw net inflows in 2022.

The World’s Biggest Mutual Fund and ETF Providers

The global net assets of mutual fund and ETF providers totaled $38 trillion in 2022. Despite its massive size, the industry is dominated by a relatively small number of brands.

This graphic uses data from Morningstar to show the largest fund brands and their growth rates in 2022.

The Biggest Get Bigger

Below, we rank mutual fund and ETF brands by net assets and show their organic growth rate.

The organic growth rate measures the change in net flows, which reflects growth related to marketing efforts and not the market performance of the provider’s funds.

| Rank | Fund Provider | Net Assets in 2022 | Organic Growth Rate (2021-2022) |

|---|---|---|---|

| 1 | Vanguard | $6.6T | 1.3% |

| 2 | iShares | $2.9T | 6.8% |

| 3 | Fidelity | $2.1T | -0.4% |

| 4 | American Funds | $1.9T | -2.4% |

| 5 | State Street | $1.1T | 2.2% |

| 6 | Invesco | $732B | -1.8% |

| 7 | JPMorgan | $708B | -1.2% |

| 8 | BlackRock | $690B | -5.3% |

| 9 | T. Rowe Price | $637B | -7.2% |

| 10 | Franklin Templeton | $577B | -8.1% |

Vanguard and iShares continue to dominate the list and account for 25% of mutual fund and ETF net assets globally. Both saw net inflows, though iShares’ growth rate was much higher. It collected $222B, more than double the $101 billion that Vanguard received.

State Street, the fifth-largest fund brand, was the only other name on the list to see net inflow. The company manages the SPDR S&P 500 ETF, which is the largest ETF in the world. It was a top pick for retail investors in early 2023.

The smallest of the giants—T. Rowe Price and Franklin Templeton—saw net outflows for the second year in a row. Both firms focus on active management, a strategy designed to outperform the general market through the decisions of investment managers.

Shifting Preferences: From Mutual Fund to ETF

The decline of brands focused on active management reflects a larger trend within the industry. In 2022, investors heavily favored passive funds and ETFs over mutual funds and active funds.

This could be due to the higher fees and long-term underperformance of many active funds.

| Fund Type | Inflows (+) or Outflows (-) in 2022 |

|---|---|

| Mutual Funds | -$1.3T |

| Actively-Managed Funds | -$349B |

| ETFs | +$754B |

| Indexed (Passive) Funds | +$348B |

Passive funds now comprise 38% of global assets, up from 19% in 2013.

Typically, passive funds have very low expense ratios that limit the fees providers can earn. Existing brands also have large economies of scale that would be difficult for new entrants to replicate. For these reasons, fewer firms compete in passive management and this is ultimately leading to more consolidation in the industry.

Fortunately, investors have benefited from the cost-effective and efficient path to investment ownership that passive funds provide. In 2022, the average expense ratio of an actively-managed equity mutual fund was 0.66%, while the average for an index equity mutual fund was 0.05%.

On the flip side, some experts have expressed concerns that industry consolidation reduces financial stability. The Federal Reserve states that if a large firm experienced a significant event, such as a cybersecurity breach, it could “lead to sudden massive redemptions from that firm’s funds and thus potentially from the asset management industry as a whole.”

Where Does This Data Come From?

Source: Morningstar Global Fund Flows Report

Data note: Organic growth rate measures the change in net flows from 2021 to 2022 divided by the net assets in 2021. This measures growth related to marketing efforts and not the performance of the funds. Data does not include funds of funds, feeder funds, money market funds, collective investment trusts, or separate accounts.

The post The World’s Biggest Mutual Fund and ETF Providers appeared first on Visual Capitalist.